Avoid Metro Holdings On SGX And Explore This One Attractive Dividend Stock Instead

Reviewed by Sasha Jovanovic

Dividend-paying stocks are often sought after for their potential to provide a steady income stream. However, it's crucial to examine the sustainability of these dividends. Companies like Metro Holdings, with high payout ratios, may indicate that their dividends could be at risk, making them less attractive for long-term investment stability.

Top 10 Dividend Stocks In Singapore

| Name | Dividend Yield | Dividend Rating |

| BRC Asia (SGX:BEC) | 7.34% | ★★★★★☆ |

| China Sunsine Chemical Holdings (SGX:QES) | 6.34% | ★★★★★☆ |

| Civmec (SGX:P9D) | 6.00% | ★★★★★☆ |

| Singapore Exchange (SGX:S68) | 3.62% | ★★★★★☆ |

| Multi-Chem (SGX:AWZ) | 8.80% | ★★★★★☆ |

| UOB-Kay Hian Holdings (SGX:U10) | 6.87% | ★★★★★☆ |

| UOL Group (SGX:U14) | 3.82% | ★★★★★☆ |

| Bumitama Agri (SGX:P8Z) | 6.77% | ★★★★★☆ |

| Singapore Airlines (SGX:C6L) | 6.98% | ★★★★★☆ |

| YHI International (SGX:BPF) | 6.56% | ★★★★★☆ |

Click here to see the full list of 21 stocks from our Top SGX Dividend Stocks screener.

Let's uncover one of the gems from our specialized screener and one you can probably ignore.

Top Pick

Multi-Chem (SGX:AWZ)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Multi-Chem Limited, primarily an investment holding company, operates in the distribution of information technology products across regions including Singapore, Greater China, Australia, and India, with a market capitalization of SGD 248.66 million.

Operations: The company generates revenue from its IT business in Singapore (SGD 372.78 million), Australia (SGD 54.60 million), India (SGD 40.56 million), Greater China (SGD 34.96 million), and other regions (SGD 153.93 million), along with a smaller segment in PCB business in Singapore (SGD 1.79 million).

Dividend Yield: 8.8%

Multi-Chem Limited, a Singapore-based company, maintains a stable dividend cover with its earnings and cash flows adequately covering an 80.7% payout ratio and an 88.1% cash payout ratio respectively. This financial prudence contrasts sharply with some peers struggling with unsustainable high payout ratios. However, investors should note Multi-Chem's dividend history has been marked by volatility over the past decade, reflecting some inconsistency in payouts despite recent improvements in earnings growth (35.6% year-over-year). Recent board enhancements could signal stronger governance ahead, potentially stabilizing future dividends.

- Delve into the full analysis dividend report here for a deeper understanding of Multi-Chem.

- Insights from our recent valuation report point to the potential undervaluation of Multi-Chem shares in the market.

One To Reconsider

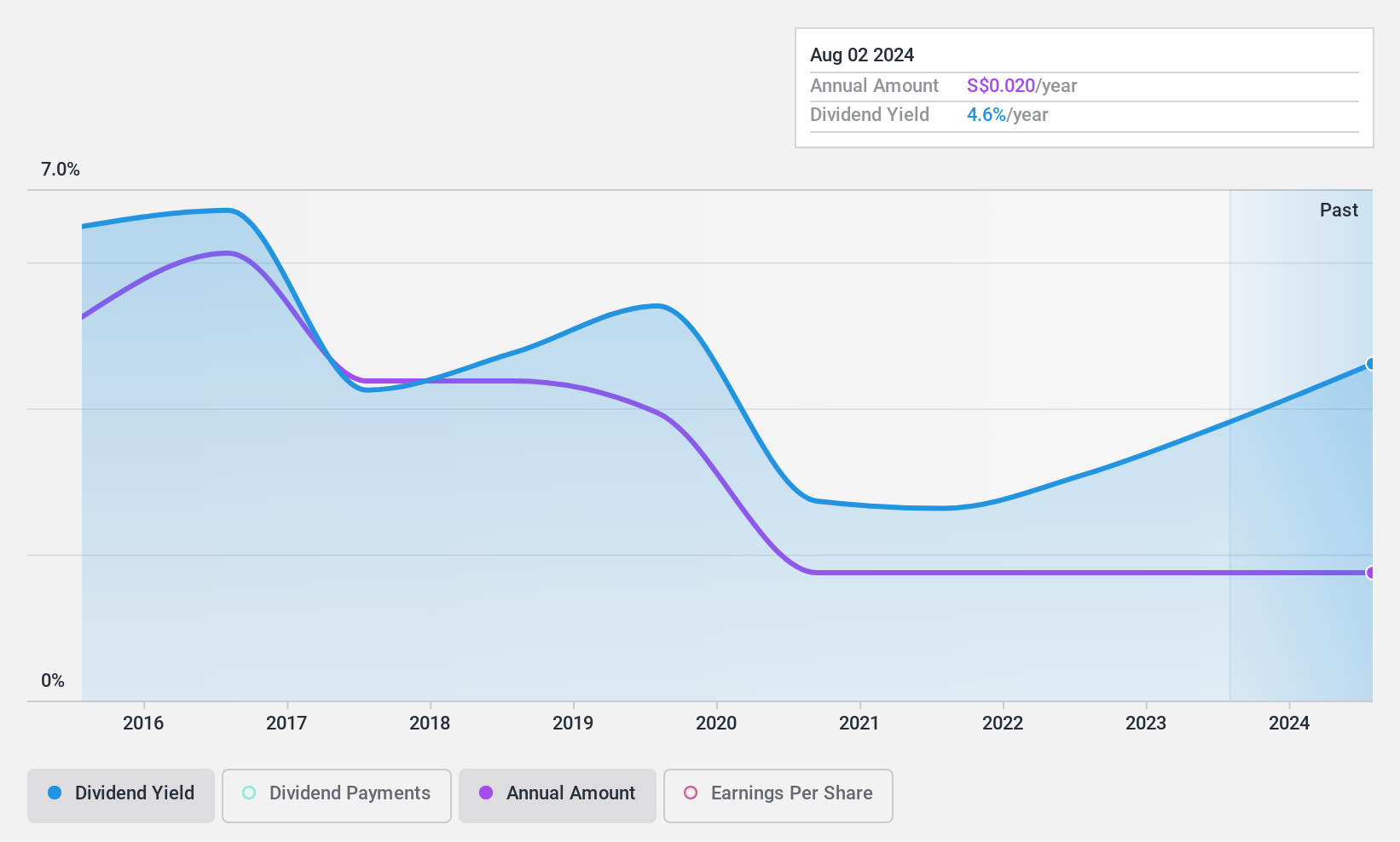

Metro Holdings (SGX:M01)

Simply Wall St Dividend Rating: ★☆☆☆☆☆

Overview: Metro Holdings Limited operates in retail, as well as property development and investment, across Singapore, China, Indonesia, the UK, and Australia, with a market capitalization of approximately SGD 397.46 million.

Operations: The company generates revenue through two main segments: retail, which brought in SGD 105.44 million, and property development and investment, contributing SGD 5.48 million.

Dividend Yield: 4.2%

Metro Holdings Limited faces significant challenges as a dividend stock. With a high payout ratio of 113.8% and an even higher cash payout ratio of 18.42, its dividends are poorly covered by both earnings and cash flows, indicating potential sustainability issues. Additionally, the company's dividend yield of 4.17% is below the top quartile in Singapore's market, further diminishing its attractiveness to income-focused investors. Recent financials show declining revenues and net income, compounding concerns about its ability to maintain dividends without financial strain.

Turning Ideas Into Actions

- Click this link to deep-dive into the 21 companies within our Top SGX Dividend Stocks screener.

- Are any of these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:M01

Metro Holdings

Engages in retail, and property development and investment businesses in Singapore, the People’s Republic of China, Indonesia, the United Kingdom, and Australia.

Mediocre balance sheet and slightly overvalued.

Market Insights

Community Narratives