- Singapore

- /

- Real Estate

- /

- SGX:CLN

3 High Yield Dividend Stocks On SGX With Up To 6.7% Yield

Reviewed by Simply Wall St

As global financial dynamics continue to evolve, recent developments such as Visa and Mastercard's commitment to maintaining capped fees on tourist card transactions underscore a broader trend towards regulatory stability and cost predictability in international commerce. In this context, dividend stocks, particularly those offering high yields on the Singapore Exchange (SGX), may appeal to investors looking for reliable income streams amid fluctuating market conditions.

Top 10 Dividend Stocks In Singapore

| Name | Dividend Yield | Dividend Rating |

| BRC Asia (SGX:BEC) | 6.99% | ★★★★★☆ |

| Multi-Chem (SGX:AWZ) | 8.50% | ★★★★★☆ |

| UOL Group (SGX:U14) | 3.80% | ★★★★★☆ |

| UOB-Kay Hian Holdings (SGX:U10) | 6.81% | ★★★★★☆ |

| Bumitama Agri (SGX:P8Z) | 6.71% | ★★★★★☆ |

| Civmec (SGX:P9D) | 5.66% | ★★★★★☆ |

| Singapore Exchange (SGX:S68) | 3.55% | ★★★★★☆ |

| Singapore Airlines (SGX:C6L) | 6.88% | ★★★★★☆ |

| YHI International (SGX:BPF) | 6.77% | ★★★★★☆ |

| Sing Investments & Finance (SGX:S35) | 6.00% | ★★★★☆☆ |

Click here to see the full list of 21 stocks from our Top SGX Dividend Stocks screener.

Let's uncover some gems from our specialized screener.

YHI International (SGX:BPF)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: YHI International Limited operates as an investment holding company that distributes automotive and industrial products across regions including Singapore, Malaysia, China, Hong Kong, Taiwan, Australia, and New Zealand with a market capitalization of SGD 135.65 million.

Operations: YHI International Limited generates revenue through various segments, with SGD 120.10 million from Distribution in ASEAN, SGD 47.72 million from Manufacturing in ASEAN, SGD 136.97 million from Distribution in Oceania, SGD 18.29 million from Distribution in North East Asia, and SGD 57.87 million from Manufacturing in North East Asia (excluding rental).

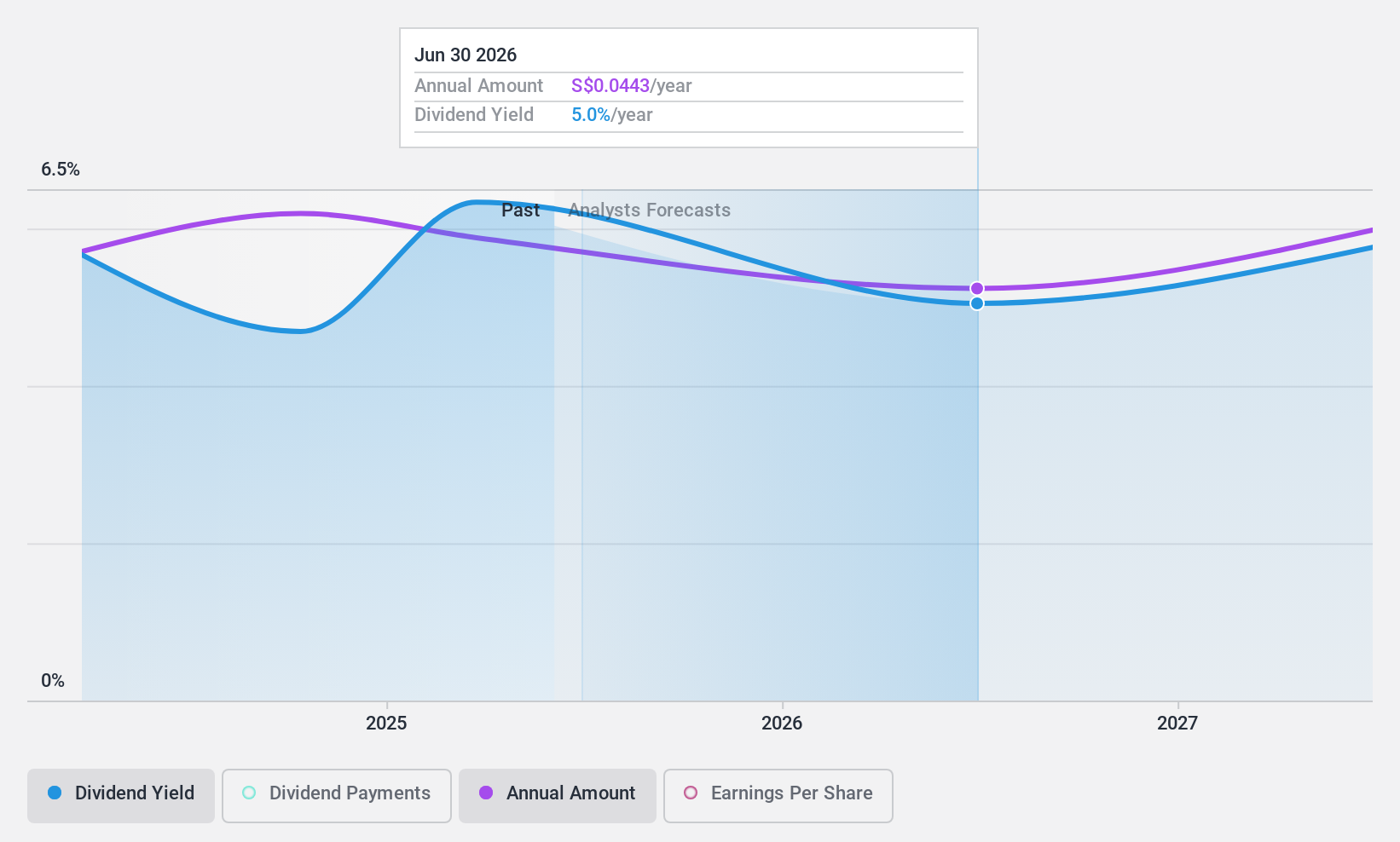

Dividend Yield: 6.8%

YHI International's recent dividend declaration of 3.15 Singapore cents per share reflects a cautious approach amidst its unstable dividend history over the past decade, characterized by volatility and unpredictability in payments. Despite this, the company maintains a healthy payout scenario with a 70.1% earnings coverage and an even stronger cash flow position at 26.6%, suggesting reasonable support for ongoing dividends from operational performance. This financial prudence is evident despite trading at a significant discount to estimated fair value, indicating potential undervaluation.

- Unlock comprehensive insights into our analysis of YHI International stock in this dividend report.

- The valuation report we've compiled suggests that YHI International's current price could be quite moderate.

APAC Realty (SGX:CLN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: APAC Realty Limited is an investment holding company that offers real estate services across Singapore, Indonesia, Vietnam, and other international markets, with a market capitalization of SGD 142.08 million.

Operations: APAC Realty Limited generates revenue primarily through real estate brokerage, contributing SGD 548.88 million, and a smaller portion from rental income at SGD 2.15 million.

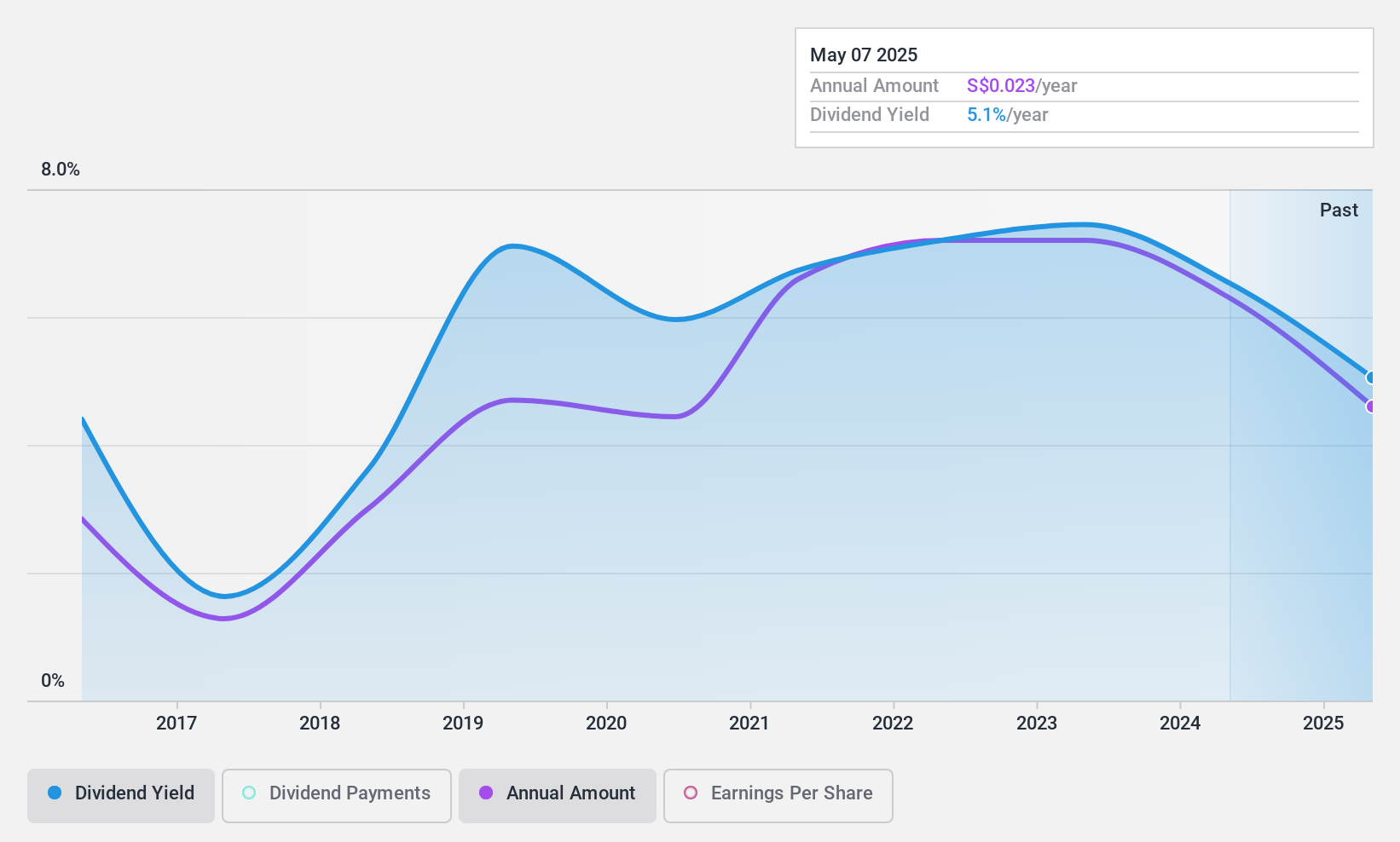

Dividend Yield: 6.2%

APAC Realty's recent expansion into the Philippines through a franchise agreement could bolster its regional presence, potentially impacting long-term earnings. However, its dividend history is marked by instability, with a recent cut to 1.4 Singapore cents per share reflecting this trend. Despite earnings forecasted to grow by 10.1% annually, dividends have been inconsistent over the past six years and are only moderately covered by cash flows (55.6%) and earnings (75.4%), suggesting potential challenges in maintaining future dividend payments amidst volatile profit margins which have decreased from last year’s 3.8% to current 2.1%.

- Dive into the specifics of APAC Realty here with our thorough dividend report.

- Upon reviewing our latest valuation report, APAC Realty's share price might be too pessimistic.

Civmec (SGX:P9D)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Civmec Limited, an investment holding company based in Australia, offers construction and engineering services to sectors including energy, resources, infrastructure, and marine and defense, with a market capitalization of approximately SGD 449.22 million.

Operations: Civmec Limited generates revenue through its construction and engineering services, with A$46.02 million from the energy sector, A$752.82 million from resources, and A$105.52 million from infrastructure, marine, and defense combined.

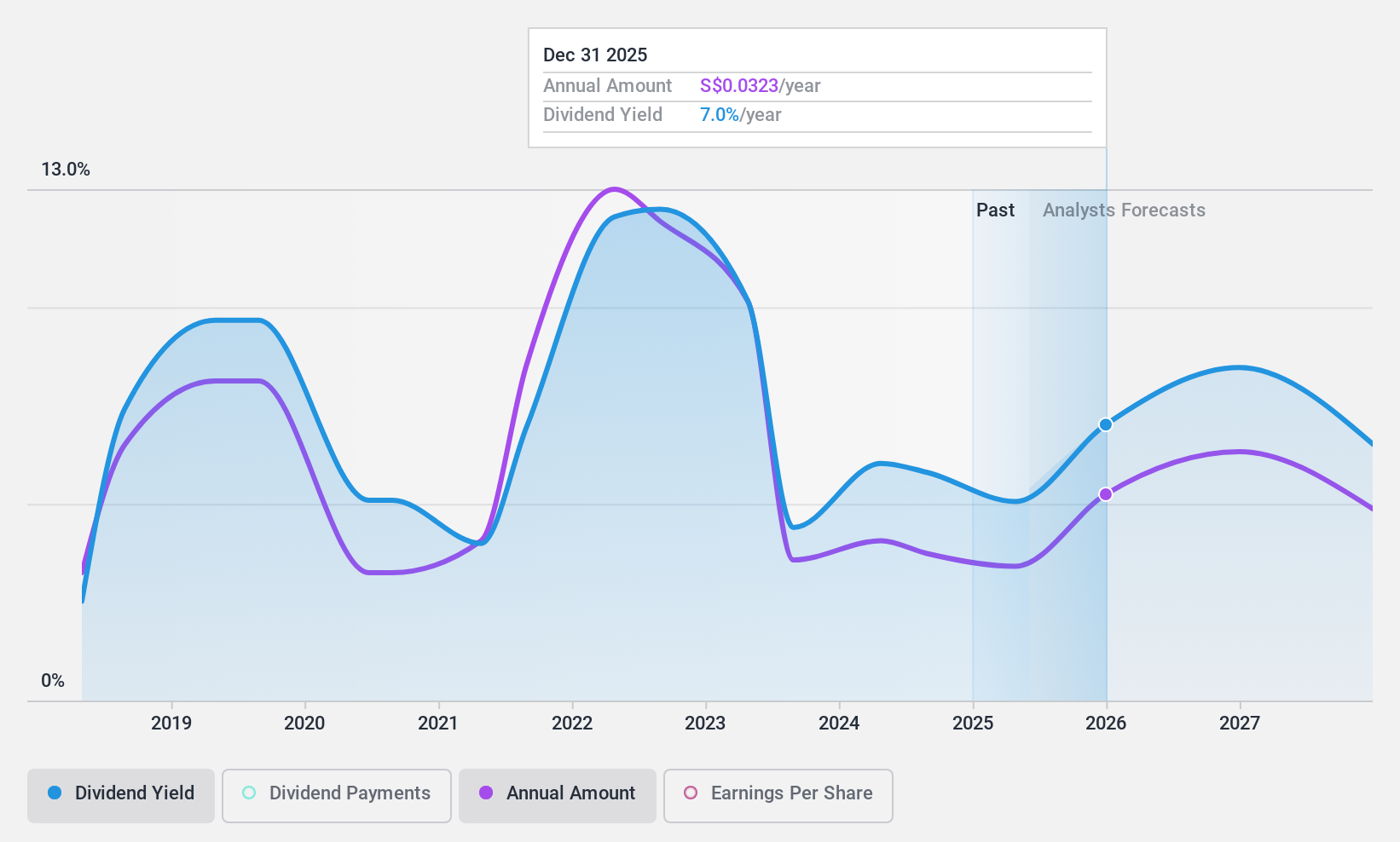

Dividend Yield: 5.7%

Civmec's recent contract awards, including a significant shiploader project for A$174 million, underscore its robust operational capabilities and potential for sustained earnings. Despite a low dividend yield of 5.66% compared to the top Singaporean dividend stocks, Civmec has maintained stable and reliable dividends over the past decade with growth in payments supported by a conservative payout ratio of 45.4% and cash payout ratio of 27%. These financial practices suggest a prudent approach to balancing growth and shareholder returns.

- Get an in-depth perspective on Civmec's performance by reading our dividend report here.

- Our valuation report here indicates Civmec may be undervalued.

Taking Advantage

- Investigate our full lineup of 21 Top SGX Dividend Stocks right here.

- Already own these companies? Bring clarity to your investment decisions by linking up your portfolio with Simply Wall St, where you can monitor all the vital signs of your stocks effortlessly.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:CLN

APAC Realty

An investment holding company, provides real estate services in Singapore, Indonesia, Vietnam, and internationally.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives