- Singapore

- /

- Real Estate

- /

- SGX:5JK

How Much Did Hiap Hoe's(SGX:5JK) Shareholders Earn From Share Price Movements Over The Last Year?

Passive investing in an index fund is a good way to ensure your own returns roughly match the overall market. While individual stocks can be big winners, plenty more fail to generate satisfactory returns. That downside risk was realized by Hiap Hoe Limited (SGX:5JK) shareholders over the last year, as the share price declined 19%. That contrasts poorly with the market decline of 14%. Even if shareholders bought some time ago, they wouldn't be particularly happy: the stock is down 17% in three years. It's up 2.4% in the last seven days.

See our latest analysis for Hiap Hoe

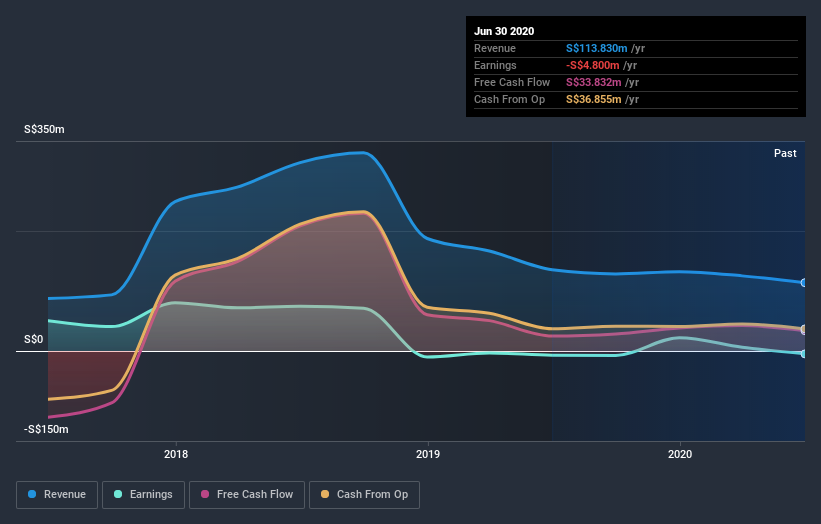

Given that Hiap Hoe didn't make a profit in the last twelve months, we'll focus on revenue growth to form a quick view of its business development. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. Some companies are willing to postpone profitability to grow revenue faster, but in that case one does expect good top-line growth.

Hiap Hoe's revenue didn't grow at all in the last year. In fact, it fell 16%. That looks pretty grim, at a glance. The stock price has languished lately, falling 19% in a year. That seems pretty reasonable given the lack of both profits and revenue growth. It's hard to escape the conclusion that buyers must envision either growth down the track, cost cutting, or both.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

What about the Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between Hiap Hoe's total shareholder return (TSR) and its share price return. The TSR attempts to capture the value of dividends (as if they were reinvested) as well as any spin-offs or discounted capital raisings offered to shareholders. Dividends have been really beneficial for Hiap Hoe shareholders, and that cash payout explains why its total shareholder loss of 18%, over the last year, isn't as bad as the share price return.

A Different Perspective

While the broader market lost about 14% in the twelve months, Hiap Hoe shareholders did even worse, losing 18%. However, it could simply be that the share price has been impacted by broader market jitters. It might be worth keeping an eye on the fundamentals, in case there's a good opportunity. Regrettably, last year's performance caps off a bad run, with the shareholders facing a total loss of 1.0% per year over five years. Generally speaking long term share price weakness can be a bad sign, though contrarian investors might want to research the stock in hope of a turnaround. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 1 warning sign for Hiap Hoe that you should be aware of.

For those who like to find winning investments this free list of growing companies with recent insider purchasing, could be just the ticket.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SG exchanges.

If you decide to trade Hiap Hoe, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Hiap Hoe might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About SGX:5JK

Hiap Hoe

An investment holding company, engages in the development of portfolio of hospitality, retail, commercial, and residential assets in Australia, the United Kingdom, and Singapore.

Proven track record unattractive dividend payer.

Similar Companies

Market Insights

Community Narratives