- China

- /

- Consumer Durables

- /

- SZSE:002005

Global Penny Stocks With Market Caps Up To US$700M

Reviewed by Simply Wall St

Global markets have recently shown resilience, with U.S. stocks advancing despite volatile headlines and the small-cap Russell 2000 Index outperforming its large-cap counterparts. Against this backdrop, penny stocks—often seen as relics of past market eras—continue to offer intriguing opportunities due to their affordability and potential for growth when backed by strong financials. In this article, we explore three penny stocks that stand out for their financial strength and potential value in today's market landscape.

Top 10 Penny Stocks Globally

| Name | Share Price | Market Cap | Rewards & Risks |

| Cloudpoint Technology Berhad (KLSE:CLOUDPT) | MYR0.75 | MYR398.7M | ✅ 4 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.52 | HK$933.97M | ✅ 4 ⚠️ 1 View Analysis > |

| IVE Group (ASX:IGL) | A$2.76 | A$425.72M | ✅ 4 ⚠️ 3 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.60 | HK$2.17B | ✅ 4 ⚠️ 1 View Analysis > |

| Angler Gaming (NGM:ANGL) | SEK3.60 | SEK269.95M | ✅ 4 ⚠️ 2 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD1.11 | SGD449.87M | ✅ 4 ⚠️ 2 View Analysis > |

| Deleum Berhad (KLSE:DELEUM) | MYR1.25 | MYR501.94M | ✅ 4 ⚠️ 1 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.52 | SGD13.85B | ✅ 5 ⚠️ 1 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.5525 | $321.18M | ✅ 4 ⚠️ 2 View Analysis > |

| Deceuninck (ENXTBR:DECB) | €2.045 | €282.66M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 3,583 stocks from our Global Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

17LIVE Group (SGX:LVR)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: 17LIVE Group Limited operates a live streaming platform and has a market capitalization of SGD176.14 million.

Operations: The company generates revenue primarily from its live streaming segment, which accounts for $162.82 million.

Market Cap: SGD176.14M

17LIVE Group Limited, with a market cap of SGD176.14 million, primarily generates revenue from its live streaming segment, reporting US$81.15 million in sales for the first half of 2025 despite a net loss of US$4.61 million. The company has undertaken share buybacks and declared an interim dividend funded from its share premium account, highlighting shareholder returns amidst financial challenges. Recent board changes include the resignation of an independent director due to OFAC listing concerns. While unprofitable, 17LIVE maintains a strong cash position exceeding debt levels and has sufficient cash runway for over three years if current conditions persist.

- Take a closer look at 17LIVE Group's potential here in our financial health report.

- Evaluate 17LIVE Group's prospects by accessing our earnings growth report.

Elec-Tech International (SZSE:002005)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Elec-Tech International Co., Ltd. manufactures and sells small household appliances and LED products both in China and internationally, with a market cap of CN¥4.32 billion.

Operations: Elec-Tech International Co., Ltd. has not reported any specific revenue segments.

Market Cap: CN¥4.32B

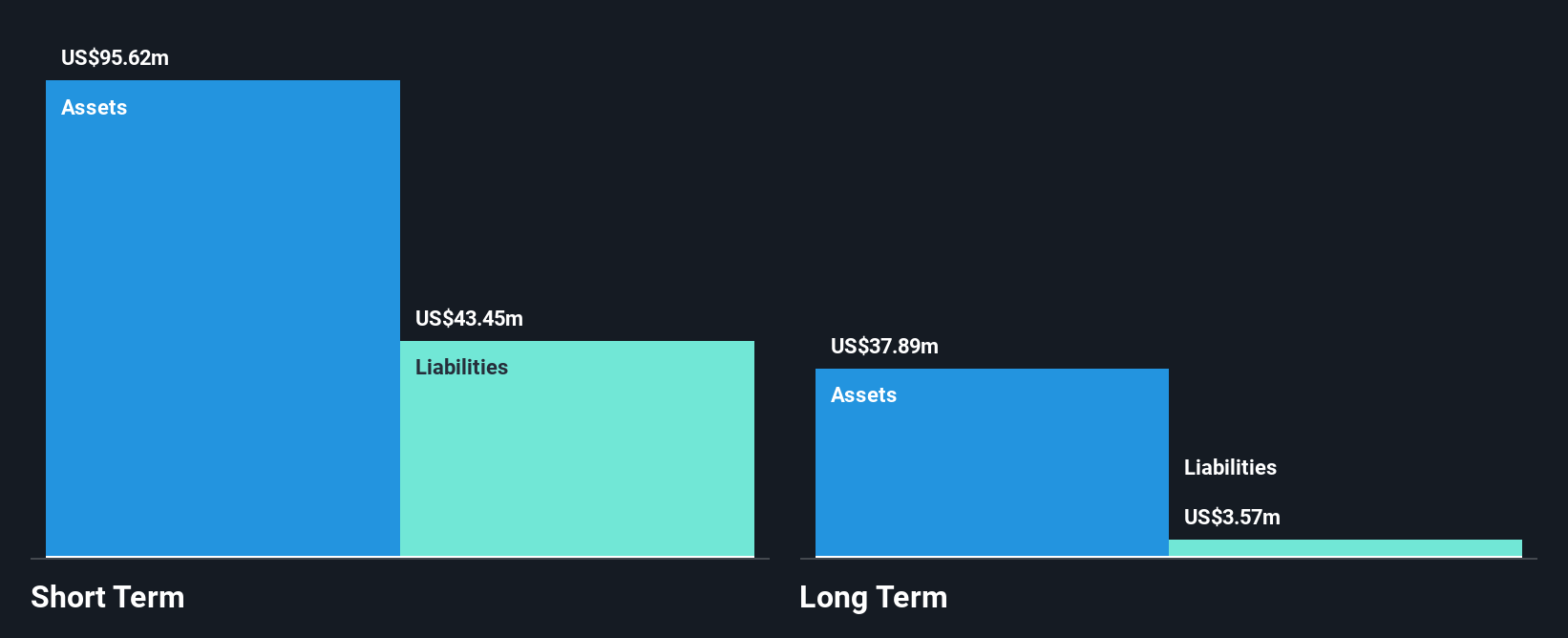

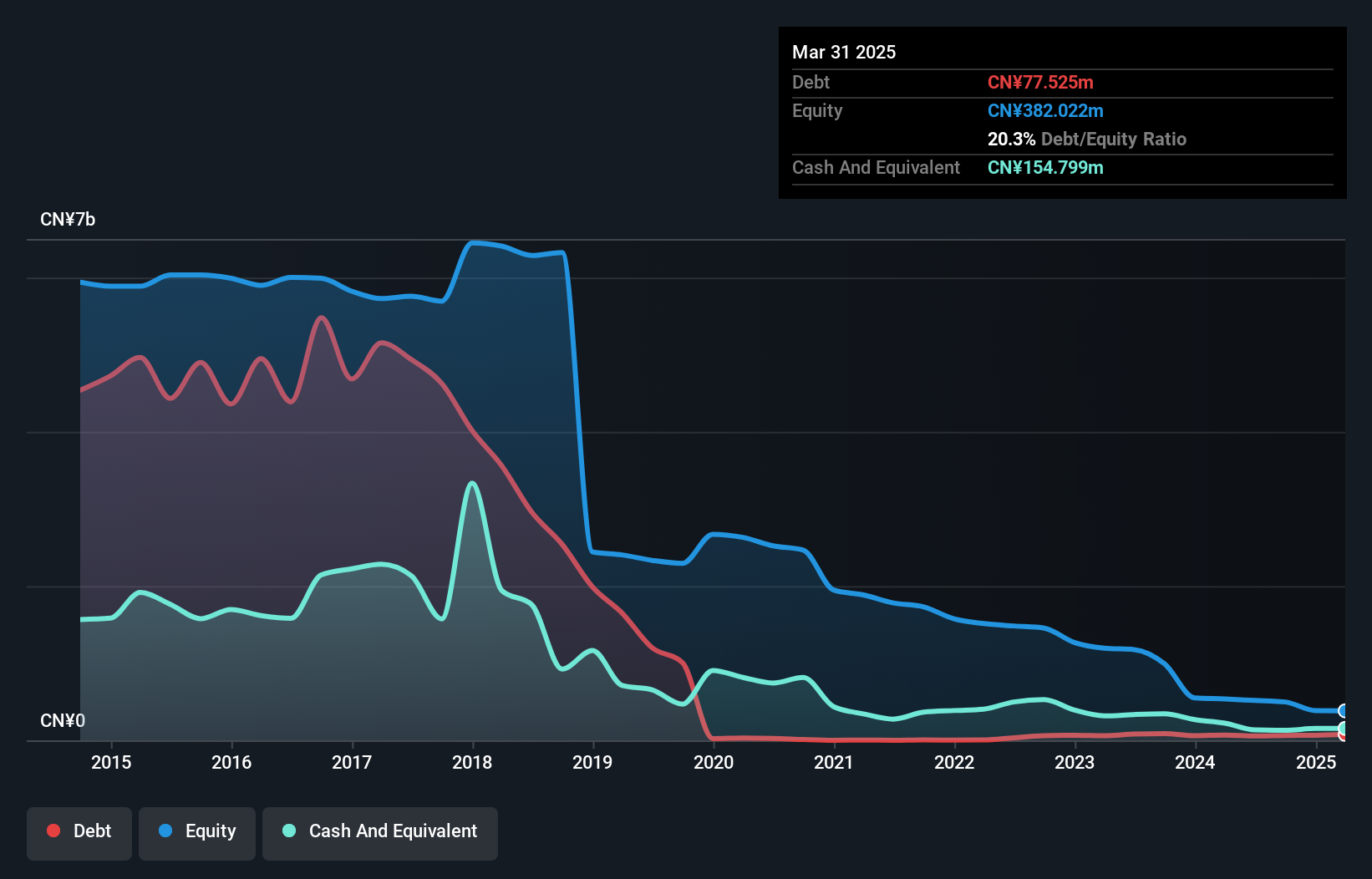

Elec-Tech International, with a market cap of CN¥4.32 billion, has shown improvement in profitability by reporting a net income of CN¥90.15 million for the nine months ended September 30, 2025, compared to a net loss in the previous year. Despite facing challenges such as increased debt levels and short-term liabilities exceeding assets, the company maintains more cash than total debt and has not diluted shareholders recently. Although unprofitable over five years, Elec-Tech has reduced losses annually by 20.8% and holds sufficient cash runway for over a year if free cash flow continues to decrease at historical rates.

- Dive into the specifics of Elec-Tech International here with our thorough balance sheet health report.

- Evaluate Elec-Tech International's historical performance by accessing our past performance report.

Goldlok Holdings(Guangdong)Ltd (SZSE:002348)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Goldlok Holdings (Guangdong) Co., Ltd. operates in the toys and Internet education sectors in China, with a market capitalization of CN¥4.11 billion.

Operations: No specific revenue segments have been reported for the company.

Market Cap: CN¥4.11B

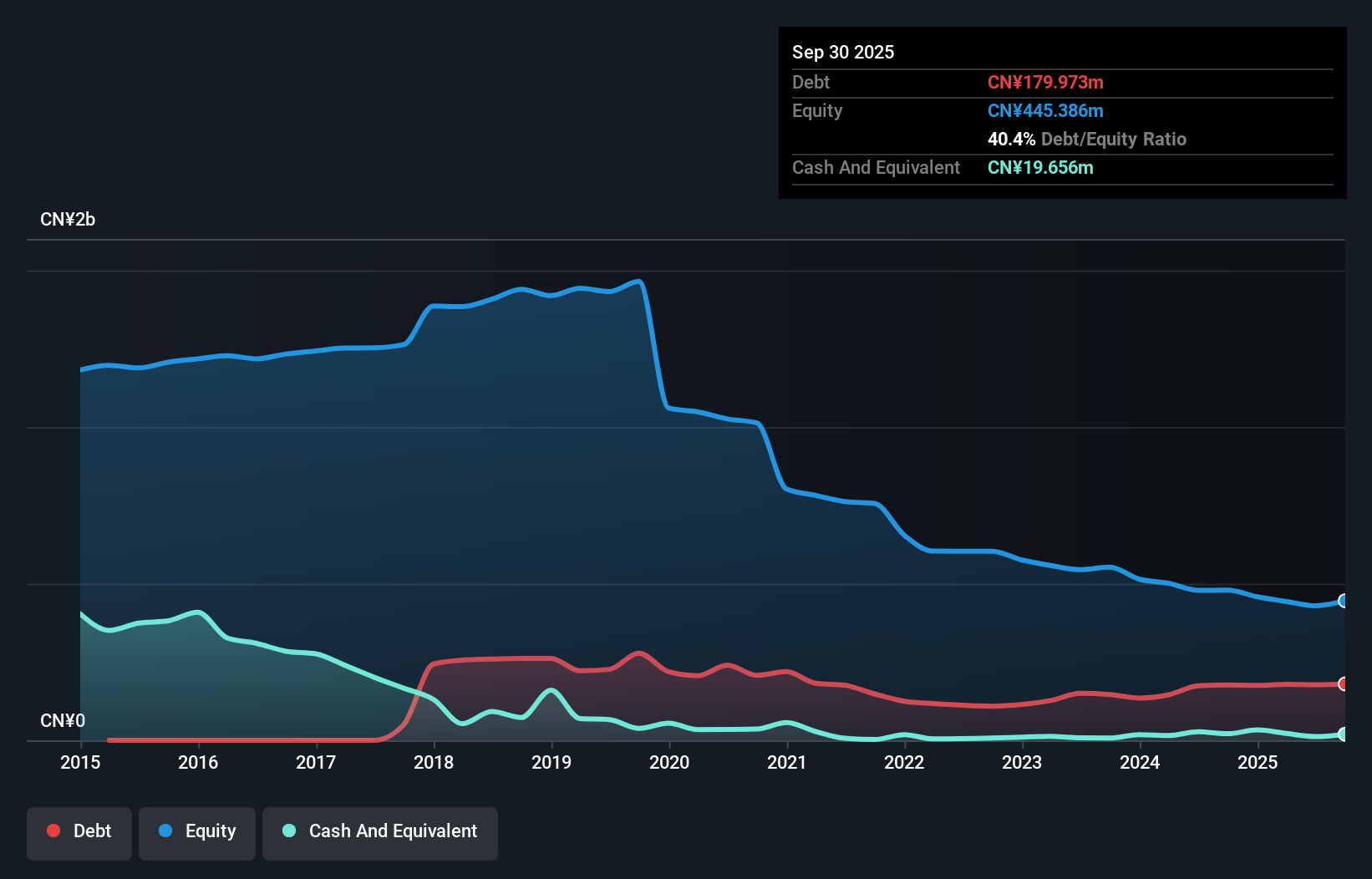

Goldlok Holdings (Guangdong) Ltd., with a market cap of CN¥4.11 billion, has reduced its net loss to CN¥11.67 million for the nine months ended September 30, 2025, from CN¥34.24 million a year ago, indicating progress towards profitability despite remaining unprofitable. The company benefits from a satisfactory net debt to equity ratio of 17.8% and possesses short-term assets of CN¥238 million that exceed long-term liabilities but fall short of covering short-term liabilities completely. Goldlok's cash runway exceeds three years, supported by positive free cash flow and stable weekly volatility over the past year without significant shareholder dilution recently.

- Unlock comprehensive insights into our analysis of Goldlok Holdings(Guangdong)Ltd stock in this financial health report.

- Learn about Goldlok Holdings(Guangdong)Ltd's historical performance here.

Summing It All Up

- Dive into all 3,583 of the Global Penny Stocks we have identified here.

- Looking For Alternative Opportunities? The end of cancer? These 29 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Elec-Tech International might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002005

Elec-Tech International

Research, develops, manufactures, and sells small household appliances and LED products in China and internationally.

Adequate balance sheet and overvalued.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

An amazing opportunity to potentially get a 100 bagger

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)