Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

It's only natural that many investors, especially those who are new to the game, prefer to buy shares in 'sexy' stocks with a good story, even if those businesses lose money. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses.

So if you're like me, you might be more interested in profitable, growing companies, like First Sponsor Group (SGX:ADN). Even if the shares are fully valued today, most capitalists would recognize its profits as the demonstration of steady value generation. While a well funded company may sustain losses for years, unless its owners have an endless appetite for subsidizing the customer, it will need to generate a profit eventually, or else breathe its last breath.

View our latest analysis for First Sponsor Group

First Sponsor Group's Earnings Per Share Are Growing.

As one of my mentors once told me, share price follows earnings per share (EPS). That means EPS growth is considered a real positive by most successful long-term investors. As a tree reaches steadily for the sky, First Sponsor Group's EPS has grown 19% each year, compound, over three years. If the company can sustain that sort of growth, we'd expect shareholders to come away winners.

I like to see top-line growth as an indication that growth is sustainable, and I look for a high earnings before interest and taxation (EBIT) margin to point to a competitive moat (though some companies with low margins also have moats). Unfortunately, First Sponsor Group's revenue dropped 21% last year, but the silver lining is that EBIT margins improved from 33% to 61%. That's not ideal.

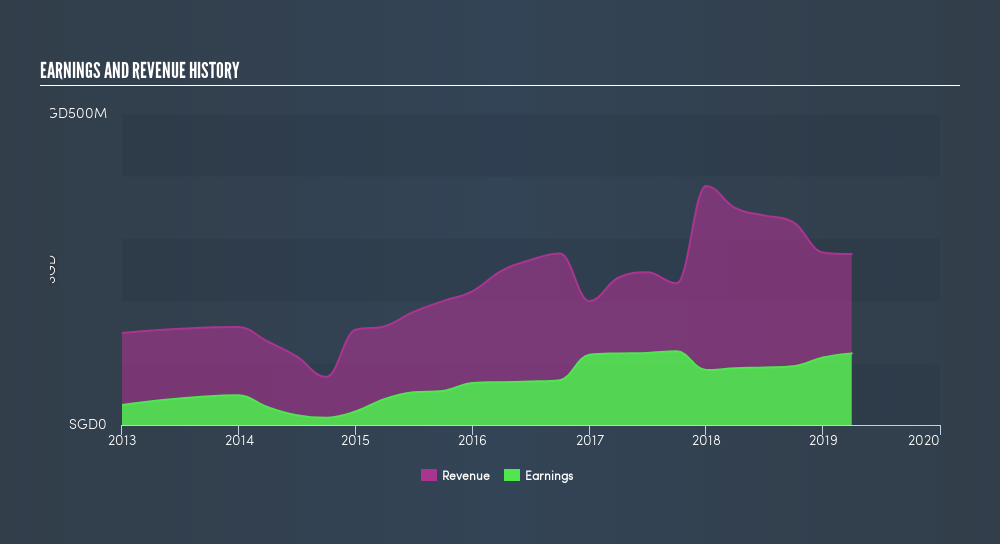

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check First Sponsor Group's balance sheet strength, before getting too excited.

Are First Sponsor Group Insiders Aligned With All Shareholders?

Like standing at the lookout, surveying the horizon at sunrise, insider buying, for some investors, sparks joy. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

It's a pleasure to note that insiders spent S$1.4m buying First Sponsor Group shares, over the last year, without reporting any share sales whatsoever. As if for a flower bud approaching bloom, I become an expectant observer, anticipating with hope, that something splendid is coming. We also note that it was the Non-Executive Chairman, Han Ho, who made the biggest single acquisition, paying S$452k for shares at about S$1.29 each.

The good news, alongside the insider buying, for First Sponsor Group bulls is that insiders (collectively) have a meaningful investment in the stock. To be specific, they have S$30m worth of shares. That shows significant buy-in, and may indicate conviction in the business strategy. Even though that's only about 2.9% of the company, it's enough money to indicate alignment between the leaders of the business and ordinary shareholders.

Does First Sponsor Group Deserve A Spot On Your Watchlist?

For growth investors like me, First Sponsor Group's raw rate of earnings growth is a beacon in the night. Not only that, but we can see that insiders both own a lot of, and are buying more, shares in the company. So it's fair to say I think this stock may well deserve a spot on your watchlist. Now, you could try to make up your mind on First Sponsor Group by focusing on just these factors, oryou could also consider how its price-to-earnings ratio compares to other companies in its industry.

There are plenty of other companies that have insiders buying up shares. So if you like the sound of First Sponsor Group, you'll probably love this freelist of growing companies that insiders are buying.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdictionWe aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About SGX:ADN

First Sponsor Group

An investment holding company, invests in, develops, and sells residential and commercial properties in the People’s Republic of China, Europe, and internationally.

Proven track record average dividend payer.

Market Insights

Community Narratives