- Singapore

- /

- Real Estate

- /

- SGX:Z25

Yanlord Land Group (SGX:Z25) Reports Recovery In Net Income And EPS

Reviewed by Simply Wall St

Yanlord Land Group (SGX:Z25) recently announced a striking 62% price increase over the last quarter. This significant stock price appreciation coincided with the company's financial turnaround, as reported in its half-year earnings, which highlighted a recovery in net income and EPS despite reduced sales, suggesting improved operational efficiency. The broader market trends were mixed, with the tech-heavy Nasdaq seeing gains and the Dow experiencing slight declines. While the broader market changes emphasize a cautious investment sentiment, Yanlord's positive earnings report and corporate restructuring, including the appointment of a new company secretary, contributed positively to investor confidence.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Over the past year, Yanlord Land Group Ltd's total shareholder return, which includes both share price appreciation and dividends, surged 101.27%. This performance significantly outpaced both the SG Market's 21.8% and the SG Real Estate industry's 32.6% return over the same period. This robust performance suggests a strong recovery and positive investor sentiment, despite the company's ongoing financial challenges.

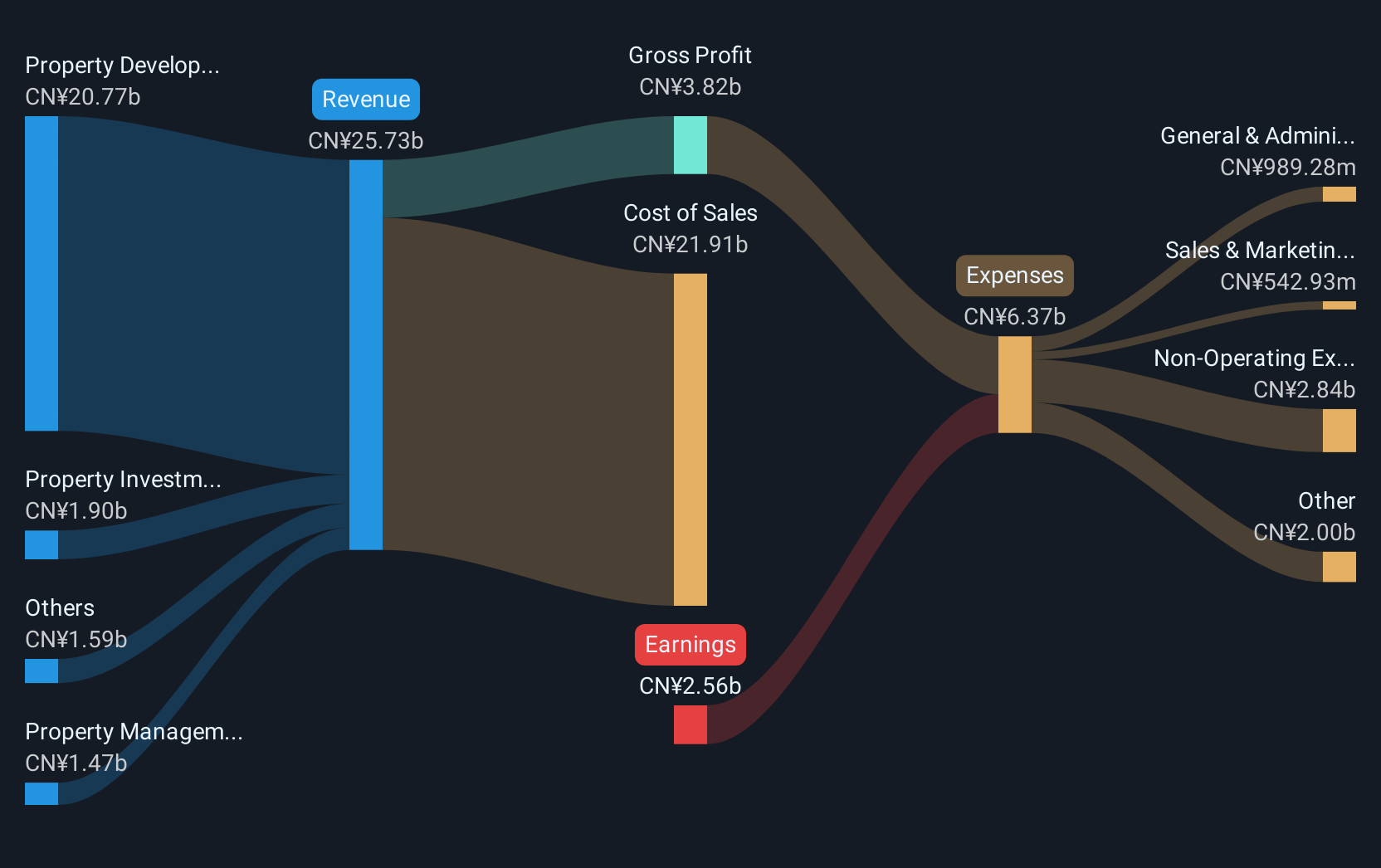

The recent 62% share price increase over the last quarter was influenced by Yanlord's improved net income and EPS, even as sales dropped to CNY 9.29 billion from CNY 19.95 billion a year ago. However, the outlook remains cautious, with revenue forecasted to decline by 14.3% annually over the next three years. Additionally, the current share price of SGD0.79 exceeds the SGD0.54 target, indicating potential market overoptimism or a reassessment by analysts. The company's unprofitability and projected earnings struggles may continue to affect long-term valuation.

Explore Yanlord Land Group's analyst forecasts in our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:Z25

Yanlord Land Group

A real estate developer focusing on developing high-end fully-fitted residential, commercial and integrated property projects in strategically selected key and high-growth cities in the PRC and Singapore.

Fair value with mediocre balance sheet.

Market Insights

Community Narratives