Some say volatility, rather than debt, is the best way to think about risk as an investor, but Warren Buffett famously said that 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We note that Sunright Limited (SGX:S71) does have debt on its balance sheet. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for Sunright

How Much Debt Does Sunright Carry?

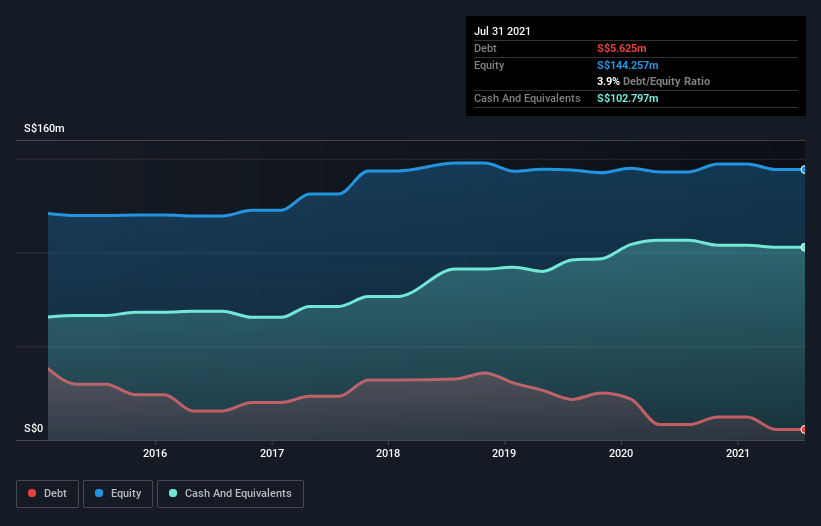

You can click the graphic below for the historical numbers, but it shows that Sunright had S$5.63m of debt in July 2021, down from S$8.21m, one year before. But on the other hand it also has S$102.8m in cash, leading to a S$97.2m net cash position.

How Healthy Is Sunright's Balance Sheet?

We can see from the most recent balance sheet that Sunright had liabilities of S$22.0m falling due within a year, and liabilities of S$7.32m due beyond that. Offsetting these obligations, it had cash of S$102.8m as well as receivables valued at S$20.4m due within 12 months. So it actually has S$93.9m more liquid assets than total liabilities.

This surplus strongly suggests that Sunright has a rock-solid balance sheet (and the debt is of no concern whatsoever). On this view, lenders should feel as safe as the beloved of a black-belt karate master. Succinctly put, Sunright boasts net cash, so it's fair to say it does not have a heavy debt load! The balance sheet is clearly the area to focus on when you are analysing debt. But it is Sunright's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Over 12 months, Sunright saw its revenue hold pretty steady, and it did not report positive earnings before interest and tax. While that hardly impresses, its not too bad either.

So How Risky Is Sunright?

Although Sunright had an earnings before interest and tax (EBIT) loss over the last twelve months, it made a statutory profit of S$1.3m. So taking that on face value, and considering the cash, we don't think its very risky in the near term. The next few years will be important as the business matures. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. For instance, we've identified 2 warning signs for Sunright (1 can't be ignored) you should be aware of.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SGX:S71

Sunright

An investment holding company, provides semiconductor test and burn-in services to semiconductor and electronics manufacturers in Singapore, Malaysia, Mainland China, the United States, and internationally.

Adequate balance sheet with low risk.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The Industrialist of the Skies – Scaling with "Automotive DNA

The "End-to-End" Space Prime – The Only Real Competitor to SpaceX

De-Risked Production Ramp with Exceptional Silver Price Leverage

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026