- Singapore

- /

- Industrial REITs

- /

- SGX:BWCU

Imagine Owning EC World Real Estate Investment Trust (SGX:BWCU) And Wondering If The 32% Share Price Slide Is Justified

The simplest way to benefit from a rising market is to buy an index fund. But if you buy individual stocks, you can do both better or worse than that. That downside risk was realized by EC World Real Estate Investment Trust (SGX:BWCU) shareholders over the last year, as the share price declined 32%. That's well bellow the market return of -21%. To make matters worse, the returns over three years have also been really disappointing (the share price is 31% lower than three years ago). Shareholders have had an even rougher run lately, with the share price down 31% in the last 90 days. Of course, this share price action may well have been influenced by the 24% decline in the broader market, throughout the period.

See our latest analysis for EC World Real Estate Investment Trust

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

During the unfortunate twelve months during which the EC World Real Estate Investment Trust share price fell, it actually saw its earnings per share (EPS) improve by 38%. It's quite possible that growth expectations may have been unreasonable in the past.

It's fair to say that the share price does not seem to be reflecting the EPS growth. So it's well worth checking out some other metrics, too.

Vibrant companies don't usually cut their dividends, so the recent reduction might help explain why the EC World Real Estate Investment Trust share price has been weak.

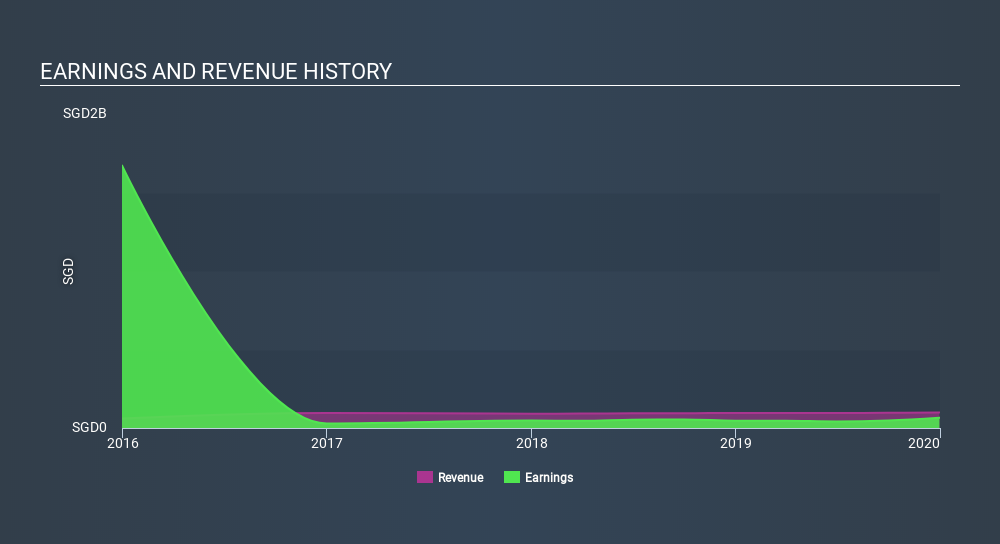

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. If you are thinking of buying or selling EC World Real Estate Investment Trust stock, you should check out this free report showing analyst profit forecasts.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. Arguably, the TSR gives a more comprehensive picture of the return generated by a stock. In the case of EC World Real Estate Investment Trust, it has a TSR of -26% for the last year. That exceeds its share price return that we previously mentioned. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

The last twelve months weren't great for EC World Real Estate Investment Trust shares, which performed worse than the market, costing holders 26% , including dividends . The market shed around 21%, no doubt weighing on the stock price. The three-year loss of 4.1% per year isn't as bad as the last twelve months, suggesting that the company has not been able to convince the market it has solved its problems. Although Baron Rothschild famously said to "buy when there's blood in the streets, even if the blood is your own", he also focusses on high quality stocks with solid prospects. It's always interesting to track share price performance over the longer term. But to understand EC World Real Estate Investment Trust better, we need to consider many other factors. Like risks, for instance. Every company has them, and we've spotted 4 warning signs for EC World Real Estate Investment Trust (of which 1 is significant!) you should know about.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SG exchanges.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About SGX:BWCU

EC World Real Estate Investment Trust

Listed on 28 July 2016, EC World REIT is the first Chinese specialised logistics and e-commerce logistics REIT listed on Singapore Exchange Securities Trading Limited ("SGX-ST").

Good value average dividend payer.

Market Insights

Community Narratives