- Singapore

- /

- Real Estate

- /

- SGX:Z25

Even after rising 5.1% this past week, Yanlord Land Group (SGX:Z25) shareholders are still down 28% over the past five years

While it may not be enough for some shareholders, we think it is good to see the Yanlord Land Group Limited (SGX:Z25) share price up 16% in a single quarter. But over the last half decade, the stock has not performed well. You would have done a lot better buying an index fund, since the stock has dropped 35% in that half decade.

On a more encouraging note the company has added S$68m to its market cap in just the last 7 days, so let's see if we can determine what's driven the five-year loss for shareholders.

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One way to examine how market sentiment has changed over time is to look at the interaction between a company's share price and its earnings per share (EPS).

We know that Yanlord Land Group has been profitable in the past. However, it made a loss in the last twelve months, suggesting profit may be an unreliable metric at this stage. Other metrics may better explain the share price move.

In contrast to the share price, revenue has actually increased by 9.0% a year in the five year period. So it seems one might have to take closer look at the fundamentals to understand why the share price languishes. After all, there may be an opportunity.

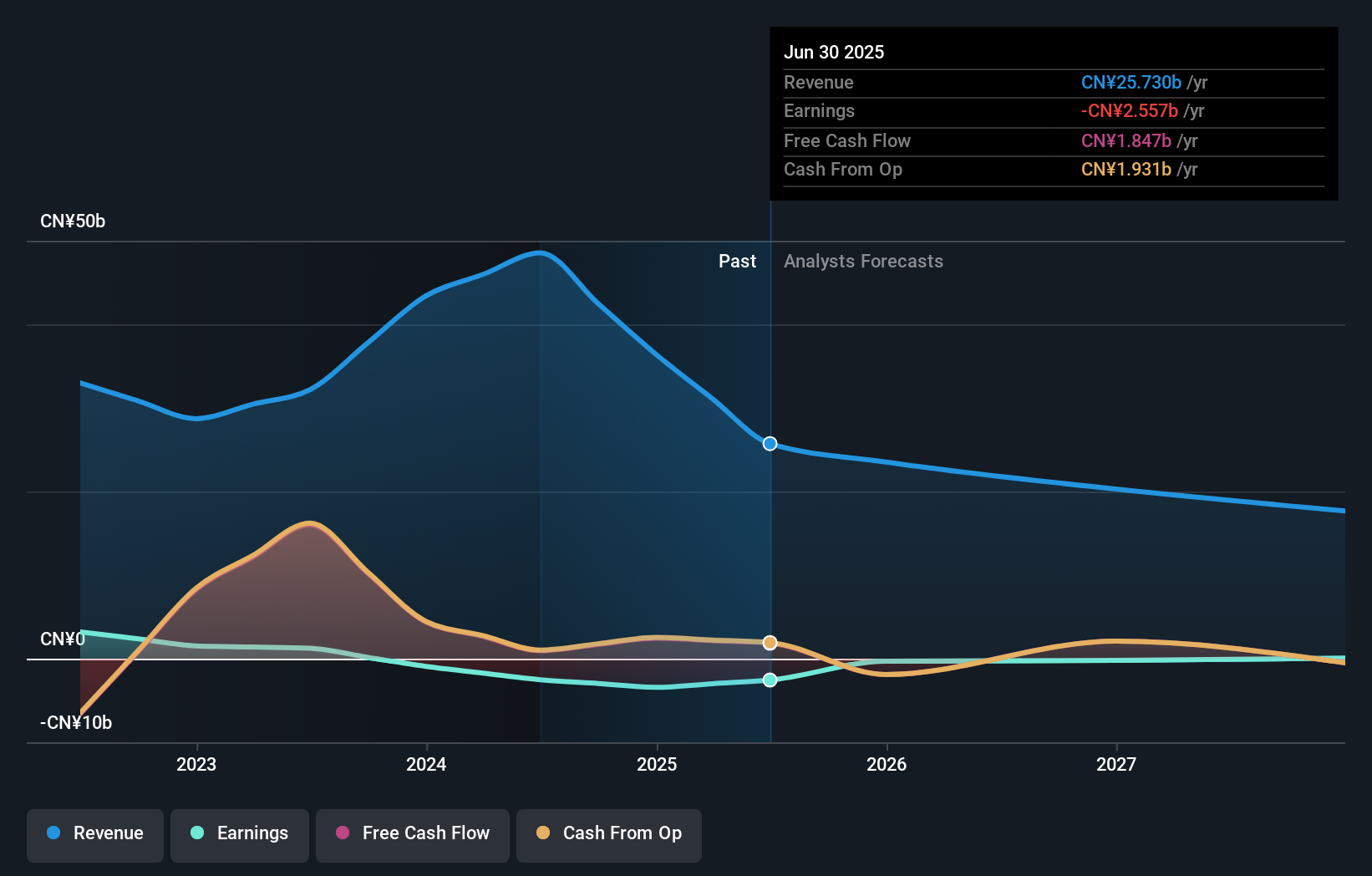

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

It's probably worth noting that the CEO is paid less than the median at similar sized companies. But while CEO remuneration is always worth checking, the really important question is whether the company can grow earnings going forward. You can see what analysts are predicting for Yanlord Land Group in this interactive graph of future profit estimates.

What About The Total Shareholder Return (TSR)?

We've already covered Yanlord Land Group's share price action, but we should also mention its total shareholder return (TSR). Arguably the TSR is a more complete return calculation because it accounts for the value of dividends (as if they were reinvested), along with the hypothetical value of any discounted capital that have been offered to shareholders. Dividends have been really beneficial for Yanlord Land Group shareholders, and that cash payout explains why its total shareholder loss of 28%, over the last 5 years, isn't as bad as the share price return.

A Different Perspective

Yanlord Land Group shareholders are up 4.3% for the year. But that was short of the market average. On the bright side, that's still a gain, and it is certainly better than the yearly loss of about 5% endured over half a decade. It could well be that the business is stabilizing. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider risks, for instance. Every company has them, and we've spotted 1 warning sign for Yanlord Land Group you should know about.

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Singaporean exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SGX:Z25

Yanlord Land Group

A real estate developer focusing on developing high-end fully-fitted residential, commercial and integrated property projects in strategically selected key and high-growth cities in the PRC and Singapore.

Fair value with mediocre balance sheet.

Market Insights

Community Narratives