As global markets experience broad-based gains with smaller-cap indexes outperforming large-caps, investors are increasingly interested in uncovering potential opportunities within the small-cap segment. With economic indicators showing positive sentiment, particularly in the U.S., identifying stocks that demonstrate resilience and growth potential can be beneficial for enhancing a diversified portfolio.

Top 10 Undiscovered Gems With Strong Fundamentals

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Soft-World International | NA | -0.68% | 6.00% | ★★★★★★ |

| Impellam Group | 31.12% | -5.43% | -6.86% | ★★★★★★ |

| Dareway SoftwareLtd | NA | 2.71% | -0.03% | ★★★★★★ |

| Ovostar Union | 0.01% | 10.19% | 49.85% | ★★★★★★ |

| All E Technologies | NA | 34.23% | 31.58% | ★★★★★★ |

| Tianyun International Holdings | 10.09% | -5.59% | -9.92% | ★★★★★★ |

| Interarch Building Products | 2.55% | 10.02% | 28.21% | ★★★★★☆ |

| Billion Industrial Holdings | 3.63% | 18.00% | -11.38% | ★★★★★☆ |

| A2B Australia | 15.83% | -7.78% | 25.44% | ★★★★☆☆ |

| Wilson | 64.79% | 30.09% | 68.29% | ★★★★☆☆ |

Here we highlight a subset of our preferred stocks from the screener.

TF Bank (OM:TFBANK)

Simply Wall St Value Rating: ★★★★☆☆

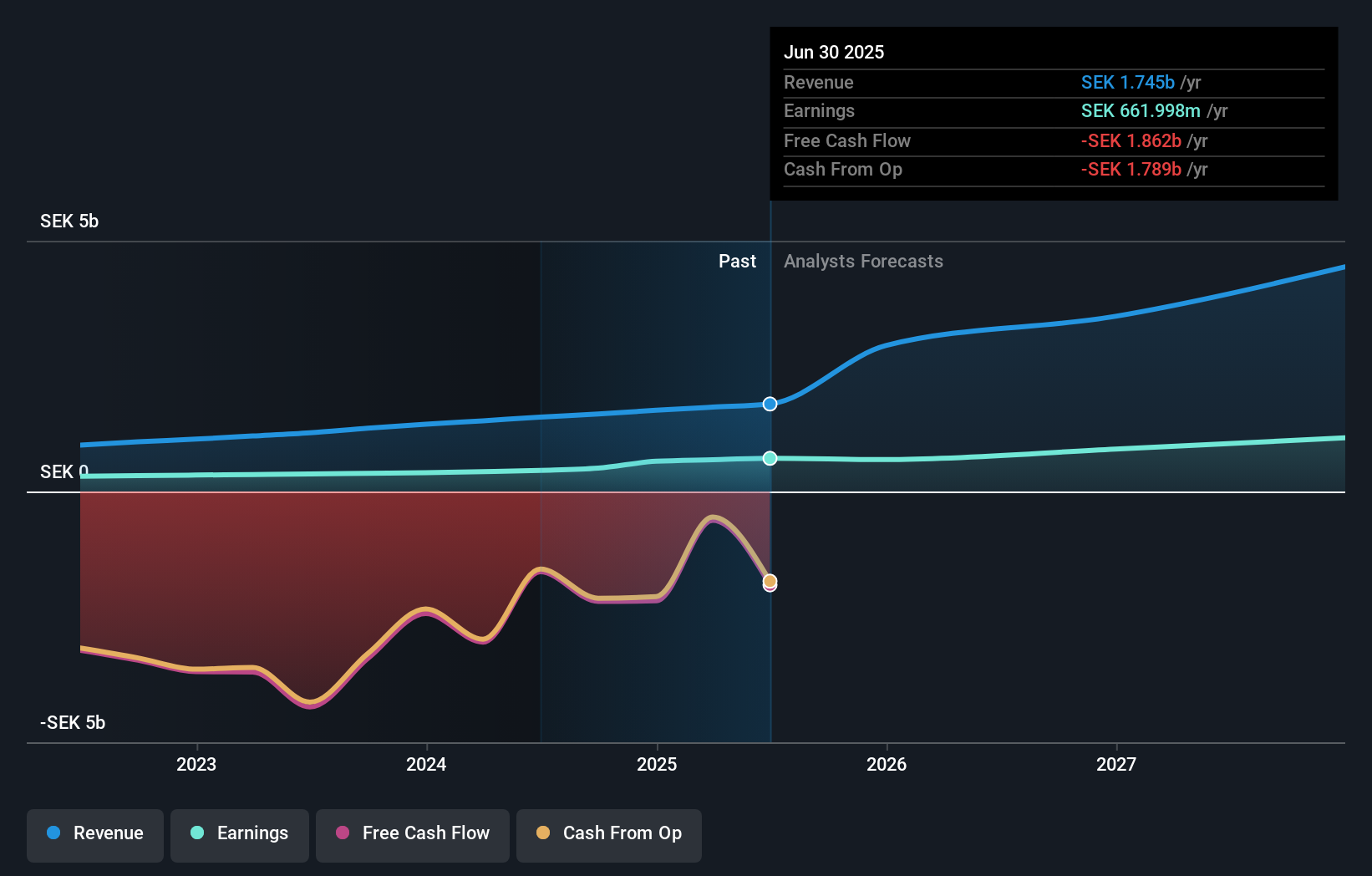

Overview: TF Bank AB (publ) is a digital bank offering consumer banking services and e-commerce solutions via its proprietary IT platform, with a market cap of SEK6.84 billion.

Operations: TF Bank generates revenue primarily from three segments: Credit Cards (SEK 563.14 million), Consumer Lending (SEK 602.16 million), and E-commerce Solutions excluding Credit Cards (SEK 380.14 million).

TF Bank, a relatively small player in the banking sector, showcases intriguing financial dynamics. With total assets of SEK25.3 billion and equity at SEK2.5 billion, it operates with a robust deposit base of SEK21.6 billion against loans totaling SEK20.3 billion. Despite a high bad loan ratio of 11.4%, the bank's allowance for these loans is notably low at 61%. Earnings have surged by 28% over the past year, outpacing industry growth significantly and trading nearly half below its estimated fair value suggests potential undervaluation opportunities for investors keeping an eye on this niche market player.

- Get an in-depth perspective on TF Bank's performance by reading our health report here.

Review our historical performance report to gain insights into TF Bank's's past performance.

Haw Par (SGX:H02)

Simply Wall St Value Rating: ★★★★★☆

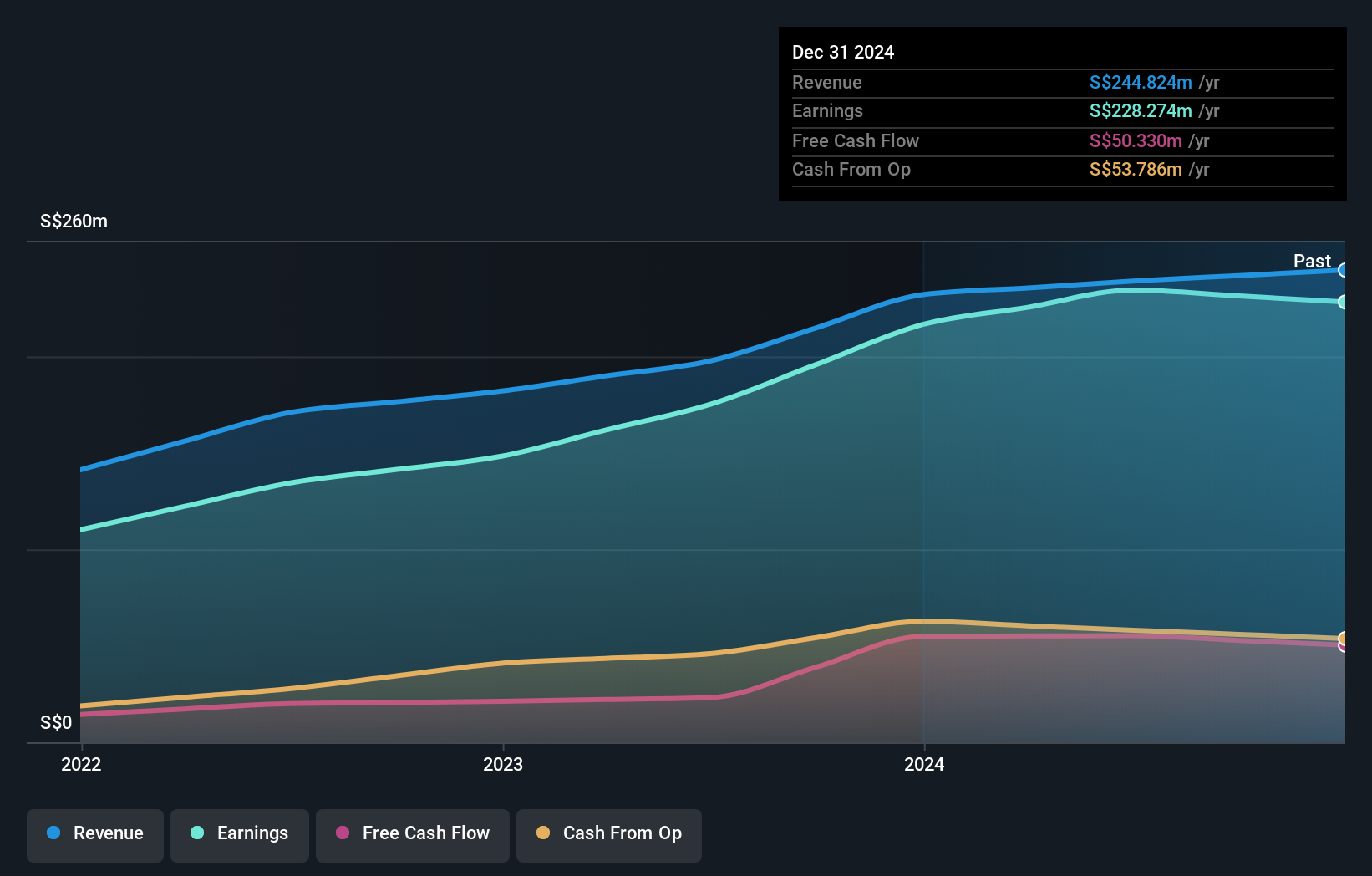

Overview: Haw Par Corporation Limited, with a market cap of SGD2.49 billion, is engaged in the manufacturing, marketing, and trading of healthcare products across Singapore, ASEAN countries, other Asian regions, and globally.

Operations: Haw Par's primary revenue stream comes from healthcare products, contributing SGD220.30 million. The company's market cap stands at SGD2.49 billion.

Haw Par, a compact player in the pharmaceutical sector, showcases robust financial health with high-quality earnings. Its earnings growth of 33.8% over the past year outpaces the industry average of 7.3%. The price-to-earnings ratio stands at 10.6x, offering better value compared to the SG market's 11.7x. Despite an uptick in its debt-to-equity ratio from 0.8% to 1% over five years, it holds more cash than total debt and remains free cash flow positive at US$55 million as of June 2024. Recently dropped from the S&P Global BMI Index, Haw Par continues to manage interest payments effectively without concern for cash runway issues.

V-ZUG Holding (SWX:VZUG)

Simply Wall St Value Rating: ★★★★★★

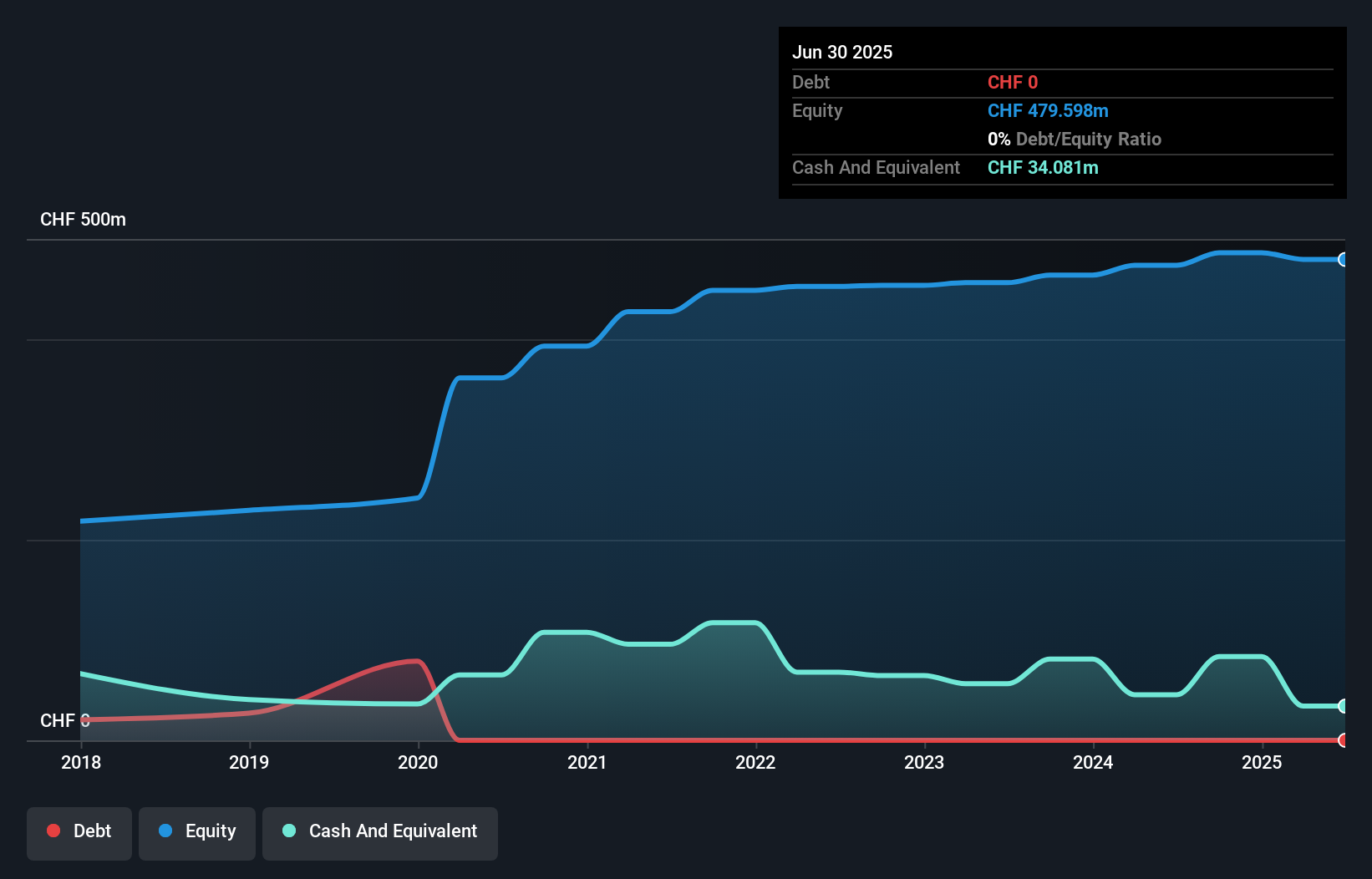

Overview: V-ZUG Holding AG develops, manufactures, markets, sells, and services kitchen and laundry appliances for private households in Switzerland and internationally, with a market capitalization of CHF305.36 million.

Operations: V-ZUG generates revenue primarily from its Household Appliances segment, amounting to CHF571.35 million. The company's financial performance is influenced by its net profit margin trends over recent periods.

V-ZUG, a noteworthy player in the consumer durables sector, is trading at 82.2% below its estimated fair value, highlighting potential undervaluation. This debt-free company has seen an impressive earnings growth of 89.2% over the past year, significantly outpacing the industry average of -4.7%. Despite not being free cash flow positive recently, V-ZUG's profitability and high-quality earnings bolster its financial health. The company’s capital expenditures have been substantial, with recent figures around US$58 million for 2024 suggesting ongoing investments in growth initiatives. Earnings are forecasted to grow by 38.68% annually, indicating promising future prospects for this small-cap entity within its industry landscape.

- Delve into the full analysis health report here for a deeper understanding of V-ZUG Holding.

Explore historical data to track V-ZUG Holding's performance over time in our Past section.

Next Steps

- Delve into our full catalog of 4637 Undiscovered Gems With Strong Fundamentals here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Haw Par might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:H02

Haw Par

Manufactures, markets, and trades in healthcare products in Singapore, ASEAN countries, other Asian countries, and internationally.

Solid track record with excellent balance sheet.