SGX Stocks That Might Be Trading Below Their Estimated Value October 2024

Reviewed by Simply Wall St

As Singapore's economy stabilizes post-pandemic, the labor market has returned to pre-2019 levels of tightness, reflecting a more predictable economic environment. In this context, identifying stocks that might be undervalued becomes crucial for investors seeking opportunities in a market where traditional metrics of value are once again reliable indicators.

Top 5 Undervalued Stocks Based On Cash Flows In Singapore

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Singapore Technologies Engineering (SGX:S63) | SGD4.66 | SGD7.31 | 36.3% |

| Digital Core REIT (SGX:DCRU) | US$0.595 | US$0.82 | 27.7% |

| Nanofilm Technologies International (SGX:MZH) | SGD0.88 | SGD1.43 | 38.6% |

| Frasers Logistics & Commercial Trust (SGX:BUOU) | SGD1.15 | SGD1.60 | 27.9% |

| Seatrium (SGX:5E2) | SGD2.10 | SGD3.09 | 32% |

Let's explore several standout options from the results in the screener.

Seatrium (SGX:5E2)

Overview: Seatrium Limited offers engineering solutions to the offshore, marine, and energy industries with a market cap of SGD7.13 billion.

Operations: The company's revenue primarily comes from its Rigs & Floaters, Repairs & Upgrades, Offshore Platforms, and Specialised Shipbuilding segment, which generated SGD8.39 billion.

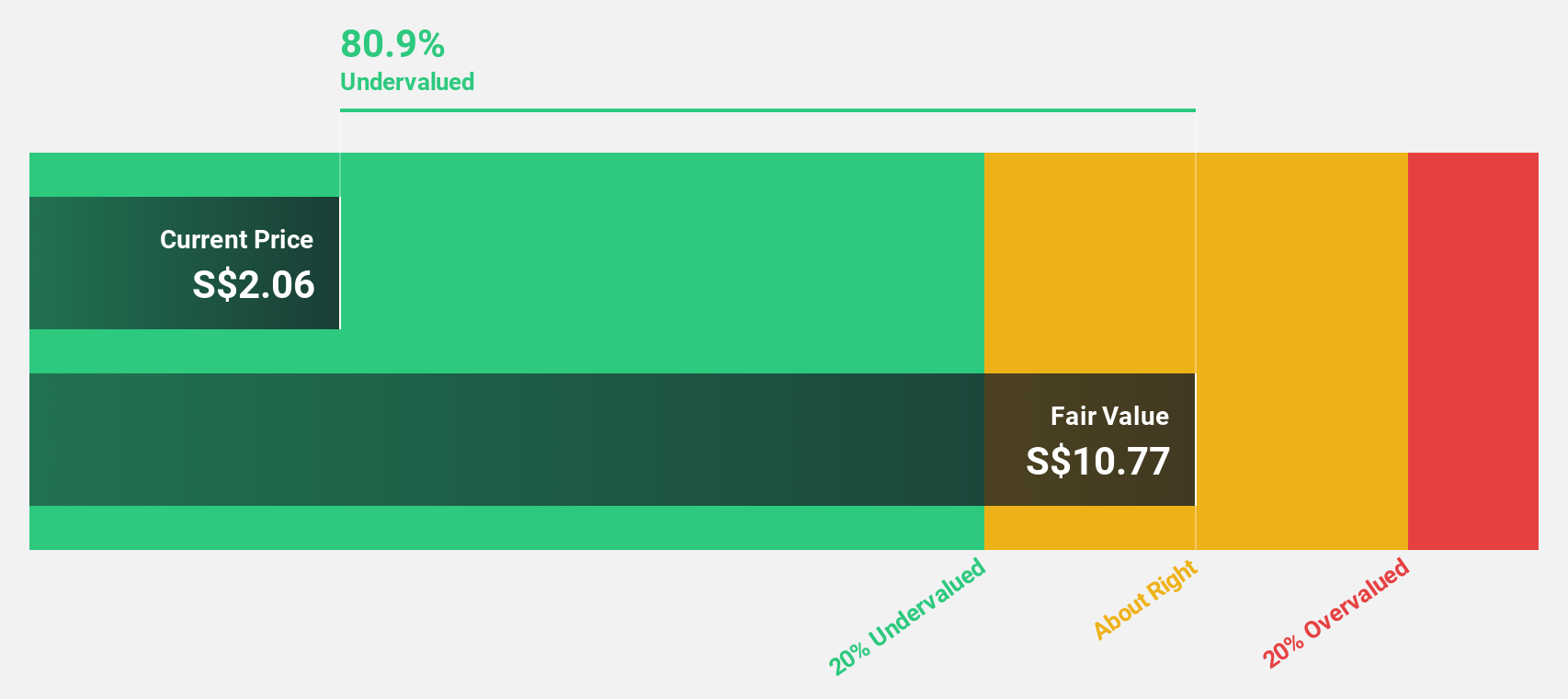

Estimated Discount To Fair Value: 32%

Seatrium Limited appears undervalued based on cash flows, trading at 32% below its estimated fair value of S$3.09, with a current price of S$2.1. The company reported a significant turnaround with net income of S$35.97 million for H1 2024, compared to a loss last year, supported by strong sales growth to S$4.01 billion. Recent successful project deliveries and share buybacks further enhance its financial position and operational credibility in the market.

- The analysis detailed in our Seatrium growth report hints at robust future financial performance.

- Get an in-depth perspective on Seatrium's balance sheet by reading our health report here.

Frasers Logistics & Commercial Trust (SGX:BUOU)

Overview: Frasers Logistics & Commercial Trust (SGX:BUOU) is a Singapore-listed real estate investment trust that manages a diversified portfolio of 107 industrial and commercial properties valued at approximately S$6.4 billion across Australia, Germany, Singapore, the United Kingdom and the Netherlands, with a market capitalization of about S$4.32 billion.

Operations: Frasers Logistics & Commercial Trust generates revenue from its diversified portfolio of 107 industrial and commercial properties across five major developed markets, including Australia, Germany, Singapore, the United Kingdom and the Netherlands.

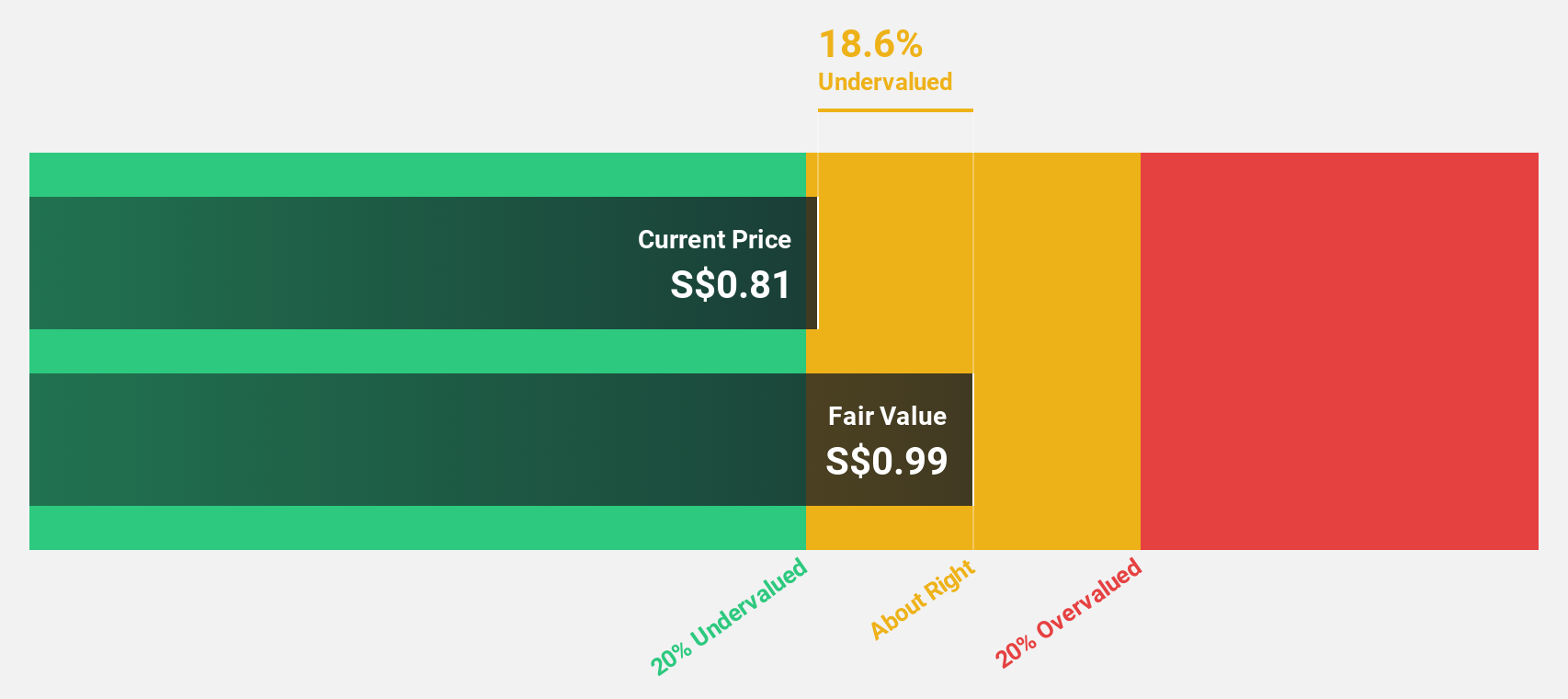

Estimated Discount To Fair Value: 27.9%

Frasers Logistics & Commercial Trust is trading at S$1.15, which is 27.9% below its estimated fair value of S$1.6, indicating it may be undervalued based on cash flows. Despite an unstable dividend track record and debt not well covered by operating cash flow, the Trust's revenue is forecast to grow faster than the Singapore market at 6.4% annually, with profitability expected within three years—an above-average market growth rate.

- Our earnings growth report unveils the potential for significant increases in Frasers Logistics & Commercial Trust's future results.

- Navigate through the intricacies of Frasers Logistics & Commercial Trust with our comprehensive financial health report here.

Nanofilm Technologies International (SGX:MZH)

Overview: Nanofilm Technologies International Limited, with a market cap of SGD572.95 million, offers nanotechnology solutions across Singapore, China, Japan, and Vietnam.

Operations: The company's revenue is derived from several segments, including Advanced Materials at SGD153.32 million, Nanofabrication at SGD18.37 million, Industrial Equipment at SGD28.71 million, and Sydrogen at SGD1.40 million.

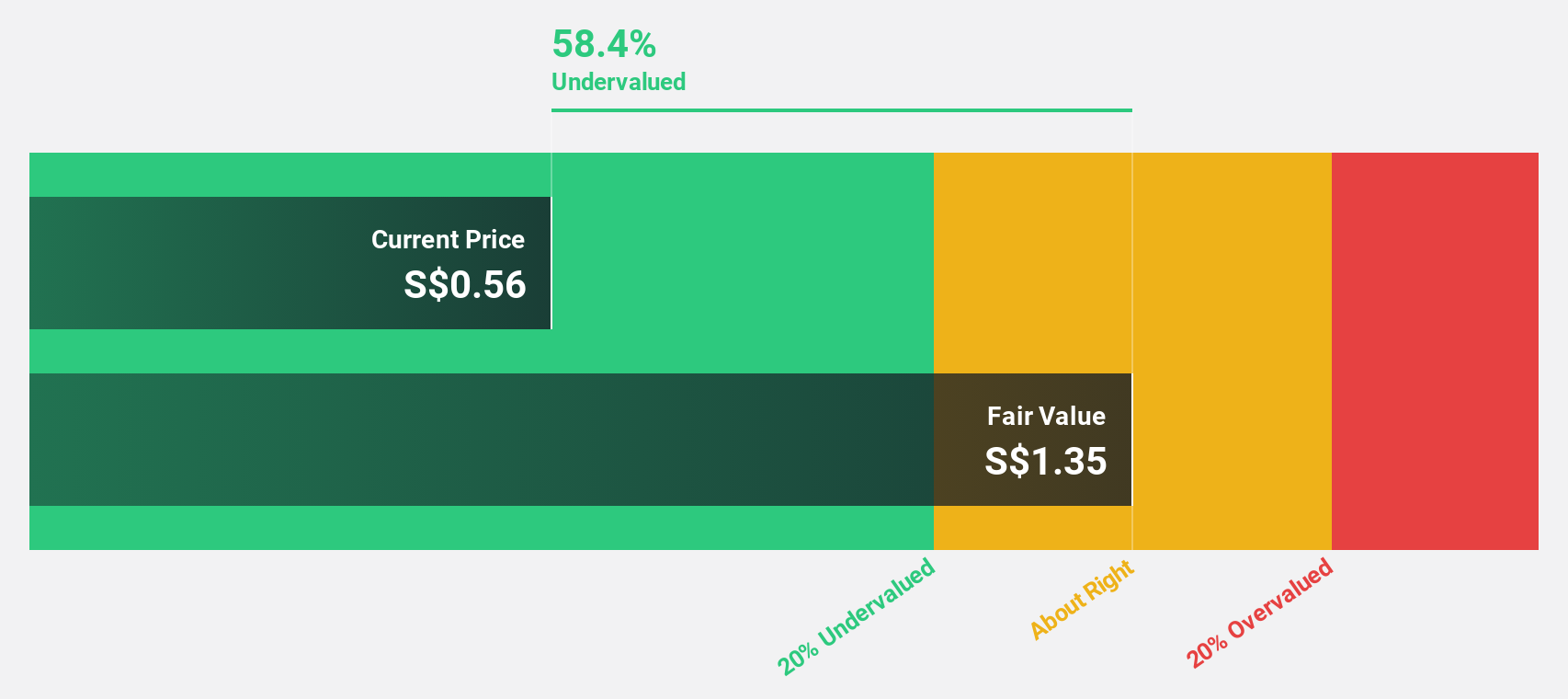

Estimated Discount To Fair Value: 38.6%

Nanofilm Technologies International is trading at S$0.88, significantly below its estimated fair value of S$1.43, suggesting potential undervaluation based on cash flows. Despite reporting a net loss for the first half of 2024, revenue grew to S$82.65 million from S$73.15 million year-over-year. Earnings are forecast to increase by 54% annually, outpacing the broader Singapore market's growth rate of 10.4%, though profit margins have declined compared to last year.

- Upon reviewing our latest growth report, Nanofilm Technologies International's projected financial performance appears quite optimistic.

- Click here and access our complete balance sheet health report to understand the dynamics of Nanofilm Technologies International.

Seize The Opportunity

- Unlock our comprehensive list of 5 Undervalued SGX Stocks Based On Cash Flows by clicking here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Elevate your portfolio with Simply Wall St, the ultimate app for investors seeking global market coverage.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:5E2

Seatrium

Provides engineering solutions to the offshore, marine, and energy industries.

Excellent balance sheet and good value.