- Singapore

- /

- Paper and Forestry Products

- /

- SGX:N08

New Toyo International Holdings (SGX:N08) Has Affirmed Its Dividend Of SGD0.009

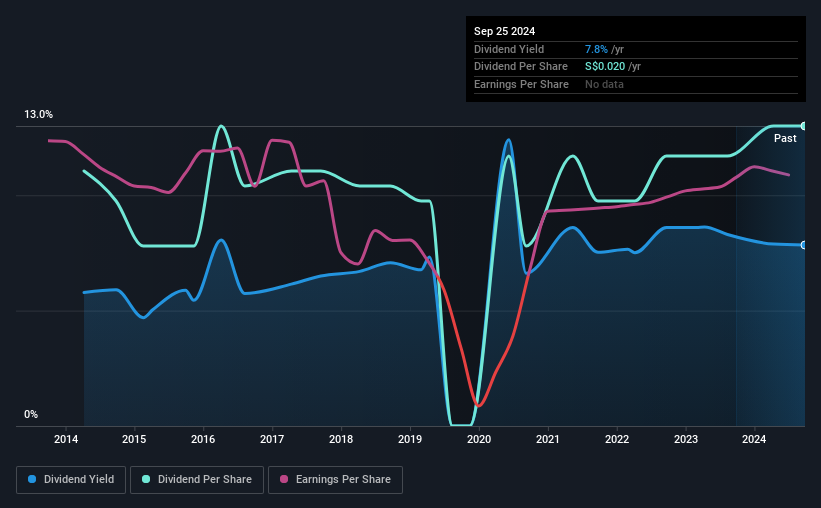

New Toyo International Holdings Ltd (SGX:N08) has announced that it will pay a dividend of SGD0.009 per share on the 16th of October. This makes the dividend yield 7.8%, which will augment investor returns quite nicely.

View our latest analysis for New Toyo International Holdings

New Toyo International Holdings' Payment Could Potentially Have Solid Earnings Coverage

While it is great to have a strong dividend yield, we should also consider whether the payment is sustainable. Before making this announcement, New Toyo International Holdings' was paying out quite a large proportion of earnings and 88% of free cash flows. This is usually an indication that the focus of the company is returning cash to shareholders rather than reinvesting it for growth.

Over the next year, EPS could expand by 50.4% if recent trends continue. If the dividend continues on this path, the payout ratio could be 48% by next year, which we think can be pretty sustainable going forward.

Dividend Volatility

The company's dividend history has been marked by instability, with at least one cut in the last 10 years. Since 2014, the dividend has gone from SGD0.017 total annually to SGD0.02. This works out to be a compound annual growth rate (CAGR) of approximately 1.6% a year over that time. We're glad to see the dividend has risen, but with a limited rate of growth and fluctuations in the payments the total shareholder return may be limited.

The Dividend Looks Likely To Grow

With a relatively unstable dividend, it's even more important to evaluate if earnings per share is growing, which could point to a growing dividend in the future. New Toyo International Holdings has seen EPS rising for the last five years, at 50% per annum. Fast growing earnings are great, but this can rarely be sustained without some reinvestment into the business, which New Toyo International Holdings hasn't been doing.

Our Thoughts On New Toyo International Holdings' Dividend

Overall, it's nice to see a consistent dividend payment, but we think that longer term, the current level of payment might be unsustainable. While New Toyo International Holdings is earning enough to cover the dividend, we are generally unimpressed with its future prospects. We would probably look elsewhere for an income investment.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. Meanwhile, despite the importance of dividend payments, they are not the only factors our readers should know when assessing a company. As an example, we've identified 2 warning signs for New Toyo International Holdings that you should be aware of before investing. Looking for more high-yielding dividend ideas? Try our collection of strong dividend payers.

Valuation is complex, but we're here to simplify it.

Discover if New Toyo International Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SGX:N08

New Toyo International Holdings

An investment holding company, produces and sells specialty packaging materials in Singapore, Hong Kong, Vietnam, Indonesia, Malaysia, and Dubai.

Flawless balance sheet with slight risk.

Market Insights

Community Narratives

Recently Updated Narratives

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

Near zero debt, Japan centric focus provides future growth

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.