- Singapore

- /

- Specialized REITs

- /

- SGX:AJBU

Assessing Keppel DC REIT (SGX:AJBU): Is the Current Valuation Overlooked by Investors?

Reviewed by Simply Wall St

Price-to-Earnings of 16.2x: Is it justified?

Keppel DC REIT currently trades at a price-to-earnings (P/E) ratio of 16.2x, which appears to be good value when compared to both industry peers and global averages. This suggests that, based on earnings, the stock is comparatively inexpensive.

The price-to-earnings ratio is a widely used valuation metric. It shows how much investors are willing to pay for each dollar of the company's earnings. For real estate investment trusts, this ratio helps investors gauge whether the current share price reflects the business’s actual profitability.

With Keppel DC REIT’s P/E sitting below the average for specialized REITs, the market may be underappreciating its profit potential or expecting slower growth ahead. This valuation paints the REIT as attractively priced on an earnings basis relative to its sector.

Result: Fair Value of $2.34 (UNDERVALUED)

See our latest analysis for Keppel DC REIT.However, slower net income growth or broader market volatility could quickly challenge the argument that Keppel DC REIT remains undervalued at current levels.

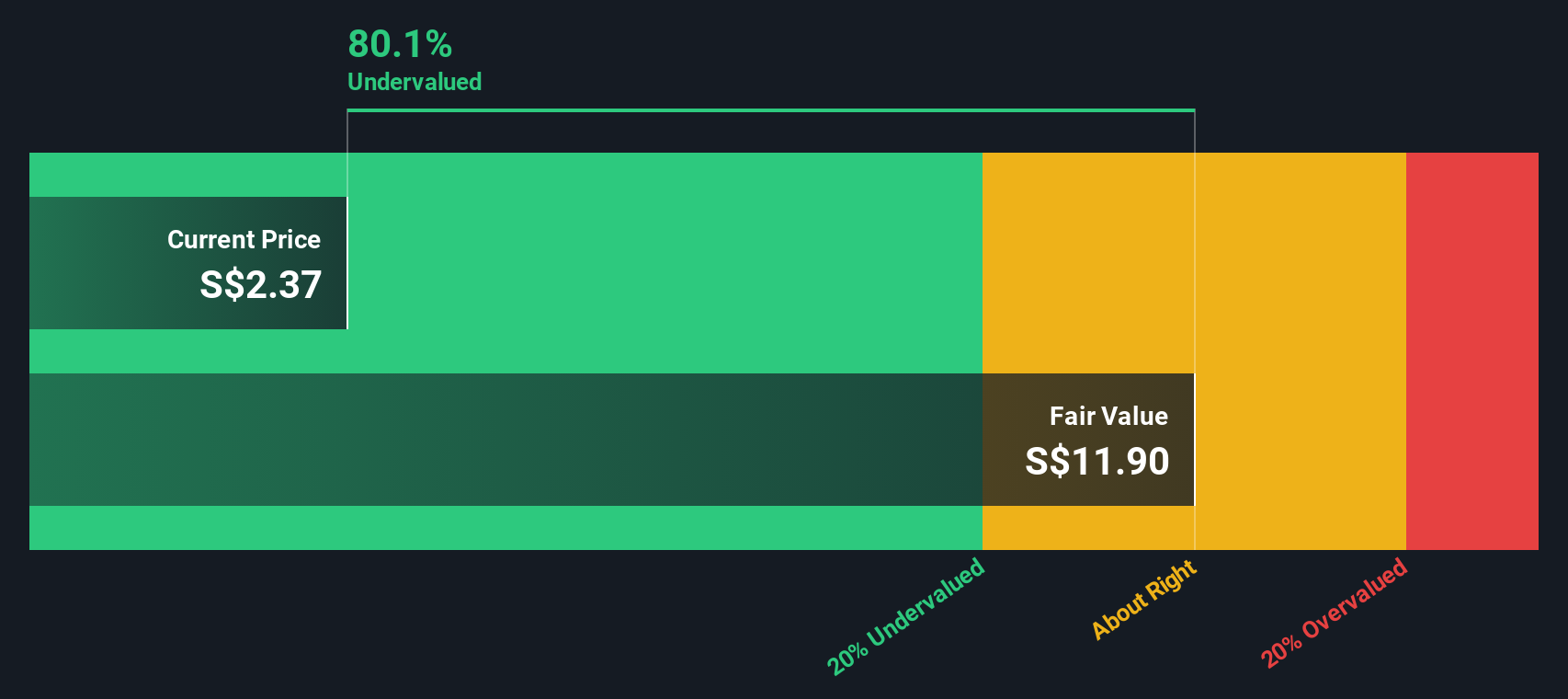

Find out about the key risks to this Keppel DC REIT narrative.Another View: Discounted Cash Flow Says Undervalued

Looking at Keppel DC REIT through the SWS DCF model, the numbers tell a similar story to the earnings-based valuation and suggest the shares are undervalued. But are investors missing something, or does value really lie beneath the surface?

Look into how the SWS DCF model arrives at its fair value.

Build Your Own Keppel DC REIT Narrative

If you would rather look at the numbers firsthand or want to develop your own take on Keppel DC REIT, you can do so quickly and easily by using the following resource: Do it your way.

A great starting point for your Keppel DC REIT research is our analysis highlighting 4 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more smart investment angles?

Don’t let standout opportunities pass you by. Put the Simply Wall Street Screener to work and unlock investment ideas you won’t see in the headlines.

- Unearth hidden value by tracking companies that our tool highlights as undervalued stocks based on cash flows based on the strength of their cash flows.

- Jump ahead of fintech trends by scanning the market for innovators in cryptocurrency and blockchain stocks and digital blockchain solutions.

- Boost your income strategy by handpicking shares that offer dividend stocks with yields > 3% with strong yields above 3%.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Keppel DC REIT might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Kshitija Bhandaru

Kshitija (or Keisha) Bhandaru is an Equity Analyst at Simply Wall St and has over 6 years of experience in the finance industry and describes herself as a lifelong learner driven by her intellectual curiosity. She previously worked with Market Realist for 5 years as an Equity Analyst.

About SGX:AJBU

Keppel DC REIT

Keppel DC REIT was listed on the Singapore Exchange on 12 December 2014 as the first pure-play data centre REIT in Asia.

Proven track record with adequate balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Nova Ljubljanska Banka d.d will expect a 11.2% revenue boost driving future growth

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success