- Singapore

- /

- Real Estate

- /

- SGX:TQ5

What Frasers Property (SGX:TQ5)'s SME Loan Partnership Means For Shareholders

Reviewed by Sasha Jovanovic

- CIMB Singapore and Frasers Property recently announced a five-year partnership to introduce Singapore's first 'pay-as-you-earn' SME loan, along with various financial solutions for over 2,000 retailers across 12 Frasers Property malls.

- This move marks a significant enhancement in supporting retailer resiliency and could help to boost overall tenant stability within Frasers Property’s retail portfolio.

- We'll now explore how expanding retailer support through tailored SME financing could influence Frasers Property’s broader investment outlook.

Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

What Is Frasers Property's Investment Narrative?

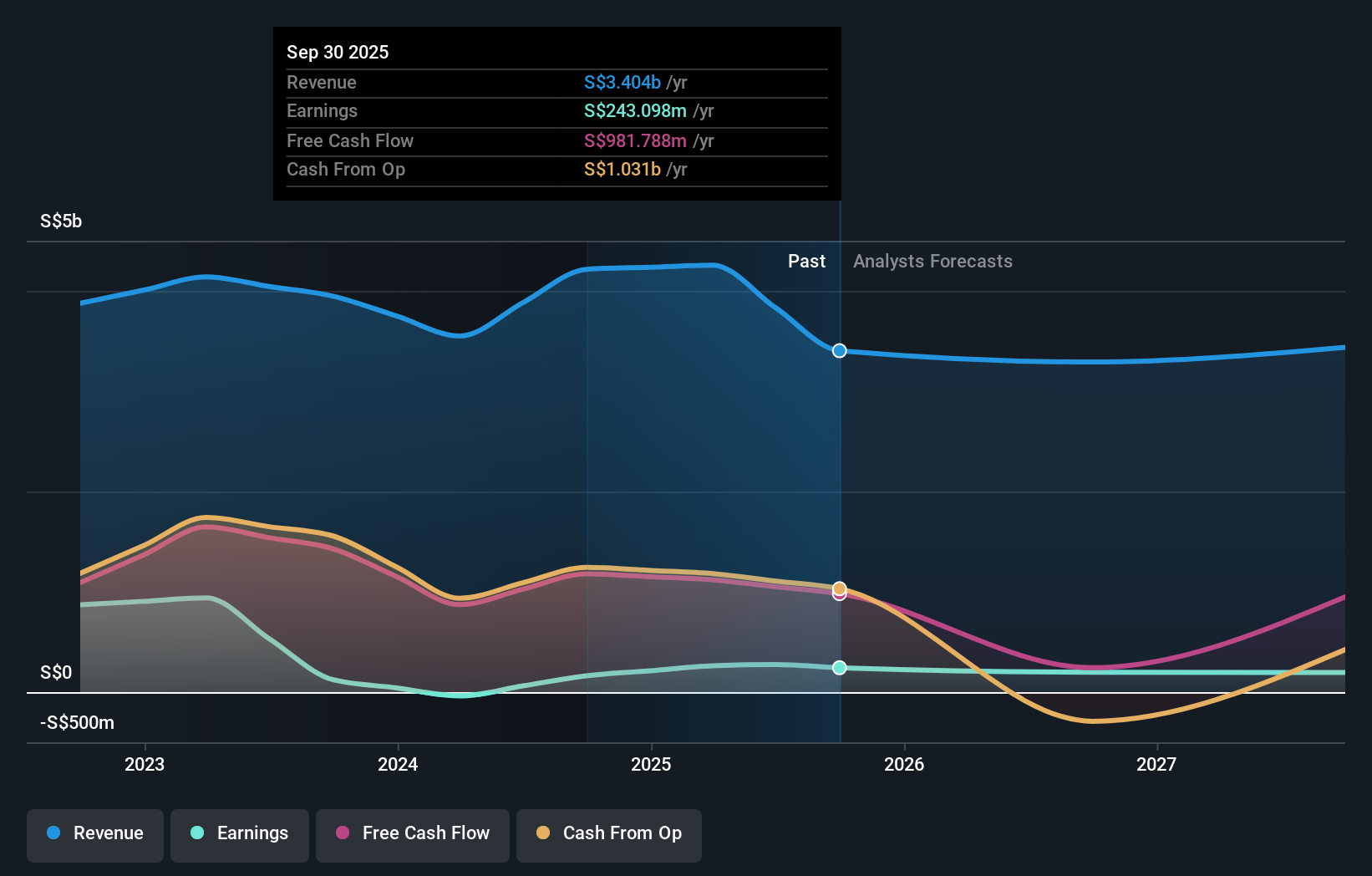

To see value in Frasers Property, investors need to believe in the resilience of its retail ecosystem and the company's ability to adapt amid challenging real estate market conditions. The new SME financing partnership with CIMB may strengthen short-term tenant stability by extending tailored working capital and payment flexibility, potentially mitigating some near-term occupancy and cash flow risks. Until now, concerns had centered on declining revenues, low returns on equity, ongoing board changes, and a lack of clear profit growth forecasts. The recent move could shift attention to improved tenant retention and mall footfall, possibly supporting overall revenue quality, but may not be enough on its own to change the forecast of declining earnings. Investors should weigh this initiative against persistent headwinds such as declining revenue and earnings and a relatively inexperienced board.

But, the risk from declining earnings forecasts is still front and centre. Frasers Property's shares have been on the rise but are still potentially undervalued by 48%. Find out what it's worth.Exploring Other Perspectives

Explore 2 other fair value estimates on Frasers Property - why the stock might be worth just SGD1.28!

Build Your Own Frasers Property Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Frasers Property research is our analysis highlighting 2 key rewards and 4 important warning signs that could impact your investment decision.

- Our free Frasers Property research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Frasers Property's overall financial health at a glance.

Interested In Other Possibilities?

The market won't wait. These fast-moving stocks are hot now. Grab the list before they run:

- Outshine the giants: these 27 early-stage AI stocks could fund your retirement.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:TQ5

Frasers Property

An investment holding company, develops, invests in, and manages a portfolio of real estate assets in Singapore, Australia, Europe, China, Thailand, and internationally.

Slight risk and fair value.

Market Insights

Community Narratives