- Singapore

- /

- Semiconductors

- /

- SGX:AWX

Can You Imagine How Ecstatic AEM Holdings's (SGX:AWX) Shareholders Feel About Its 1340% Share Price Increase?

For us, stock picking is in large part the hunt for the truly magnificent stocks. Not every pick can be a winner, but when you pick the right stock, you can win big. Take, for example, the AEM Holdings Ltd (SGX:AWX) share price, which skyrocketed 1340% over three years. Also pleasing for shareholders was the 15% gain in the last three months.

We love happy stories like this one. The company should be really proud of that performance!

View our latest analysis for AEM Holdings

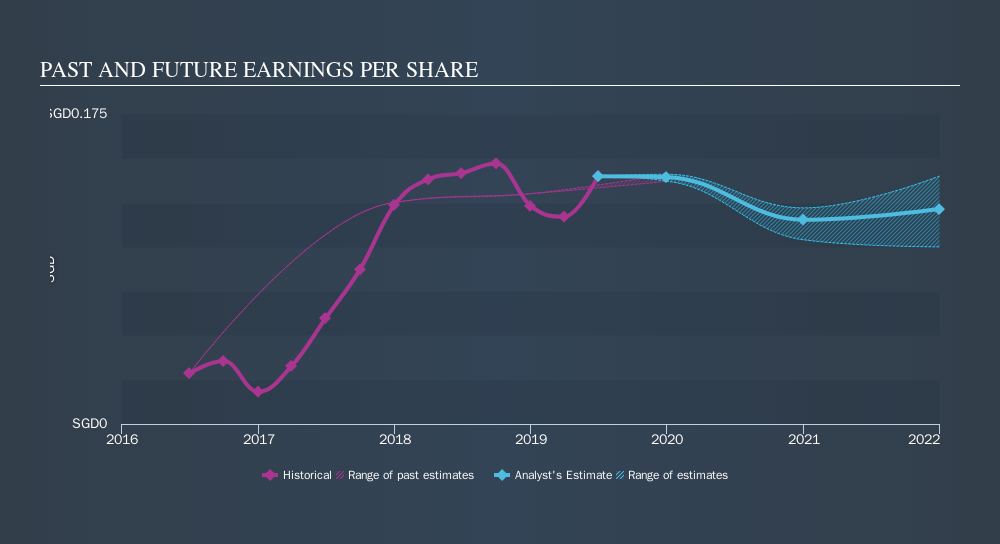

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During three years of share price growth, AEM Holdings achieved compound earnings per share growth of 70% per year. This EPS growth is lower than the 143% average annual increase in the share price. So it's fair to assume the market has a higher opinion of the business than it did three years ago. It's not unusual to see the market 're-rate' a stock, after a few years of growth.

The company's earnings per share (over time) are depicted in the image below.

It is of course excellent to see how AEM Holdings has grown profits over the years, but the future is more important for shareholders. If you are thinking of buying or selling AEM Holdings stock, you should check out this FREE detailed report on its balance sheet.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. As it happens, AEM Holdings's TSR for the last 3 years was 1468%, which exceeds the share price return mentioned earlier. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

We're pleased to report that AEM Holdings shareholders have received a total shareholder return of 50% over one year. And that does include the dividend. Having said that, the five-year TSR of 73% a year, is even better. Potential buyers might understandably feel they've missed the opportunity, but it's always possible business is still firing on all cylinders. Before deciding if you like the current share price, check how AEM Holdings scores on these 3 valuation metrics.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SG exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About SGX:AWX

AEM Holdings

Provides semiconductor and electronics test solutions worldwide.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives