- Singapore

- /

- Retail REITs

- /

- SGX:SK6U

Introducing SPH REIT (SGX:SK6U), A Stock That Climbed 12% In The Last Three Years

Vanguard founder Jack Bogle helped spearhead the low-cost index fund, putting average returns within reach of every investor. But you can make superior returns by picking better-than average stocks. Notably, the SPH REIT (SGX:SK6U) share price has gained 12% in three years, which is better than the average market return. Zooming in, the stock is up just 4.0% in the last year.

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

See our latest analysis for SPH REIT

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Over the last three years, SPH REIT failed to grow earnings per share, which fell 7.3% (annualized). The strong decline in earnings per share suggests the market isn't using EPS to judge the company. So we'll need to take a look at some different metrics to try to understand why the share price remains solid.

Interestingly, the dividend has increased over time; so that may have given the share price a boost. Sometimes yield-chasing investors will flock to a company if they think the dividend can grow over time.

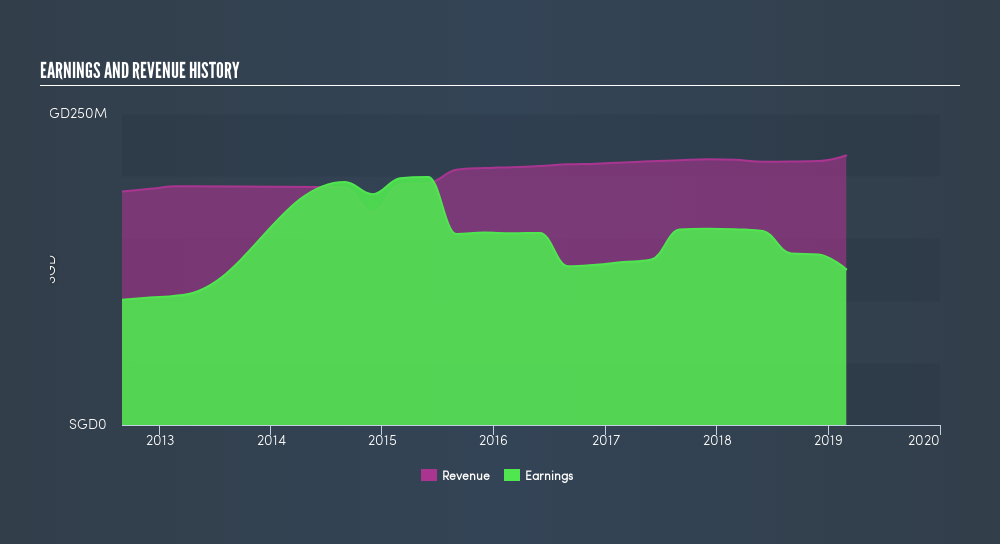

You can see how revenue and earnings have changed over time in the image below, (click on the chart to see cashflow).

If you are thinking of buying or selling SPH REIT stock, you should check out this FREE detailed report on its balance sheet.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. In the case of SPH REIT, it has a TSR of 32% for the last 3 years. That exceeds its share price return that we previously mentioned. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

We're pleased to report that SPH REIT shareholders have received a total shareholder return of 9.8% over one year. That's including the dividend. That's better than the annualised return of 6.1% over half a decade, implying that the company is doing better recently. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. Keeping this in mind, a solid next step might be to take a look at SPH REIT's dividend track record. This free interactive graph is a great place to start.

But note: SPH REIT may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SG exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About SGX:SK6U

Paragon REIT

PARAGON REIT is a Singapore-based real estate investment trust established principally to invest in a portfolio of income-producing real estate primarily for retail purposes in AsiaPacific, as well as real estate-related assets.

Undervalued with proven track record.

Market Insights

Community Narratives