- Singapore

- /

- Healthcare Services

- /

- SGX:QC7

Asian Market Highlights: Top Penny Stocks For May 2025

Reviewed by Simply Wall St

As global markets grapple with volatility and geopolitical uncertainties, investors are increasingly looking toward Asia for potential opportunities. Penny stocks, though often seen as relics of past market eras, remain relevant due to their affordability and growth potential when backed by strong financials. In this article, we explore several Asian penny stocks that stand out for their robust fundamentals and the promise they hold in today's complex economic landscape.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| North East Rubber (SET:NER) | THB4.16 | THB7.69B | ✅ 5 ⚠️ 2 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.44 | SGD178.33M | ✅ 4 ⚠️ 3 View Analysis > |

| YKGI (Catalist:YK9) | SGD0.096 | SGD40.8M | ✅ 2 ⚠️ 3 View Analysis > |

| Beng Kuang Marine (SGX:BEZ) | SGD0.18 | SGD35.86M | ✅ 4 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.04 | SGD8.03B | ✅ 5 ⚠️ 0 View Analysis > |

| Ever Sunshine Services Group (SEHK:1995) | HK$1.84 | HK$3.18B | ✅ 5 ⚠️ 1 View Analysis > |

| Bosideng International Holdings (SEHK:3998) | HK$4.43 | HK$50.72B | ✅ 4 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.14 | HK$719.28M | ✅ 4 ⚠️ 2 View Analysis > |

| Goodbaby International Holdings (SEHK:1086) | HK$1.20 | HK$2B | ✅ 4 ⚠️ 2 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.12 | HK$1.77B | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 1,169 stocks from our Asian Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Global New Material International Holdings (SEHK:6616)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Global New Material International Holdings Limited is an investment holding company that produces and sells pearlescent pigment, functional mica filler, and related products both in China and internationally, with a market cap of HK$4.91 billion.

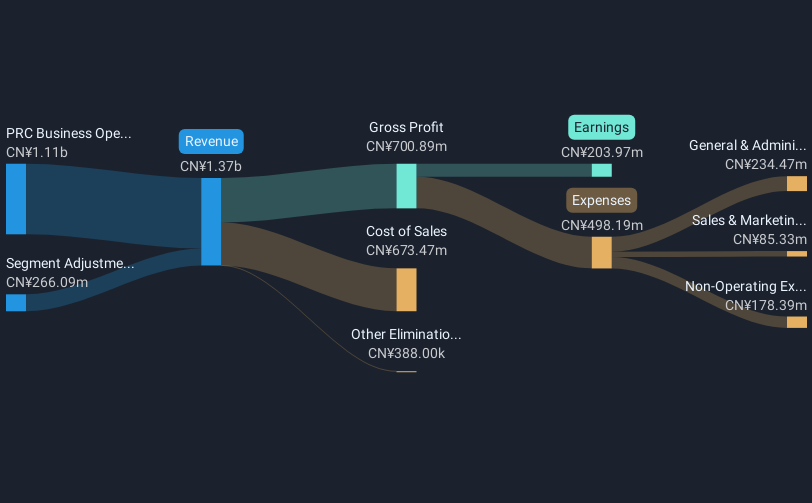

Operations: The company generates revenue from its operations in the PRC, amounting to CN¥1.33 billion, and from its business activities in Korea, which contribute CN¥316.59 million.

Market Cap: HK$4.91B

Global New Material International Holdings has demonstrated significant earnings growth, reporting CN¥1.65 billion in sales for 2024, up from CN¥1.06 billion the previous year. The company has a solid financial position with short-term assets of CN¥4.3 billion exceeding both its short and long-term liabilities, suggesting sound liquidity management. Despite a low Return on Equity of 7.4%, earnings growth outpaced the industry average at 33.4% last year, indicating strong operational performance. However, increased debt levels and lower profit margins compared to last year may pose challenges moving forward despite well-covered interest payments and no recent shareholder dilution.

- Navigate through the intricacies of Global New Material International Holdings with our comprehensive balance sheet health report here.

- Gain insights into Global New Material International Holdings' future direction by reviewing our growth report.

Thakral (SGX:AWI)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Thakral Corporation Ltd is an investment holding company that markets and distributes beauty, fragrance, and lifestyle products across Australia, India, Japan, the People’s Republic of China, and Singapore with a market cap of SGD152.47 million.

Operations: Thakral's revenue is primarily derived from its Lifestyle segment, which generated SGD273.03 million, while its Investment segment contributed SGD15.78 million.

Market Cap: SGD152.47M

Thakral Corporation Ltd has shown robust financial performance, with sales reaching S$288.81 million for 2024, driven primarily by its Lifestyle segment. The company reported a net income of S$28.81 million, reflecting substantial earnings growth over the previous year. Its board and management team have undergone changes to enhance governance and sustainability efforts, including the formation of a Sustainability Committee. Despite its low Return on Equity at 16.2%, Thakral maintains satisfactory debt levels with interest payments well-covered by EBIT (4.1x coverage). Recent dividend affirmations underscore its commitment to shareholder returns amidst volatile share prices.

- Take a closer look at Thakral's potential here in our financial health report.

- Review our historical performance report to gain insights into Thakral's track record.

Q & M Dental Group (Singapore) (SGX:QC7)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Q & M Dental Group (Singapore) Limited is an investment holding company that offers private dental healthcare services in Singapore, Malaysia, China, and internationally with a market cap of SGD336.71 million.

Operations: The company generates revenue primarily from its Core Dental Business, which accounts for SGD173.79 million, alongside Other Businesses contributing SGD6.89 million.

Market Cap: SGD336.71M

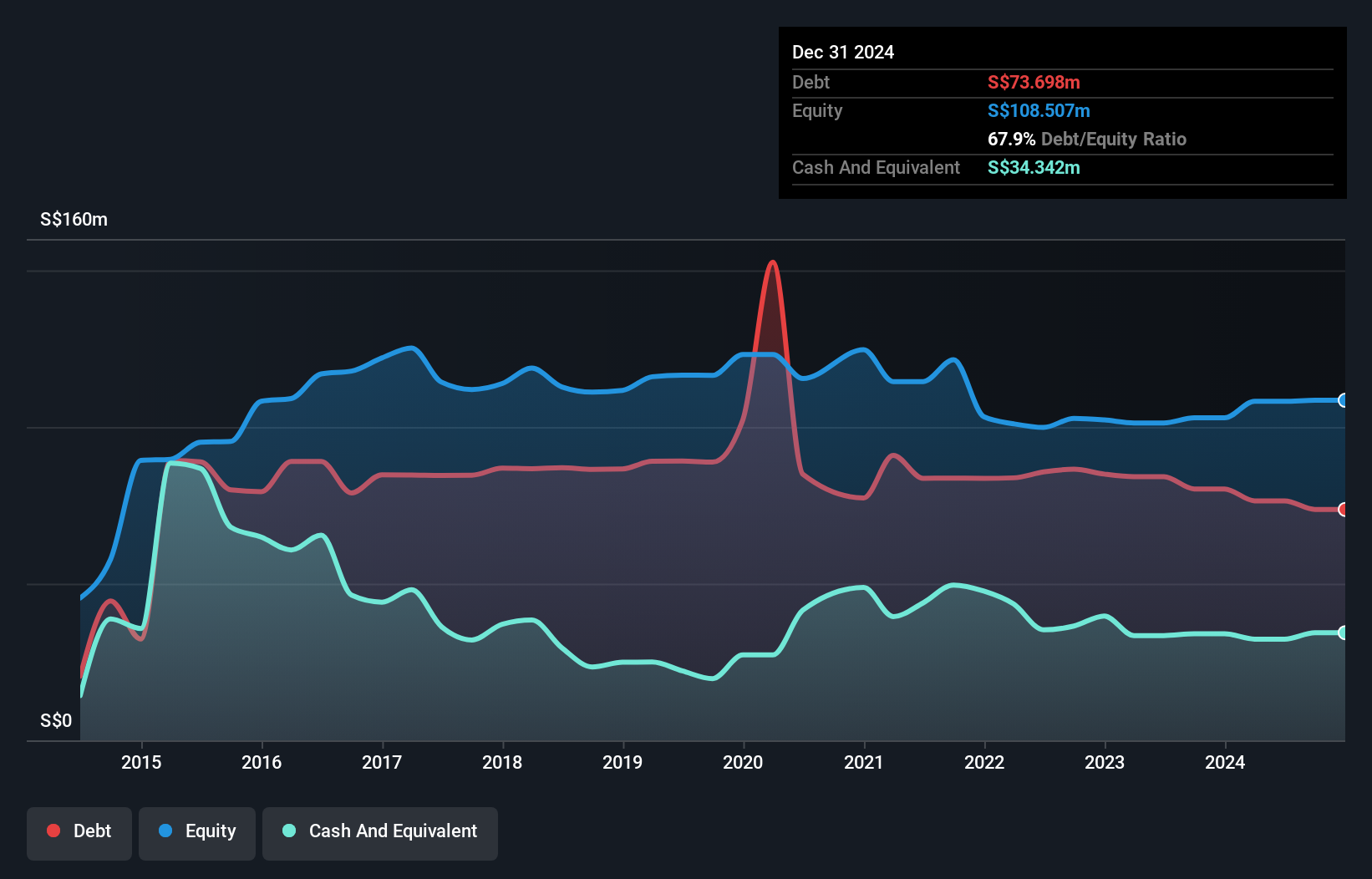

Q & M Dental Group (Singapore) Limited, with a market cap of SGD336.71 million, is trading at a significant discount to its estimated fair value. Despite experiencing a large one-off loss of SGD5.2 million in 2024, the company has demonstrated strong earnings growth of 27.1% over the past year, outpacing the healthcare industry average. The management team is experienced with satisfactory debt levels and well-covered interest payments by EBIT (4.4x coverage). Recent share buyback authorization reflects strategic capital management while maintaining stable weekly volatility and improved profit margins year-on-year from 6.3% to 8.1%.

- Unlock comprehensive insights into our analysis of Q & M Dental Group (Singapore) stock in this financial health report.

- Review our growth performance report to gain insights into Q & M Dental Group (Singapore)'s future.

Seize The Opportunity

- Embark on your investment journey to our 1,169 Asian Penny Stocks selection here.

- Seeking Other Investments? We've found 19 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Q & M Dental Group (Singapore) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:QC7

Q & M Dental Group (Singapore)

An investment holding company, provides private dental healthcare services in Singapore, Malaysia, China, and internationally.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives