- Singapore

- /

- Semiconductors

- /

- SGX:558

Why It Might Not Make Sense To Buy UMS Integration Limited (SGX:558) For Its Upcoming Dividend

UMS Integration Limited (SGX:558) is about to trade ex-dividend in the next 4 days. The ex-dividend date generally occurs two days before the record date, which is the day on which shareholders need to be on the company's books in order to receive a dividend. The ex-dividend date is important as the process of settlement involves at least two full business days. So if you miss that date, you would not show up on the company's books on the record date. Meaning, you will need to purchase UMS Integration's shares before the 7th of May to receive the dividend, which will be paid on the 23rd of May.

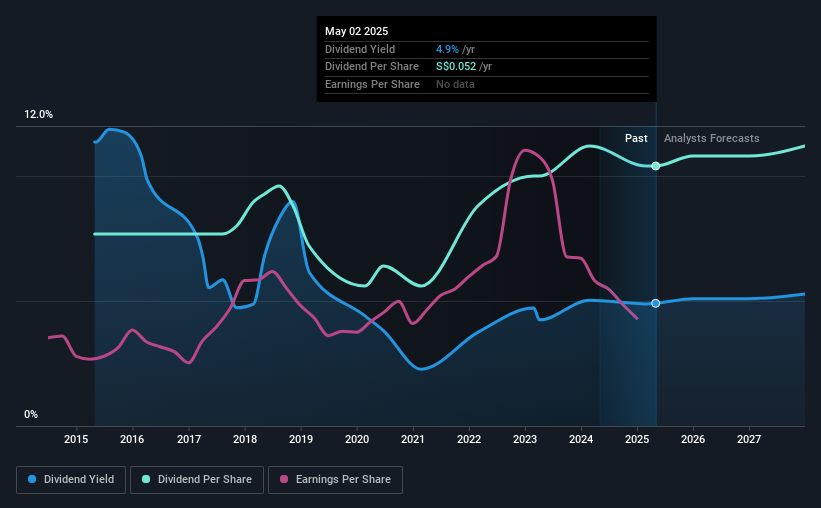

The company's next dividend payment will be S$0.02 per share. Last year, in total, the company distributed S$0.052 to shareholders. Calculating the last year's worth of payments shows that UMS Integration has a trailing yield of 4.9% on the current share price of S$1.06. Dividends are a major contributor to investment returns for long term holders, but only if the dividend continues to be paid. That's why we should always check whether the dividend payments appear sustainable, and if the company is growing.

We've discovered 1 warning sign about UMS Integration. View them for free.If a company pays out more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. Last year UMS Integration paid out 91% of its profits as dividends to shareholders, suggesting the dividend is not well covered by earnings. That said, even highly profitable companies sometimes might not generate enough cash to pay the dividend, which is why we should always check if the dividend is covered by cash flow. UMS Integration paid out more free cash flow than it generated - 167%, to be precise - last year, which we think is concerningly high. We're curious about why the company paid out more cash than it generated last year, since this can be one of the early signs that a dividend may be unsustainable.

UMS Integration does have a large net cash position on the balance sheet, which could fund large dividends for a time, if the company so chose. Still, smart investors know that it is better to assess dividends relative to the cash and profit generated by the business. Paying dividends out of cash on the balance sheet is not long-term sustainable.

Cash is slightly more important than profit from a dividend perspective, but given UMS Integration's payouts were not well covered by either earnings or cash flow, we would be concerned about the sustainability of this dividend.

See our latest analysis for UMS Integration

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Businesses with strong growth prospects usually make the best dividend payers, because it's easier to grow dividends when earnings per share are improving. Investors love dividends, so if earnings fall and the dividend is reduced, expect a stock to be sold off heavily at the same time. With that in mind, we're encouraged by the steady growth at UMS Integration, with earnings per share up 2.7% on average over the last five years. With limited earnings growth and paying out a concerningly high percentage of its earnings, the prospects of future dividend growth don't look so bright here.

We'd also point out that UMS Integration issued a meaningful number of new shares in the past year. Trying to grow the dividend while issuing large amounts of new shares reminds us of the ancient Greek tale of Sisyphus - perpetually pushing a boulder uphill.

Another key way to measure a company's dividend prospects is by measuring its historical rate of dividend growth. In the last 10 years, UMS Integration has lifted its dividend by approximately 3.1% a year on average. We're glad to see dividends rising alongside earnings over a number of years, which may be a sign the company intends to share the growth with shareholders.

To Sum It Up

Should investors buy UMS Integration for the upcoming dividend? The dividends are not well covered by either income or free cash flow, although at least earnings per share are slowly increasing. It's not the most attractive proposition from a dividend perspective, and we'd probably give this one a miss for now.

With that being said, if you're still considering UMS Integration as an investment, you'll find it beneficial to know what risks this stock is facing. Case in point: We've spotted 1 warning sign for UMS Integration you should be aware of.

A common investing mistake is buying the first interesting stock you see. Here you can find a full list of high-yield dividend stocks.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SGX:558

UMS Integration

An investment holding company, manufactures and markets precision machining components, and provides electromechanical assembly and final testing services.

Flawless balance sheet and fair value.

Market Insights

Community Narratives