The CapitaLand Mall Trust (SGX:C38U) Share Price Is Up 26% And Shareholders Are Holding On

When we invest, we're generally looking for stocks that outperform the market average. And in our experience, buying the right stocks can give your wealth a significant boost. For example, the CapitaLand Mall Trust (SGX:C38U) share price is up 26% in the last 5 years, clearly besting than the market return of around -1.4% (ignoring dividends). However, more recent returns haven't been as impressive as that, with the stock returning just 21% in the last year, including dividends.

Check out our latest analysis for CapitaLand Mall Trust

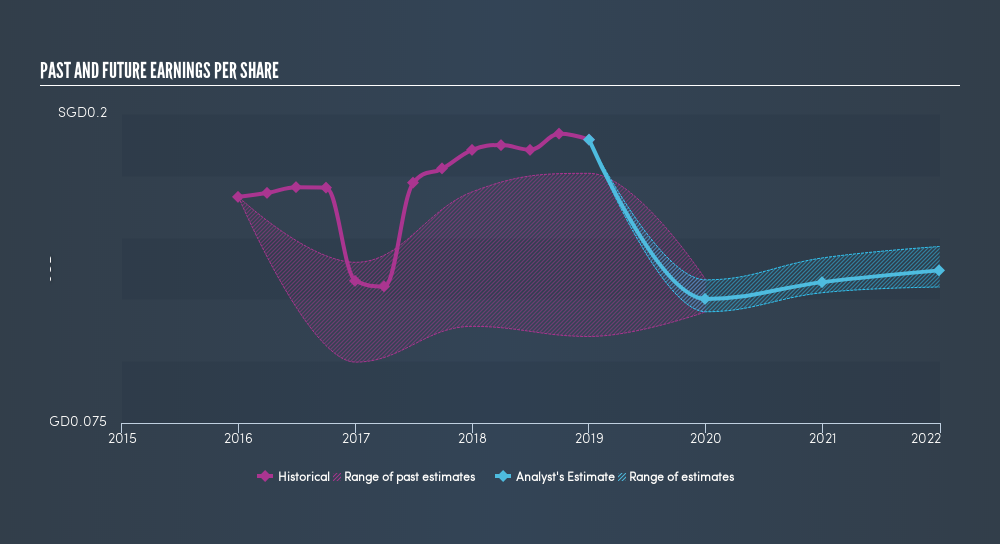

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During five years of share price growth, CapitaLand Mall Trust achieved compound earnings per share (EPS) growth of 2.7% per year. This EPS growth is slower than the share price growth of 4.8% per year, over the same period. This suggests that market participants hold the company in higher regard, these days. And that's hardly shocking given the track record of growth.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

This free interactive report on CapitaLand Mall Trust's earnings, revenue and cash flow is a great place to start, if you want to investigate the stock further.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. In the case of CapitaLand Mall Trust, it has a TSR of 65% for the last 5 years. That exceeds its share price return that we previously mentioned. This is largely a result of its dividend payments!

A Different Perspective

It's nice to see that CapitaLand Mall Trust shareholders have received a total shareholder return of 21% over the last year. That's including the dividend. That's better than the annualised return of 11% over half a decade, implying that the company is doing better recently. Given the share price momentum remains strong, it might be worth taking a closer look at the stock, lest you miss an opportunity. Keeping this in mind, a solid next step might be to take a look at CapitaLand Mall Trust's dividend track record. This freeinteractive graph is a great place to start.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this freelist of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SG exchanges.We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About SGX:C38U

CapitaLand Integrated Commercial Trust

CapitaLand Integrated Commercial Trust (CICT) is the first and largest real estate investment trust (REIT) listed on Singapore Exchange Securities Trading Limited (SGX-ST) with a market capitalisation of S$14.1 billion as at 31 December 2024.

Average dividend payer and fair value.

Market Insights

Community Narratives