- Singapore

- /

- Retail REITs

- /

- SGX:JYEU

Lendlease Global Commercial REIT (SGX:JYEU): Assessing Valuation Following SGD 280 Million Equity Raise and Dividend Update

Reviewed by Simply Wall St

Lendlease Global Commercial REIT (SGX:JYEU) has just completed a sizeable follow-on equity offering, raising about SGD 280 million with the issue of new units. These moves, along with dividend updates, are set to shape the REIT's capital base and investor outlook in the coming months.

See our latest analysis for Lendlease Global Commercial REIT.

Lendlease Global Commercial REIT’s latest SGD 280 million equity raise follows a string of key events including new dividend distributions and updated entitlement dates for unitholders. The REIT’s momentum has picked up in 2024, with its 1-year total shareholder return reaching 22.9% and five-year returns topping 37%. This performance has outpaced many local peers and hints at renewed investor confidence as strategic moves reshape the capital base.

If these recent gains have you looking beyond the familiar, now’s the perfect time to explore fast growing stocks with high insider ownership

With strong recent returns, a sizeable discount to analyst targets, and renewed capital on hand, is Lendlease Global Commercial REIT still trading below its true value? Or has the market already priced in future growth?

Price-to-Earnings of 35.6x: Is it justified?

With Lendlease Global Commercial REIT's price-to-earnings ratio standing at 35.6x, investors are paying a significant premium relative to local real estate peers. The last close of SGD 0.625 reflects a valuation that is much higher than both the sector's typical price-to-earnings and what regression-based fair value models suggest.

The price-to-earnings ratio is a common valuation benchmark, especially meaningful for property and income-generating trusts. A high ratio signals that the market expects strong or stable future profits, but it can also mean the current price does not necessarily reflect underlying fundamentals.

Compared to the Asian Retail REITs industry average of 15.4x and an estimated fair price-to-earnings ratio of 20.4x, Lendlease Global Commercial REIT is notably expensive. This sizable gap suggests that expectations for future earnings growth or profit stability may not be fully supported by recent results. If the market reassesses growth prospects or earnings quality, the multiple could move closer to the industry or fair ratio benchmarks.

Explore the SWS fair ratio for Lendlease Global Commercial REIT

Result: Price-to-Earnings of 35.6x (OVERVALUED)

However, slower revenue growth or a shift in investor sentiment could quickly challenge the optimism that is currently reflected in Lendlease Global Commercial REIT's valuation.

Find out about the key risks to this Lendlease Global Commercial REIT narrative.

Another View: What Does the SWS DCF Model Say?

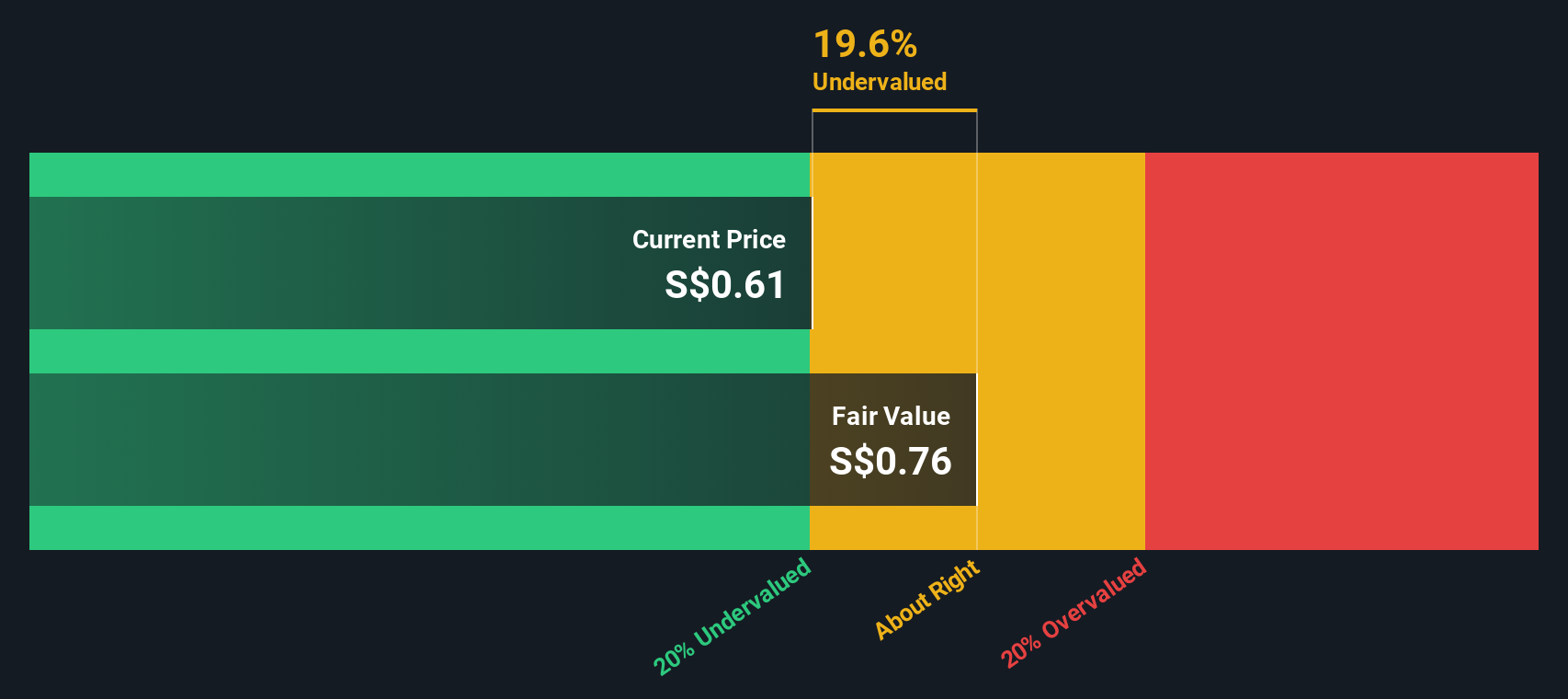

While the price-to-earnings ratio paints Lendlease Global Commercial REIT as richly valued compared to industry averages, our SWS DCF model offers a different perspective. Based on projected future cash flows, the model suggests shares are trading at a 17.7% discount to fair value. This could point to hidden opportunity, or it may indicate that market expectations require recalibration.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Lendlease Global Commercial REIT for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 886 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Lendlease Global Commercial REIT Narrative

If you prefer to dig into the data yourself or want to draw your own conclusions, you can craft a personal narrative in just a few minutes. Do it your way

A great starting point for your Lendlease Global Commercial REIT research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investing means staying one step ahead. Unlock opportunities beyond the ordinary with these handpicked screens, your shortcut to standout stocks with serious upside potential.

- Tap into the surging world of intelligent automation by reviewing these 25 AI penny stocks, which are fueling the next wave of innovation and digital transformation.

- Accelerate your portfolio’s growth and strengthen your passive income stream when you check out these 16 dividend stocks with yields > 3% offering reliable, market-beating yields.

- Capitalize on rapid advances in secure payments, Web3, and decentralized finance by following these 82 cryptocurrency and blockchain stocks, which are driving the new age of digital assets.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:JYEU

Lendlease Global Commercial REIT

Listed on 2 October 2019, Lendlease Global Commercial REIT (“LREIT”) is established with the principal investment strategy of investing, directly or indirectly, in a diversified portfolio of stabilised income-producing real estate assets located globally, which are used primarily for retail and/or office purposes.

Average dividend payer with slight risk.

Market Insights

Community Narratives