- Australia

- /

- Retail Distributors

- /

- ASX:BAP

Exploring Global's Undervalued Small Caps With Insider Action In April 2025

Reviewed by Simply Wall St

In April 2025, global markets faced significant turbulence as the U.S. announced unexpected tariffs, leading to sharp declines across major indices and heightened fears of a trade war. Small-cap stocks were particularly affected, with the Russell 2000 Index experiencing a notable drop amid concerns about slowing economic growth and rising inflation. In such volatile times, investors often look for small-cap companies that demonstrate resilience through strong fundamentals and strategic insider actions that align with long-term growth potential.

Top 10 Undervalued Small Caps With Insider Buying Globally

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Tristel | 21.4x | 3.0x | 43.75% | ★★★★★★ |

| Nexus Industrial REIT | 5.2x | 2.7x | 24.43% | ★★★★★★ |

| Chorus Aviation | NA | 0.4x | 20.55% | ★★★★★★ |

| Bytes Technology Group | 21.4x | 5.4x | 13.94% | ★★★★★☆ |

| Speedy Hire | NA | 0.2x | 30.91% | ★★★★★☆ |

| Savaria | 23.1x | 1.3x | 49.57% | ★★★★☆☆ |

| Savills | 22.9x | 0.5x | 43.85% | ★★★★☆☆ |

| Seeing Machines | NA | 2.0x | 46.05% | ★★★★☆☆ |

| FRP Advisory Group | 11.3x | 2.0x | 19.08% | ★★★☆☆☆ |

| Westshore Terminals Investment | 12.8x | 3.6x | 41.14% | ★★★☆☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

Bapcor (ASX:BAP)

Simply Wall St Value Rating: ★★★★★☆

Overview: Bapcor is a leading provider of automotive aftermarket parts, accessories, equipment, and services in Australasia with a market capitalization of over A$2.5 billion.

Operations: Bapcor generates revenue primarily from its Trade, Retail, and Specialist Wholesale segments. The company's gross profit margin has shown a trend of gradual increase from 40.92% in June 2014 to 46.02% in December 2024. Operating expenses are significant and include costs for general and administrative purposes, depreciation and amortization, as well as sales and marketing activities.

PE: -9.1x

Bapcor, a small company in the automotive sector, reported A$1.01 billion in sales for the half-year ending December 2024, slightly down from A$1.02 billion the previous year, with net income at A$40.83 million compared to A$46.94 million previously. Despite this dip and reliance on external borrowing for funding, insider confidence is evident through recent share purchases by executives within the last six months. The company's earnings are forecasted to grow significantly at 56% annually, suggesting potential growth opportunities amidst leadership changes and strategic board appointments like Jacqueline Korhonen's addition as a Non-Executive Director in February 2025.

- Click here to discover the nuances of Bapcor with our detailed analytical valuation report.

Assess Bapcor's past performance with our detailed historical performance reports.

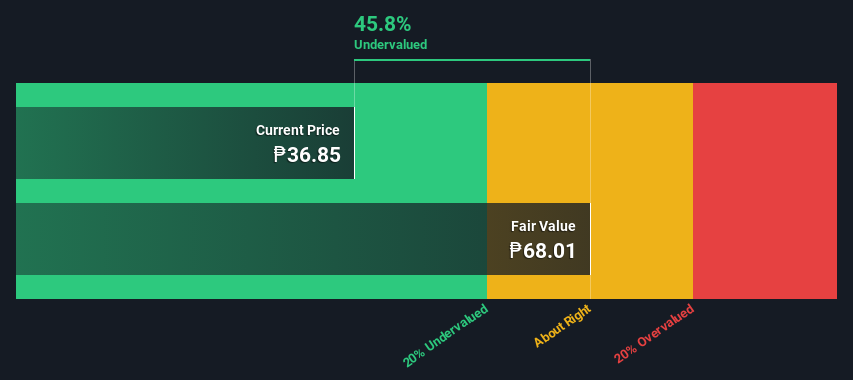

Robinsons Retail Holdings (PSE:RRHI)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Robinsons Retail Holdings operates a diversified retail business in the Philippines, with segments including food, department stores, specialty stores, drug stores, and DIY outlets.

Operations: The company's revenue streams are primarily driven by its Food segment, contributing significantly to its overall income. The Gross Profit Margin shows a trend of gradual increase, reaching 24.11% by the end of 2024. Operating expenses form a substantial part of costs, with General & Administrative Expenses being the largest component within this category.

PE: 5.0x

Robinsons Retail Holdings, a smaller player in the retail sector, recently reported full-year 2024 sales of PHP 199.2 billion and net income of PHP 10.3 billion, showing significant growth from the previous year. Despite this positive momentum, earnings are expected to decline by an average of 10.7% annually over the next three years. Insider confidence is evident as they increased their share purchases throughout late 2024 and early 2025, reflecting belief in potential value amidst external borrowing risks and modest same-store sales growth projections for 2025.

- Take a closer look at Robinsons Retail Holdings' potential here in our valuation report.

Gain insights into Robinsons Retail Holdings' past trends and performance with our Past report.

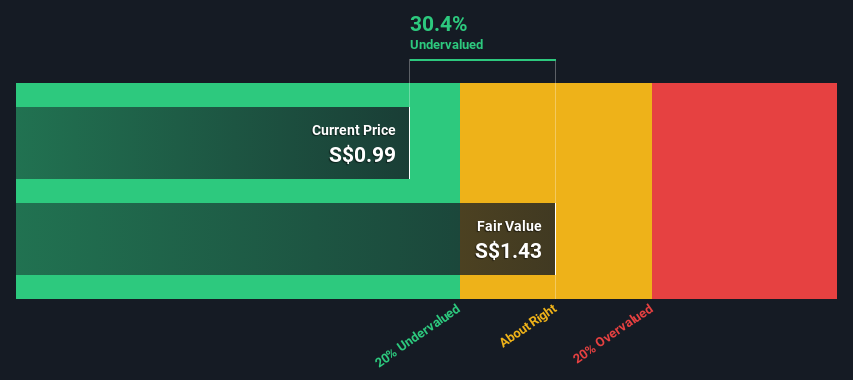

CapitaLand India Trust (SGX:CY6U)

Simply Wall St Value Rating: ★★★★★☆

Overview: CapitaLand India Trust primarily invests in income-producing business spaces in India and has a market cap of approximately SGD 1.98 billion.

Operations: Revenue is primarily derived from investment properties used as business space, totaling SGD 277.88 million as of the latest period. The net income margin has shown significant growth, reaching 1.58% in the most recent period. Operating expenses include general and administrative costs, which have been gradually increasing over time, currently at SGD 24.10 million.

PE: 2.9x

CapitaLand India Trust, a smaller entity in the market, shows potential for growth with insider confidence evident as their Chairman recently purchased 500,000 shares for approximately S$515,000. Despite earnings forecasts predicting a decline of nearly 30% annually over the next three years, revenue is expected to grow by about 14.63% per year. Recent strategic moves include a fixed-income offering of S$200 million and expansion into Bangalore's thriving office space market through acquisitions and partnerships.

- Click here and access our complete valuation analysis report to understand the dynamics of CapitaLand India Trust.

Learn about CapitaLand India Trust's historical performance.

Turning Ideas Into Actions

- Unlock our comprehensive list of 137 Undervalued Global Small Caps With Insider Buying by clicking here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bapcor might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:BAP

Bapcor

Engages in the sale and distribution of vehicle parts, accessories, automotive equipment, and services and solutions in Australia, New Zealand, and Thailand.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives