- Singapore

- /

- Metals and Mining

- /

- SGX:L23

Why Enviro-Hub Holdings' (SGX:L23) Earnings Are Weaker Than They Seem

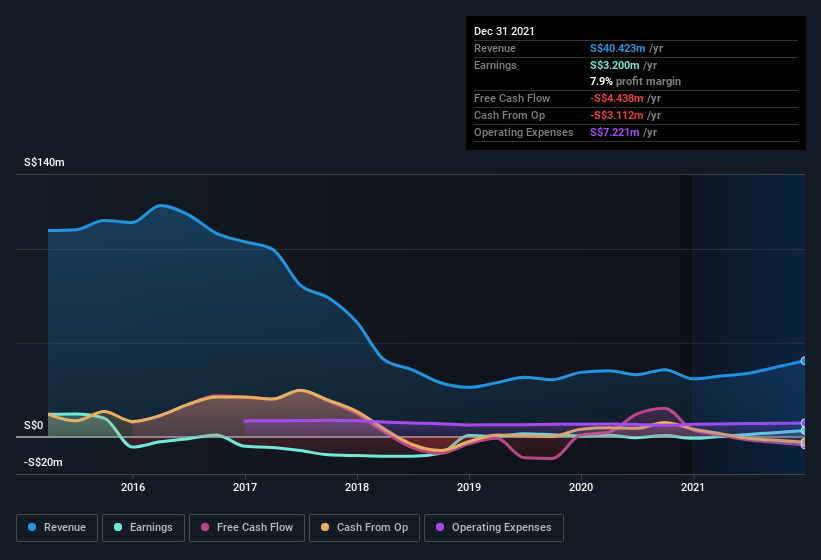

Even though Enviro-Hub Holdings Ltd. (SGX:L23) posted strong earnings recently, the stock hasn't reacted in a large way. We looked deeper into the numbers and found that shareholders might be concerned with some underlying weaknesses.

See our latest analysis for Enviro-Hub Holdings

In order to understand the potential for per share returns, it is essential to consider how much a company is diluting shareholders. Enviro-Hub Holdings expanded the number of shares on issue by 24% over the last year. As a result, its net income is now split between a greater number of shares. To talk about net income, without noticing earnings per share, is to be distracted by the big numbers while ignoring the smaller numbers that talk to per share value. Check out Enviro-Hub Holdings' historical EPS growth by clicking on this link.

How Is Dilution Impacting Enviro-Hub Holdings' Earnings Per Share? (EPS)

Unfortunately, we don't have any visibility into its profits three years back, because we lack the data. Zooming in to the last year, we still can't talk about growth rates coherently, since it made a loss last year. But mathematics aside, it is always good to see when a formerly unprofitable business come good (though we accept profit would have been higher if dilution had not been required). Therefore, one can observe that the dilution is having a fairly profound effect on shareholder returns.

In the long term, if Enviro-Hub Holdings' earnings per share can increase, then the share price should too. But on the other hand, we'd be far less excited to learn profit (but not EPS) was improving. For the ordinary retail shareholder, EPS is a great measure to check your hypothetical "share" of the company's profit.

Note: we always recommend investors check balance sheet strength. Click here to be taken to our balance sheet analysis of Enviro-Hub Holdings.

How Do Unusual Items Influence Profit?

Alongside that dilution, it's also important to note that Enviro-Hub Holdings' profit was boosted by unusual items worth S$4.9m in the last twelve months. While it's always nice to have higher profit, a large contribution from unusual items sometimes dampens our enthusiasm. We ran the numbers on most publicly listed companies worldwide, and it's very common for unusual items to be once-off in nature. Which is hardly surprising, given the name. We can see that Enviro-Hub Holdings' positive unusual items were quite significant relative to its profit in the year to December 2021. All else being equal, this would likely have the effect of making the statutory profit a poor guide to underlying earnings power.

Our Take On Enviro-Hub Holdings' Profit Performance

In its last report Enviro-Hub Holdings benefitted from unusual items which boosted its profit, which could make the profit seem better than it really is on a sustainable basis. On top of that, the dilution means that its earnings per share performance is worse than its profit performance. For the reasons mentioned above, we think that a perfunctory glance at Enviro-Hub Holdings' statutory profits might make it look better than it really is on an underlying level. In light of this, if you'd like to do more analysis on the company, it's vital to be informed of the risks involved. While conducting our analysis, we found that Enviro-Hub Holdings has 3 warning signs and it would be unwise to ignore these.

In this article we've looked at a number of factors that can impair the utility of profit numbers, and we've come away cautious. But there are plenty of other ways to inform your opinion of a company. For example, many people consider a high return on equity as an indication of favorable business economics, while others like to 'follow the money' and search out stocks that insiders are buying. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks that insiders are buying.

Valuation is complex, but we're here to simplify it.

Discover if Enviro-Hub Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SGX:L23

Enviro-Hub Holdings

An investment holding company, engages in the trading, recycling, and refining of e-waste/metals in Singapore, Hong Kong, China, Malaysia, and internationally.

Excellent balance sheet with low risk.

Market Insights

Community Narratives

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Constellation Energy Dividends and Growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026