- Hong Kong

- /

- Basic Materials

- /

- SEHK:691

July 2025 Penny Stocks Spotlight: Global Market's Rising Opportunities

Reviewed by Simply Wall St

As global markets navigate the complexities of new U.S. tariffs and mixed economic signals, investors are keeping a close eye on potential opportunities across various sectors. Penny stocks, although an older term in the investment lexicon, remain relevant as they often represent smaller or emerging companies that can offer unique growth prospects not always found in larger firms. This article will spotlight several penny stocks that stand out for their financial resilience and potential to thrive amidst current market conditions.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Rewards & Risks |

| EZZ Life Science Holdings (ASX:EZZ) | A$2.35 | A$104.25M | ✅ 4 ⚠️ 3 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.39 | HK$877.02M | ✅ 4 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.44 | SGD178.33M | ✅ 4 ⚠️ 1 View Analysis > |

| MGB Berhad (KLSE:MGB) | MYR0.52 | MYR307.66M | ✅ 5 ⚠️ 2 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.395 | £42.74M | ✅ 5 ⚠️ 2 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.37 | SGD9.33B | ✅ 5 ⚠️ 0 View Analysis > |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.505 | MYR2.51B | ✅ 5 ⚠️ 0 View Analysis > |

| Zetrix AI Berhad (KLSE:ZETRIX) | MYR0.95 | MYR7.32B | ✅ 5 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.23 | £196.23M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 3,800 stocks from our Global Penny Stocks screener.

Let's uncover some gems from our specialized screener.

China Shanshui Cement Group (SEHK:691)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: China Shanshui Cement Group Limited is an investment holding company involved in the manufacture and sale of cement, clinker, concrete, and related products in China, with a market cap of HK$2.35 billion.

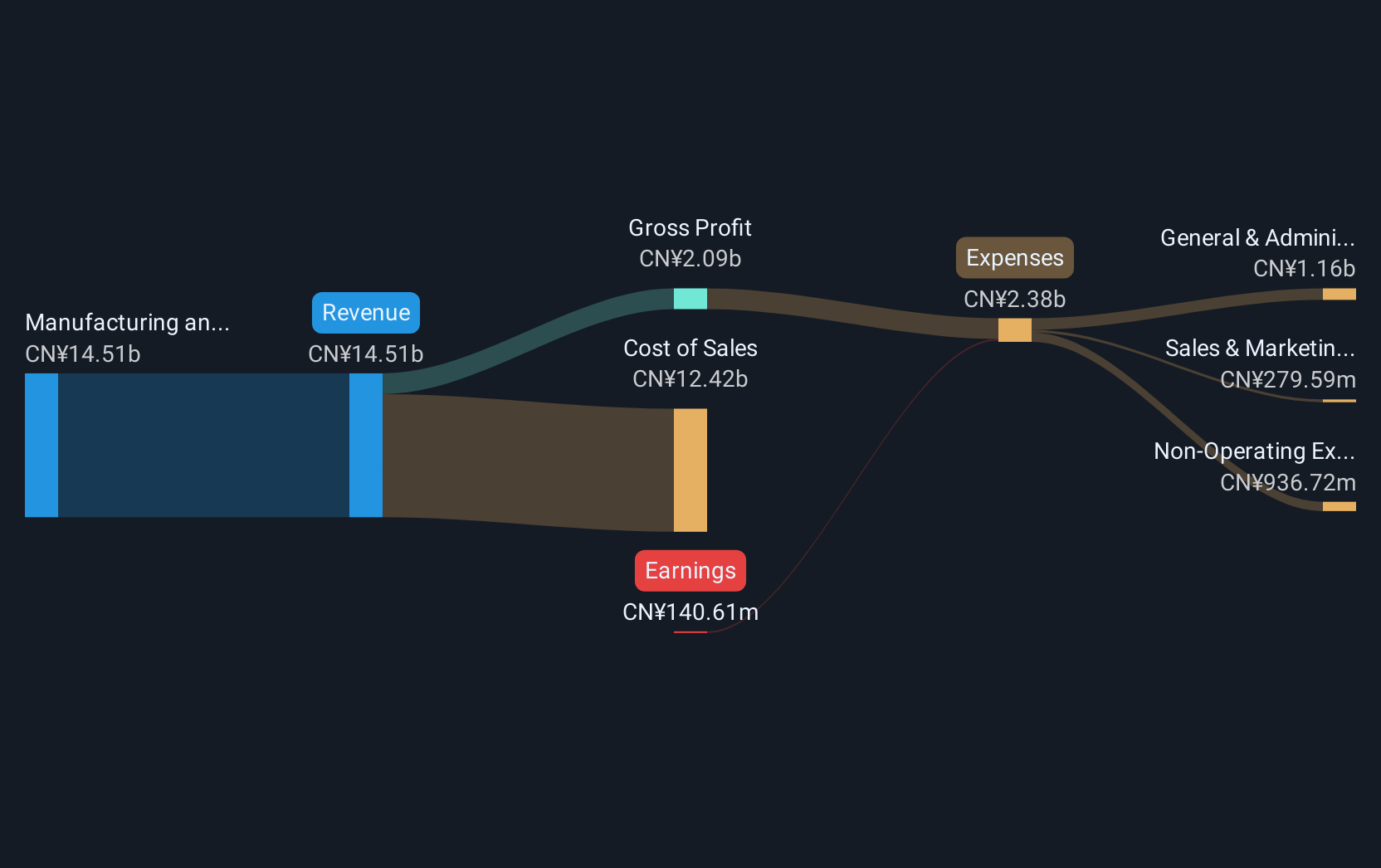

Operations: The company generates revenue of CN¥14.51 billion from its operations in manufacturing and trading cement, clinker, and concrete.

Market Cap: HK$2.35B

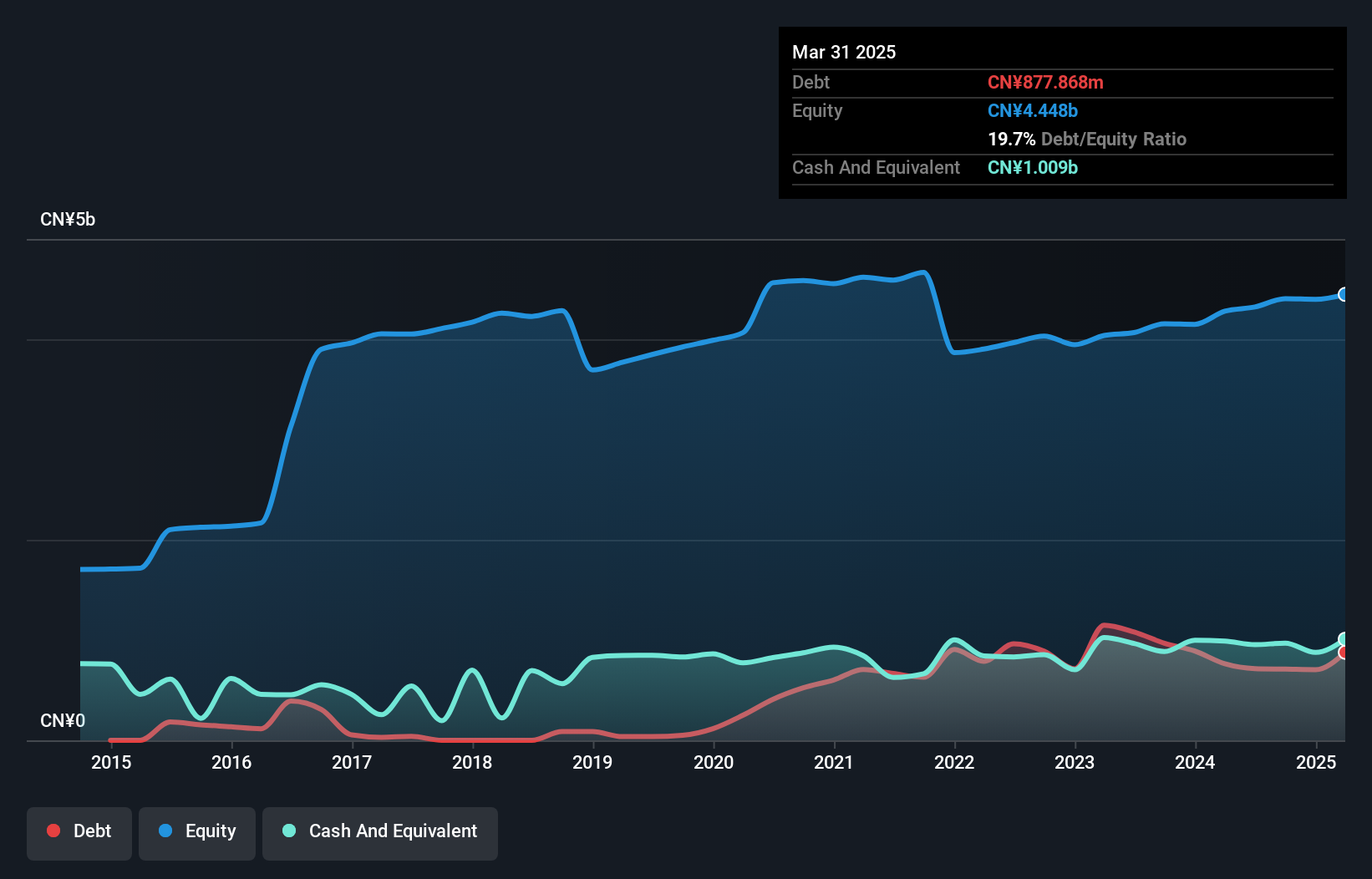

China Shanshui Cement Group Limited, with a market cap of HK$2.35 billion, has faced legal challenges recently, as allegations against former directors were dismissed in May 2025. Financially, the company struggles with profitability and cash flow issues; its return on equity is negative at -1.04%, and operating cash flow doesn't adequately cover debt obligations. Despite stable weekly volatility and satisfactory net debt to equity ratio of 19.7%, short-term liabilities exceed assets by CN¥1.2 billion. The board's experience averages seven years, but profit growth remains elusive as losses have increased significantly over the past five years.

- Take a closer look at China Shanshui Cement Group's potential here in our financial health report.

- Evaluate China Shanshui Cement Group's historical performance by accessing our past performance report.

UMS Integration (SGX:558)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: UMS Integration Limited (SGX:558) is an investment holding company that manufactures and markets precision machining components while offering electromechanical assembly and final testing services, with a market cap of SGD1 billion.

Operations: The company's revenue is primarily generated from its Semiconductor segment, which accounts for SGD207.51 million, followed by the Aerospace segment at SGD27.43 million.

Market Cap: SGD1B

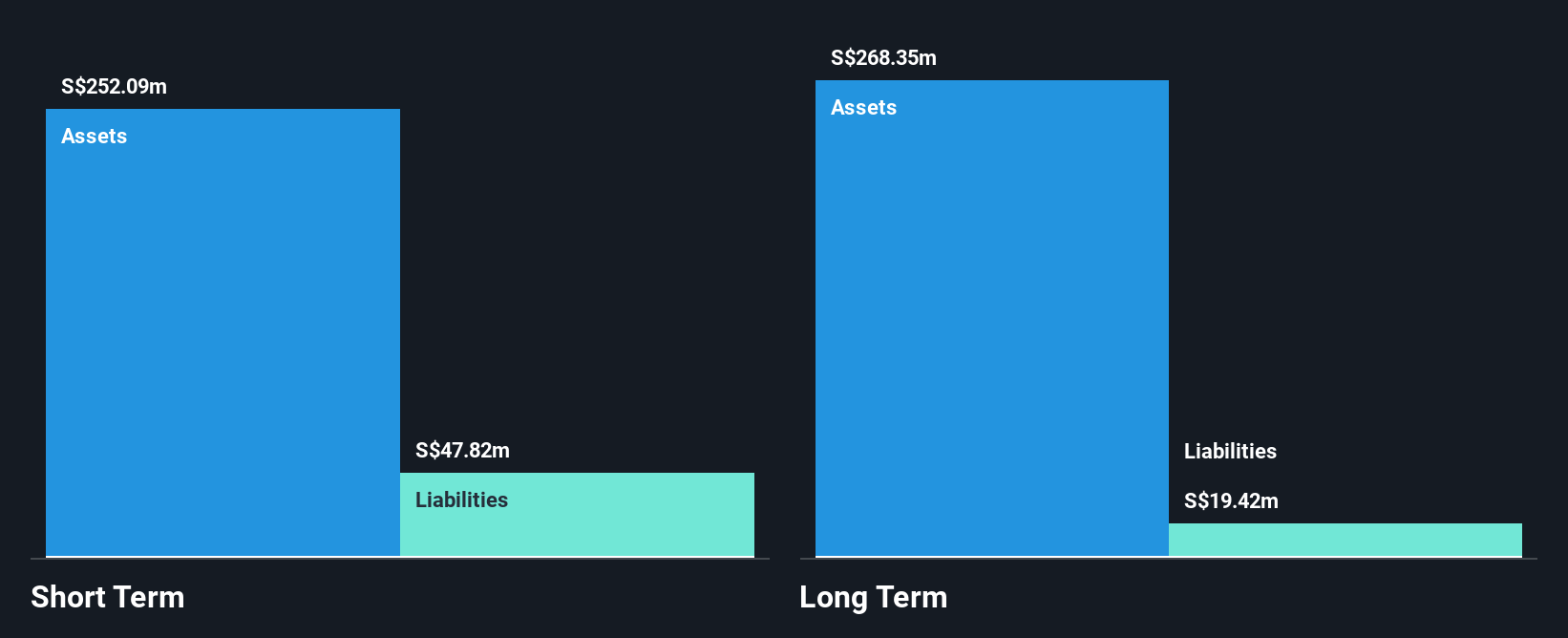

UMS Integration Limited, with a market cap of SGD1 billion, primarily generates revenue from its Semiconductor segment. The company’s financial health appears robust as short-term assets significantly exceed both short and long-term liabilities. Although UMS has more cash than debt and interest payments are well-covered by profits, its dividend yield of 3.69% isn't fully supported by free cash flow. Recent board changes include new appointments and redesignations, potentially impacting governance dynamics. Despite stable weekly volatility and a reduction in the debt-to-equity ratio over five years, recent negative earnings growth contrasts with the industry average growth rate.

- Click here to discover the nuances of UMS Integration with our detailed analytical financial health report.

- Learn about UMS Integration's future growth trajectory here.

Fuan Pharmaceutical (Group) (SZSE:300194)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Fuan Pharmaceutical (Group) Co., Ltd. and its subsidiaries focus on researching, developing, producing, and selling chemical drugs in the People's Republic of China, with a market cap of CN¥5.39 billion.

Operations: The company's revenue from the pharmaceutical industry amounts to CN¥2.05 billion.

Market Cap: CN¥5.39B

Fuan Pharmaceutical (Group) Co., Ltd. has a market cap of CN¥5.39 billion and reported first-quarter revenue of CN¥467.68 million, down from CN¥809.4 million the previous year, with net income also declining to CN¥69.05 million. The company's financial health is supported by short-term assets exceeding liabilities and having more cash than debt, though its dividend yield isn't well covered by free cash flow. Despite stable weekly volatility and an experienced management team, recent negative earnings growth presents challenges in comparison to industry trends, although its price-to-earnings ratio suggests it may be undervalued relative to the broader Chinese market.

- Dive into the specifics of Fuan Pharmaceutical (Group) here with our thorough balance sheet health report.

- Gain insights into Fuan Pharmaceutical (Group)'s historical outcomes by reviewing our past performance report.

Where To Now?

- Jump into our full catalog of 3,800 Global Penny Stocks here.

- Ready For A Different Approach? These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:691

China Shanshui Cement Group

An investment holding company, engages in the manufacture and sale of cement, clinker, concrete, and related products and services in the People’s Republic of China.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives