Can You Imagine How CapitaLand Mall Trust's (SGX:C38U) Shareholders Feel About The 34% Share Price Increase?

By buying an index fund, you can roughly match the market return with ease. But if you choose individual stocks with prowess, you can make superior returns. For example, the CapitaLand Mall Trust (SGX:C38U) share price is up 34% in the last three years, clearly besting the market return of around 8.5% (not including dividends). However, more recent returns haven't been as impressive as that, with the stock returning just 20% in the last year , including dividends .

See our latest analysis for CapitaLand Mall Trust

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

During the three years of share price growth, CapitaLand Mall Trust actually saw its earnings per share (EPS) drop 2.4% per year.

Based on these numbers, we think that the decline in earnings per share may not be a good representation of how the business has changed over the years. So other metrics may hold the key to understanding what is influencing investors.

Interestingly, the dividend has increased over time; so that may have given the share price a boost. It could be that the company is reaching maturity and dividend investors are buying for the yield.

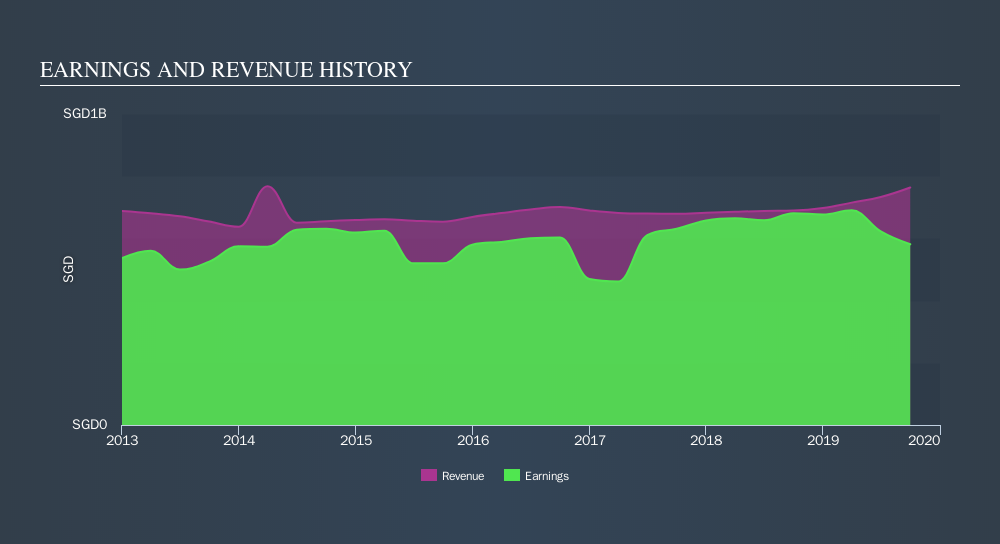

You can see how revenue has changed over time in the image below.

CapitaLand Mall Trust is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. Given we have quite a good number of analyst forecasts, it might be well worth checking out this free chart depicting consensus estimates.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. In the case of CapitaLand Mall Trust, it has a TSR of 57% for the last 3 years. That exceeds its share price return that we previously mentioned. This is largely a result of its dividend payments!

A Different Perspective

We're pleased to report that CapitaLand Mall Trust shareholders have received a total shareholder return of 20% over one year. That's including the dividend. Since the one-year TSR is better than the five-year TSR (the latter coming in at 11% per year), it would seem that the stock's performance has improved in recent times. Someone with an optimistic perspective could view the recent improvement in TSR as indicating that the business itself is getting better with time. If you would like to research CapitaLand Mall Trust in more detail then you might want to take a look at whether insiders have been buying or selling shares in the company.

We will like CapitaLand Mall Trust better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SG exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About SGX:C38U

CapitaLand Integrated Commercial Trust

CapitaLand Integrated Commercial Trust (CICT) is the first and largest real estate investment trust (REIT) listed on Singapore Exchange Securities Trading Limited (SGX-ST) with a market capitalisation of S$14.1 billion as at 31 December 2024.

Average dividend payer and fair value.

Market Insights

Community Narratives