Is Willas-Array Electronics (Holdings) (SGX:BDR) Using Too Much Debt?

David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. As with many other companies Willas-Array Electronics (Holdings) Limited (SGX:BDR) makes use of debt. But should shareholders be worried about its use of debt?

What Risk Does Debt Bring?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, the upside of debt is that it often represents cheap capital, especially when it replaces dilution in a company with the ability to reinvest at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

See our latest analysis for Willas-Array Electronics (Holdings)

What Is Willas-Array Electronics (Holdings)'s Debt?

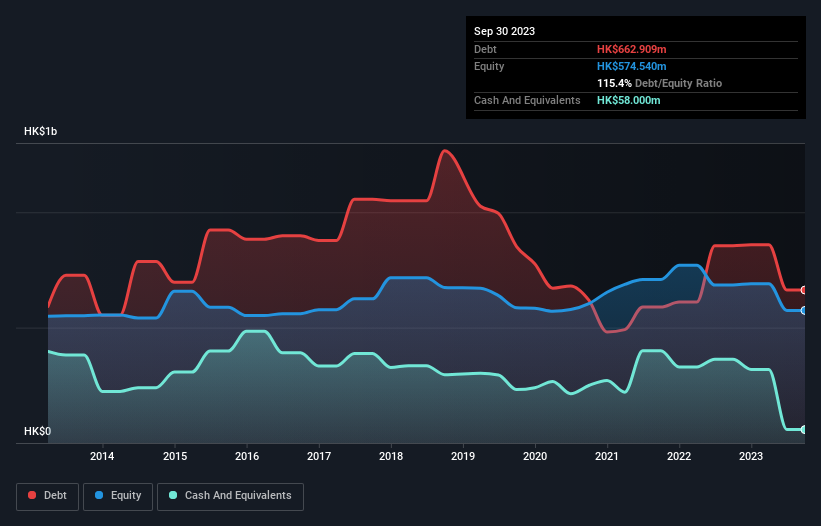

The image below, which you can click on for greater detail, shows that Willas-Array Electronics (Holdings) had debt of HK$662.9m at the end of September 2023, a reduction from HK$854.8m over a year. However, because it has a cash reserve of HK$58.0m, its net debt is less, at about HK$604.9m.

A Look At Willas-Array Electronics (Holdings)'s Liabilities

We can see from the most recent balance sheet that Willas-Array Electronics (Holdings) had liabilities of HK$1.15b falling due within a year, and liabilities of HK$29.3m due beyond that. On the other hand, it had cash of HK$58.0m and HK$811.1m worth of receivables due within a year. So its liabilities total HK$305.2m more than the combination of its cash and short-term receivables.

Given this deficit is actually higher than the company's market capitalization of HK$259.1m, we think shareholders really should watch Willas-Array Electronics (Holdings)'s debt levels, like a parent watching their child ride a bike for the first time. Hypothetically, extremely heavy dilution would be required if the company were forced to pay down its liabilities by raising capital at the current share price. The balance sheet is clearly the area to focus on when you are analysing debt. But it is Willas-Array Electronics (Holdings)'s earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Over 12 months, Willas-Array Electronics (Holdings) made a loss at the EBIT level, and saw its revenue drop to HK$2.7b, which is a fall of 21%. To be frank that doesn't bode well.

Caveat Emptor

Not only did Willas-Array Electronics (Holdings)'s revenue slip over the last twelve months, but it also produced negative earnings before interest and tax (EBIT). Indeed, it lost a very considerable HK$42m at the EBIT level. When we look at that alongside the significant liabilities, we're not particularly confident about the company. We'd want to see some strong near-term improvements before getting too interested in the stock. Not least because it burned through HK$111m in negative free cash flow over the last year. So suffice it to say we consider the stock to be risky. The balance sheet is clearly the area to focus on when you are analysing debt. However, not all investment risk resides within the balance sheet - far from it. Be aware that Willas-Array Electronics (Holdings) is showing 3 warning signs in our investment analysis , and 2 of those are potentially serious...

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

Valuation is complex, but we're here to simplify it.

Discover if Willas-Array Electronics (Holdings) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SGX:BDR

Willas-Array Electronics (Holdings)

An investment holding company, distributes and trades in electronic components for industrial, audio and video, telecommunication, home appliances, lighting, electronic manufacturing, and automotive markets.

Good value with slight risk.

Market Insights

Weekly Picks

Is this the AI replacing marketing professionals?

Pro Medicus: The Market Is Confusing a Lumpy Quarter With a Broken Business

The Rising Deal Risk That Helped Sink Netflix’s $72 Billion Bid for Warner Bros. Discovery

The Infrastructure AI Cannot Be Built Without

Recently Updated Narratives

What IREN's decision to buy over 50,000 NVIDIA GPUs could mean for its future

AI short positioning & India emerging market opportunties

Cheniere Energy (LNG) — The Toll Road That Geopolitics Just Made More Valuable

Popular Narratives

Nu holdings will continue to disrupt the South American banking market

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026