- Singapore

- /

- Semiconductors

- /

- SGX:AYN

Introducing Global Testing (SGX:AYN), The Stock That Slid 64% In The Last Five Years

For many, the main point of investing is to generate higher returns than the overall market. But every investor is virtually certain to have both over-performing and under-performing stocks. At this point some shareholders may be questioning their investment in Global Testing Corporation Limited (SGX:AYN), since the last five years saw the share price fall 64%. And some of the more recent buyers are probably worried, too, with the stock falling 34% in the last year. Shareholders have had an even rougher run lately, with the share price down 11% in the last 90 days.

Check out our latest analysis for Global Testing

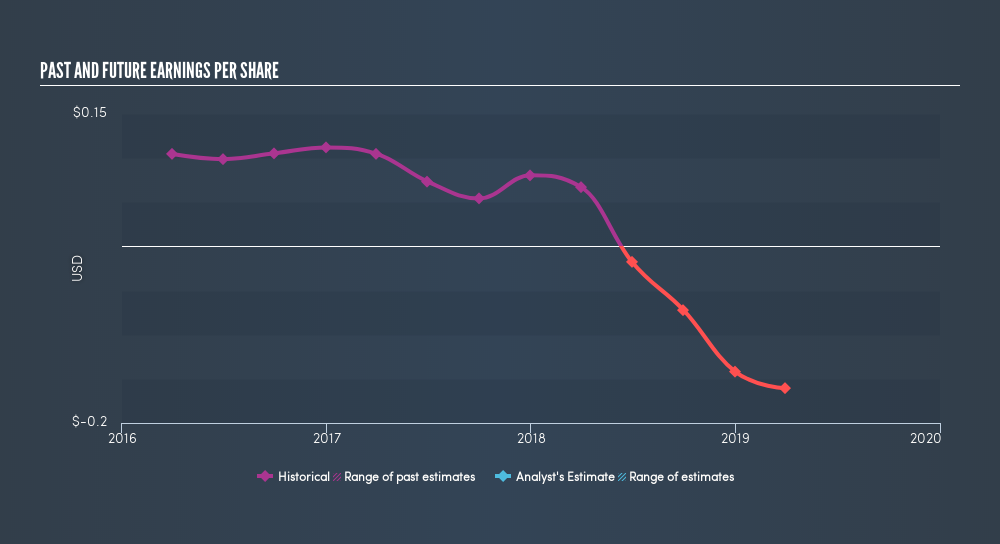

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

Over five years Global Testing's earnings per share dropped significantly, falling to a loss, with the share price also lower. Since the company has fallen to a loss making position, it's hard to compare the change in EPS with the share price change. However, we can say we'd expect to see a falling share price in this scenario.

Dive deeper into Global Testing's key metrics by checking this interactive graph of Global Testing's earnings, revenue and cash flow.

A Dividend Lost

The share price return figures discussed above don't include the value of dividends paid previously, but the total shareholder return (TSR) does. In some ways, TSR is a better measure of how well an investment has performed. Global Testing's TSR over the last 5 years is -30%; better than its share price return. Even though the company isn't paying dividends at the moment, it has done in the past.

A Different Perspective

Investors in Global Testing had a tough year, with a total loss of 23%, against a market gain of about 3.8%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 7.0% per year over five years. We realise that Buffett has said investors should 'buy when there is blood on the streets', but we caution that investors should first be sure they are buying a high quality businesses. You might want to assess this data-rich visualization of its earnings, revenue and cash flow.

We will like Global Testing better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SG exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About SGX:AYN

Global Testing

An investment holding company, provides semiconductor testing services in Taiwan, the Republic of China, Japan, the United States, Singapore, Thailand, and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives