The board of CSE Global Limited (SGX:544) has announced that it will pay a dividend of S$0.013 per share on the 2nd of September. Based on this payment, the dividend yield on the company's stock will be 5.3%, which is an attractive boost to shareholder returns.

See our latest analysis for CSE Global

CSE Global's Earnings Easily Cover the Distributions

If the payments aren't sustainable, a high yield for a few years won't matter that much. The last dividend was quite easily covered by CSE Global's earnings. This indicates that a lot of the earnings are being reinvested into the business, with the aim of fueling growth.

Over the next year, EPS is forecast to fall by 22.2%. If the dividend continues along recent trends, we estimate the payout ratio could be 65%, which we consider to be quite comfortable, with most of the company's earnings left over to grow the business in the future.

Dividend Volatility

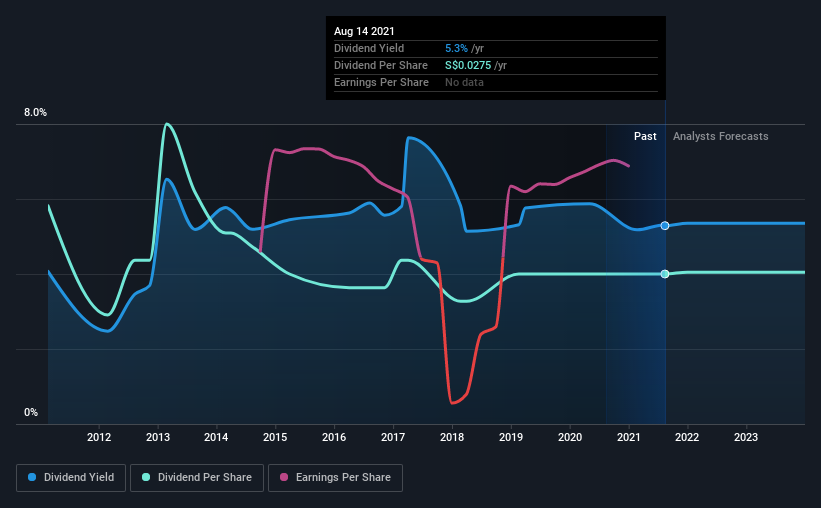

While the company has been paying a dividend for a long time, it has cut the dividend at least once in the last 10 years. Since 2011, the dividend has gone from S$0.04 to S$0.028. Doing the maths, this is a decline of about 3.7% per year. Generally, we don't like to see a dividend that has been declining over time as this can degrade shareholders' returns and indicate that the company may be running into problems.

The Dividend's Growth Prospects Are Limited

Growing earnings per share could be a mitigating factor when considering the past fluctuations in the dividend. Unfortunately, CSE Global's earnings per share has been essentially flat over the past five years, which means the dividend may not be increased each year.

Our Thoughts On CSE Global's Dividend

Overall, we don't think this company makes a great dividend stock, even though the dividend wasn't cut this year. In the past, the payments have been unstable, but over the short term the dividend could be reliable, with the company generating enough cash to cover it. Overall, we don't think this company has the makings of a good income stock.

Companies possessing a stable dividend policy will likely enjoy greater investor interest than those suffering from a more inconsistent approach. However, there are other things to consider for investors when analysing stock performance. Just as an example, we've come across 3 warning signs for CSE Global you should be aware of, and 1 of them makes us a bit uncomfortable. If you are a dividend investor, you might also want to look at our curated list of high performing dividend stock.

If you’re looking to trade CSE Global, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SGX:544

CSE Global

An investment holding company, engages in the provision of integrated industrial automation, information technology, and intelligent transport solutions in the Asia Pacific, the Americas, Europe, the Middle East, and Africa.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives