- Singapore

- /

- Health Care REITs

- /

- SGX:C2PU

A Fresh Look at Parkway Life REIT (SGX:C2PU) Valuation Following Board Renewal and Leadership Changes

Reviewed by Kshitija Bhandaru

Parkway Life Real Estate Investment Trust (SGX:C2PU) just announced a sweeping Board renewal, marked by new leadership and expanded expertise. With Mr. Robin Hu Yee Cheng stepping in as Chairman, the trust is clearly sharpening its strategic direction while emphasizing long-term value for unitholders.

See our latest analysis for Parkway Life Real Estate Investment Trust.

Alongside these board changes, Parkway Life Real Estate Investment Trust’s growth momentum has been notable, with a year-to-date share price return of 10.4% and a 1-year total shareholder return of 8%. This continued progress, especially amid recent leadership refreshes, suggests that investors see potential for strengthened governance to drive value in the years ahead.

If you’re interested in uncovering other companies with resilient growth and strong leadership, now is the perfect moment to broaden your search and discover fast growing stocks with high insider ownership

With the stock currently trading at a discount to analyst price targets and strong fundamentals in place, investors may wonder whether Parkway Life REIT is undervalued or if the market has already priced in its future growth prospects.

Price-to-Earnings of 32.4x: Is it justified?

Parkway Life Real Estate Investment Trust’s current share price implies a price-to-earnings (P/E) ratio of 32.4x, significantly higher than both the fair value P/E estimate and key sector benchmarks. This signals a premium attached by the market despite some recent challenges in earnings growth.

The price-to-earnings ratio reflects how much investors are willing to pay today for each dollar of expected earnings in the future. For REITs, the P/E ratio is often used to compare valuation against peers and broader sector trends, providing insight into whether investors are too optimistic or cautious about a company’s future profit outlook.

With Parkway Life REIT’s P/E multiple standing well above the Global Health Care REITs industry average of 24.5x and the fair value P/E of 18.7x, the market appears to be pricing in a positive outlook that is not fully backed by recent earnings. This gap could narrow if earnings accelerate, but currently the premium looks substantial when compared to what fundamentals suggest is fair value.

Explore the SWS fair ratio for Parkway Life Real Estate Investment Trust

Result: Price-to-Earnings of 32.4x (OVERVALUED)

However, slower revenue growth or unexpected earnings declines could challenge Parkway Life REIT’s premium valuation and test investor confidence in its growth story.

Find out about the key risks to this Parkway Life Real Estate Investment Trust narrative.

Another View: Discounted Cash Flow Perspective

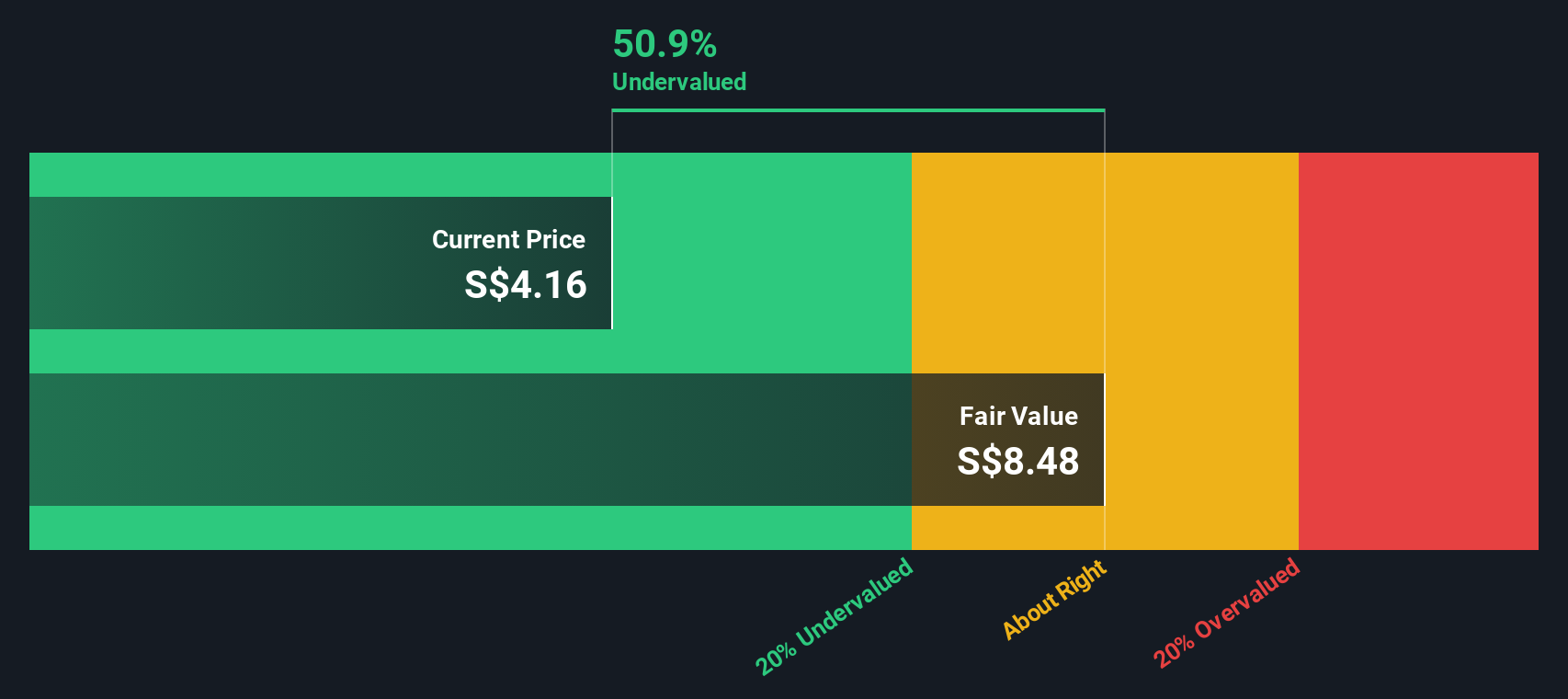

Taking a different approach, our DCF model estimates Parkway Life REIT’s fair value at SGD8.48 per unit. This places the current price of SGD4.15 at a striking 51% discount. This model seeks to capture long-term cash flow potential and raises the question of whether the market is overlooking a significant upside.

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Parkway Life Real Estate Investment Trust for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Parkway Life Real Estate Investment Trust Narrative

Whether you have a different perspective or want to dig deeper into the numbers yourself, you can craft your own view on Parkway Life REIT in just a few minutes. Do it your way.

A great starting point for your Parkway Life Real Estate Investment Trust research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Don’t let great opportunities slip by while others build smarter portfolios. Take action now and put your money to work with these standout themes:

- Capture reliable passive income and spot sustainable opportunities with these 18 dividend stocks with yields > 3% featuring the market’s top yielding stocks.

- Fuel your curiosity for trailblazing innovation by browsing these 24 AI penny stocks focused on artificial intelligence shaping tomorrow’s industries.

- Target early-stage potential with these 3601 penny stocks with strong financials and be among the first to follow promising up-and-comers.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:C2PU

Parkway Life Real Estate Investment Trust

Parkway Life Real Estate Investment Trust (“PLife REIT”) is one of Asia’s largest listed healthcare REITs by asset size.

Average dividend payer with mediocre balance sheet.

Market Insights

Community Narratives