- Singapore

- /

- Specialty Stores

- /

- SGX:5SO

Reflecting on Duty Free International's (SGX:5SO) Share Price Returns Over The Last Five Years

We think intelligent long term investing is the way to go. But no-one is immune from buying too high. For example the Duty Free International Limited (SGX:5SO) share price dropped 76% over five years. That is extremely sub-optimal, to say the least. Unfortunately the share price momentum is still quite negative, with prices down 10% in thirty days.

Check out our latest analysis for Duty Free International

To quote Buffett, 'Ships will sail around the world but the Flat Earth Society will flourish. There will continue to be wide discrepancies between price and value in the marketplace...' By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

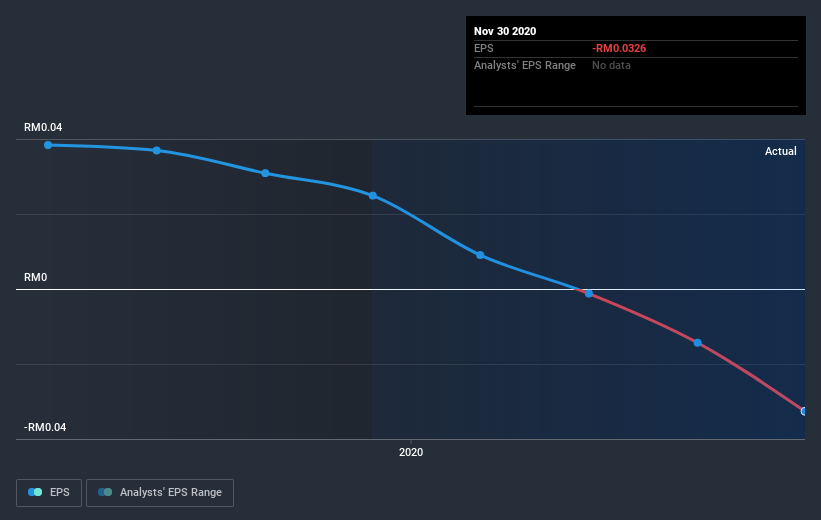

Over five years Duty Free International's earnings per share dropped significantly, falling to a loss, with the share price also lower. At present it's hard to make valid comparisons between EPS and the share price. However, we can say we'd expect to see a falling share price in this scenario.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

Dive deeper into Duty Free International's key metrics by checking this interactive graph of Duty Free International's earnings, revenue and cash flow.

What about the Total Shareholder Return (TSR)?

We've already covered Duty Free International's share price action, but we should also mention its total shareholder return (TSR). Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Duty Free International's TSR of was a loss of 59% for the 5 years. That wasn't as bad as its share price return, because it has paid dividends.

A Different Perspective

While the broader market gained around 12% in the last year, Duty Free International shareholders lost 14%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. However, the loss over the last year isn't as bad as the 10% per annum loss investors have suffered over the last half decade. We'd need to see some sustained improvements in the key metrics before we could muster much enthusiasm. It's always interesting to track share price performance over the longer term. But to understand Duty Free International better, we need to consider many other factors. Even so, be aware that Duty Free International is showing 2 warning signs in our investment analysis , and 1 of those is a bit unpleasant...

But note: Duty Free International may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SG exchanges.

If you decide to trade Duty Free International, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SGX:5SO

Duty Free International

An investment holding company, operates as a duty-free retailer under the Zon brand in Malaysia.

Flawless balance sheet and good value.

Market Insights

Community Narratives