In recent developments within the Singapore market, innovative financial services like Banking-as-a-Service (BaaS) are gaining traction, reflecting a broader trend towards digitalization and enhanced financial offerings. This evolving landscape underscores the importance of stability and consistent returns, qualities that make dividend stocks particularly appealing for investors looking to balance growth with income in their portfolios.

Top 10 Dividend Stocks In Singapore

| Name | Dividend Yield | Dividend Rating |

| Civmec (SGX:P9D) | 6.07% | ★★★★★☆ |

| Singapore Exchange (SGX:S68) | 3.54% | ★★★★★☆ |

| Multi-Chem (SGX:AWZ) | 9.84% | ★★★★★☆ |

| UOB-Kay Hian Holdings (SGX:U10) | 6.97% | ★★★★★☆ |

| China Sunsine Chemical Holdings (SGX:QES) | 6.25% | ★★★★★☆ |

| UOL Group (SGX:U14) | 3.68% | ★★★★★☆ |

| BRC Asia (SGX:BEC) | 7.48% | ★★★★★☆ |

| Bumitama Agri (SGX:P8Z) | 6.80% | ★★★★★☆ |

| Singapore Airlines (SGX:C6L) | 7.06% | ★★★★★☆ |

| YHI International (SGX:BPF) | 6.49% | ★★★★★☆ |

Click here to see the full list of 19 stocks from our Top SGX Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

Aztech Global (SGX:8AZ)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Aztech Global Ltd. operates in the design, development, and manufacturing of IoT devices, data-communication products, and LED lighting solutions across Singapore, North America, China, Europe, and other international markets with a market capitalization of approximately SGD 0.74 billion.

Operations: Aztech Global Ltd. generates revenue primarily from the design and manufacturing of IoT devices, data-communication products, and LED lighting solutions.

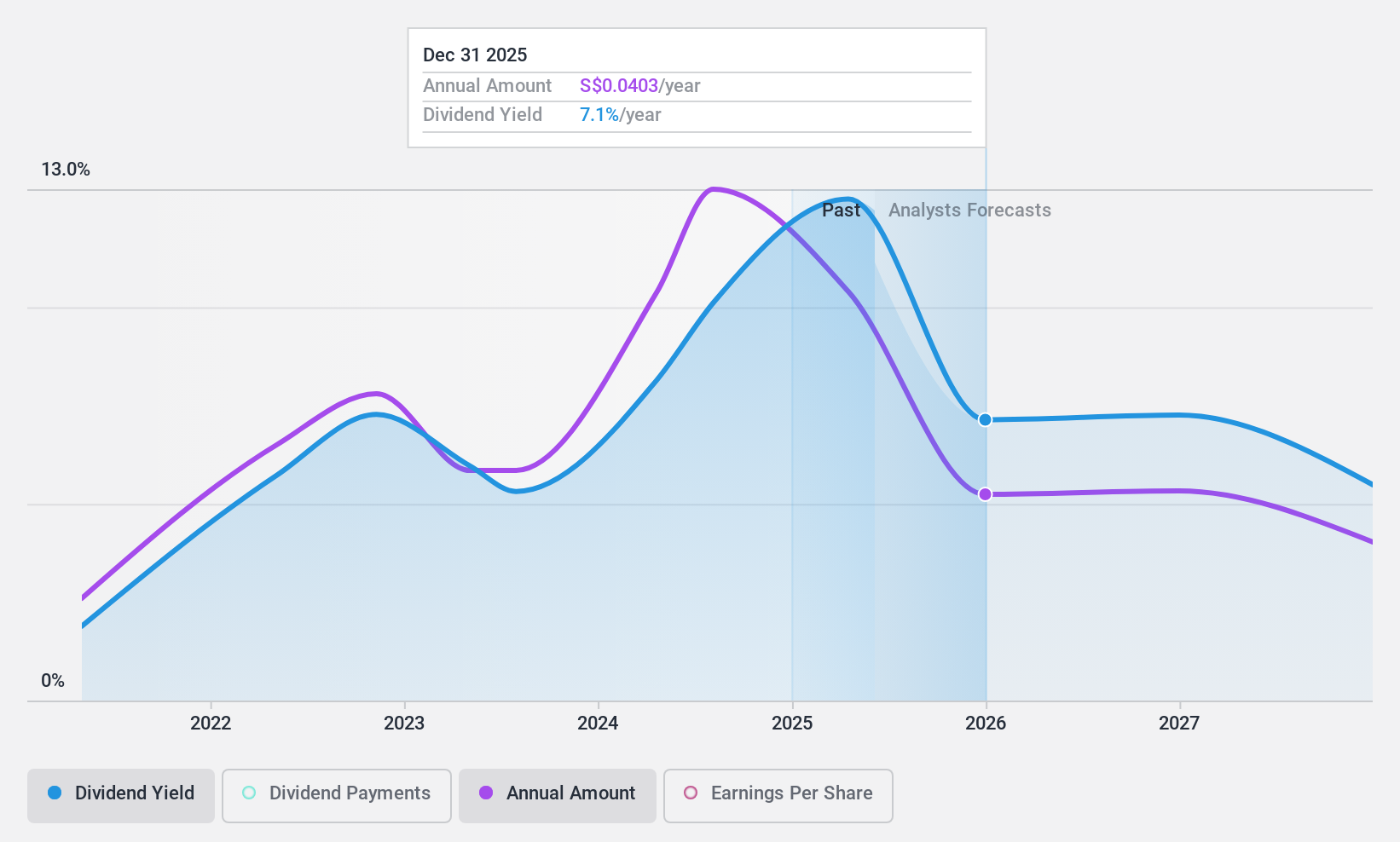

Dividend Yield: 8.3%

Aztech Global's dividend, yielding 8.33%, ranks in the top 25% in Singapore's market. Despite its attractive yield, the dividend history is unstable and payments have shown significant volatility over the past three years. Currently, dividends are well-supported by earnings with a payout ratio of 61.7% and cash flows with a cash payout ratio of 77.9%. Recent increases in dividends and consistent earnings growth suggest potential for continued support, but its short history of dividend payments raises concerns about long-term sustainability.

- Click here and access our complete dividend analysis report to understand the dynamics of Aztech Global.

- According our valuation report, there's an indication that Aztech Global's share price might be on the cheaper side.

Multi-Chem (SGX:AWZ)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Multi-Chem Limited is an investment holding company that distributes information technology products across Singapore, Greater China, Australia, India, and other international markets, with a market capitalization of SGD 222.54 million.

Operations: Multi-Chem Limited generates revenue primarily through its IT business in Singapore (SGD 372.78 million), other international locations (SGD 153.93 million), Australia (SGD 54.60 million), India (SGD 40.56 million), and Greater China (SGD 34.96 million).

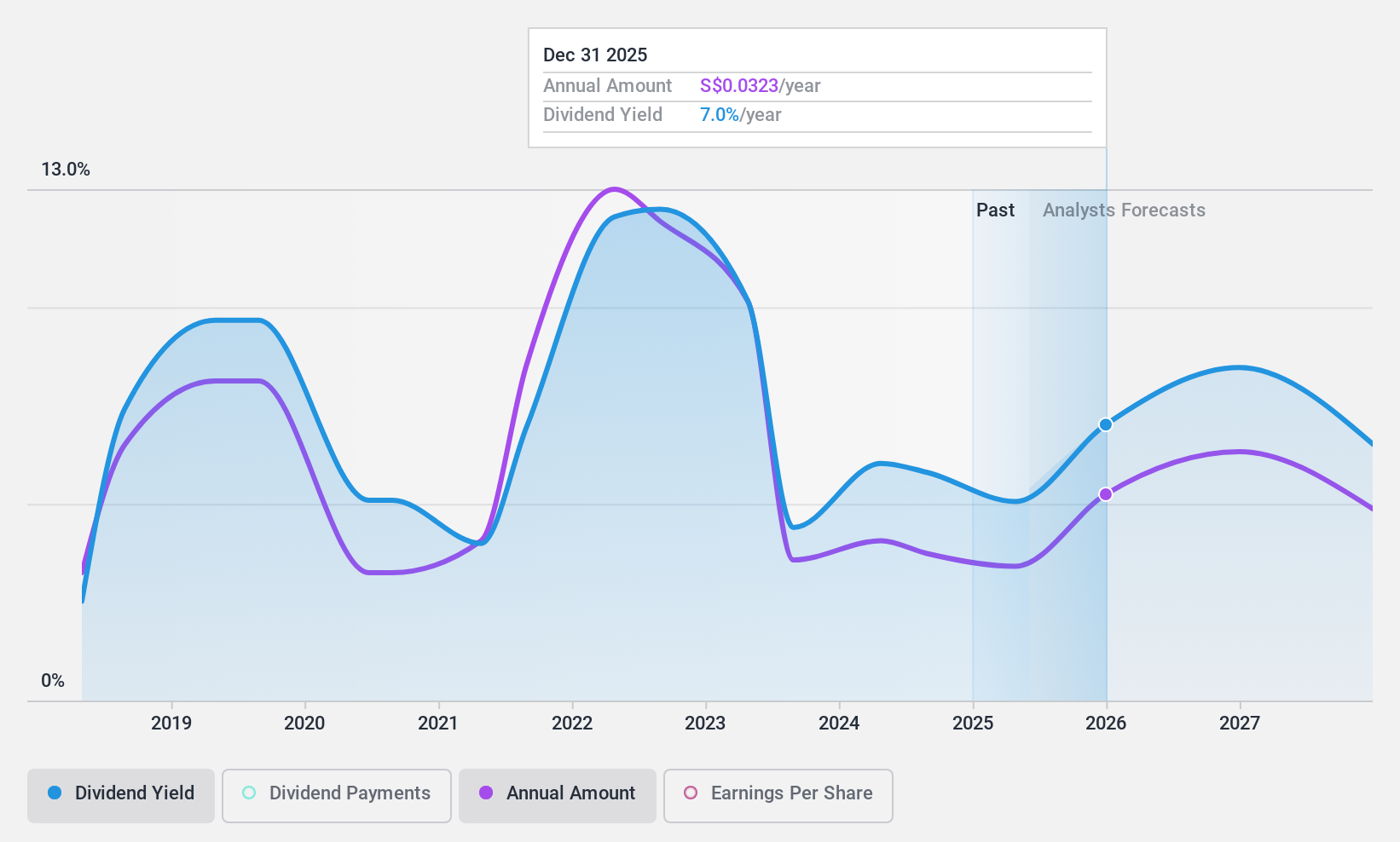

Dividend Yield: 9.8%

Multi-Chem Limited, a player in the dividend stock arena, offers a mixed outlook for investors. As of the latest analysis, its dividends are supported by earnings and cash flows with payout ratios at 80.7% and 88.1%, respectively. Despite this coverage, the company has experienced unstable dividend payments over the past decade. Recently appointed board members could bring strategic shifts; however, its current trading value is 48.2% below estimated fair value, suggesting potential undervaluation or underlying concerns about its financial health and future growth prospects.

- Get an in-depth perspective on Multi-Chem's performance by reading our dividend report here.

- Our valuation report unveils the possibility Multi-Chem's shares may be trading at a discount.

APAC Realty (SGX:CLN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: APAC Realty Limited is an investment holding company that offers real estate services in Singapore, Indonesia, Vietnam, and other international markets, with a market capitalization of SGD 142.08 million.

Operations: APAC Realty Limited generates SGD 548.88 million from real estate brokerage and SGD 2.15 million from rental income.

Dividend Yield: 6.2%

APAC Realty, despite its appeal with a 6.25% dividend yield, shows concerns with an unstable dividend history over its short six-year dividend-paying period. Recent cuts to dividends, as seen in April 2024 with a reduction to 1.4 Singapore cents per share, underscore this volatility. While earnings cover the firm's dividends at a 75.4% payout ratio and cash flows at 55.6%, the company’s profit margins have declined from last year, moving from 3.8% to 2.1%. Additionally, APAC Realty is expanding internationally through a new franchise agreement in Manila, potentially diversifying operations and revenue streams.

- Take a closer look at APAC Realty's potential here in our dividend report.

- Upon reviewing our latest valuation report, APAC Realty's share price might be too pessimistic.

Make It Happen

- Access the full spectrum of 19 Top SGX Dividend Stocks by clicking on this link.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:8AZ

Aztech Global

Engages in the research, development, design, engineering, manufacture, and sale of IoT devices, data-communication products, and LED lighting products in Singapore, North America, China, Europe, Oceania, rest of ASEAN countries, and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives