- Singapore

- /

- Real Estate

- /

- SGX:Z59

Would Shareholders Who Purchased Yoma Strategic Holdings' (SGX:Z59) Stock Three Years Be Happy With The Share price Today?

In order to justify the effort of selecting individual stocks, it's worth striving to beat the returns from a market index fund. But its virtually certain that sometimes you will buy stocks that fall short of the market average returns. Unfortunately, that's been the case for longer term Yoma Strategic Holdings Ltd. (SGX:Z59) shareholders, since the share price is down 45% in the last three years, falling well short of the market decline of around 12%.

See our latest analysis for Yoma Strategic Holdings

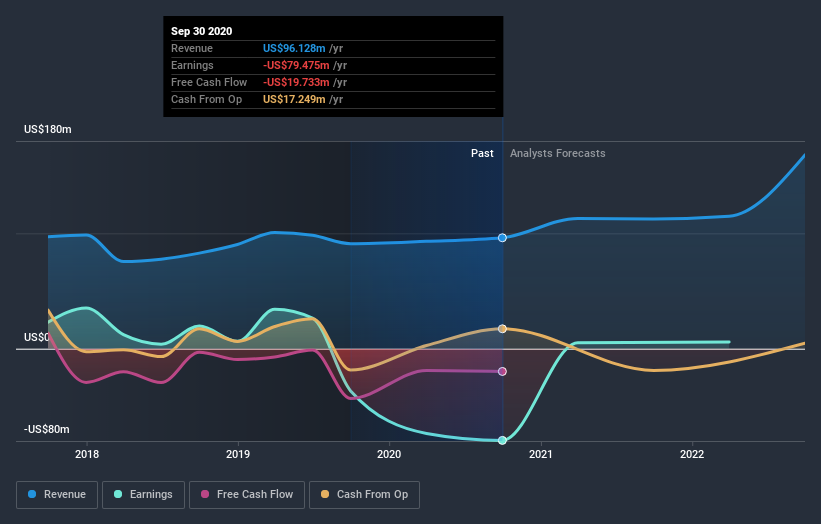

Yoma Strategic Holdings wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. When a company doesn't make profits, we'd generally expect to see good revenue growth. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last three years, Yoma Strategic Holdings saw its revenue grow by 2.8% per year, compound. Given it's losing money in pursuit of growth, we are not really impressed with that. Indeed, the stock dropped 13% over the last three years. If revenue growth accelerates, we might see the share price bounce. But ultimately the key will be whether the company can become profitability.

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

If you are thinking of buying or selling Yoma Strategic Holdings stock, you should check out this FREE detailed report on its balance sheet.

A Different Perspective

We regret to report that Yoma Strategic Holdings shareholders are down 12% for the year. Unfortunately, that's worse than the broader market decline of 9.4%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 6% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 1 warning sign for Yoma Strategic Holdings that you should be aware of.

Of course Yoma Strategic Holdings may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SG exchanges.

If you’re looking to trade Yoma Strategic Holdings, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SGX:Z59

Yoma Strategic Holdings

An investment holding company, engages in the real estate, motor, leasing, mobile financial, food and beverages, and investment businesses in Singapore, Myanmar, and the People’s Republic of China.

Adequate balance sheet with very low risk.

Market Insights

Community Narratives