The recent 12% drop in Enviro-Hub Holdings Ltd.'s (SGX:L23) stock could come as a blow to insiders who purchased S$148.9k worth of stock at an average buy price of S$0.026 over the past 12 months. This is not good as insiders invest based on expectations that their money will appreciate over time. However, as a result of recent losses, their original investment is now worth only S$127.5k.

Although we don't think shareholders should simply follow insider transactions, we do think it is perfectly logical to keep tabs on what insiders are doing.

View our latest analysis for Enviro-Hub Holdings

Enviro-Hub Holdings Insider Transactions Over The Last Year

The Executive Chairman Ah Hua Ng made the biggest insider purchase in the last 12 months. That single transaction was for S$86k worth of shares at a price of S$0.027 each. So it's clear an insider wanted to buy, even at a higher price than the current share price (being S$0.022). While their view may have changed since the purchase was made, this does at least suggest they have had confidence in the company's future. We always take careful note of the price insiders pay when purchasing shares. It is encouraging to see an insider paid above the current price for shares, as it suggests they saw value, even at higher levels. Ah Hua Ng was the only individual insider to buy shares in the last twelve months.

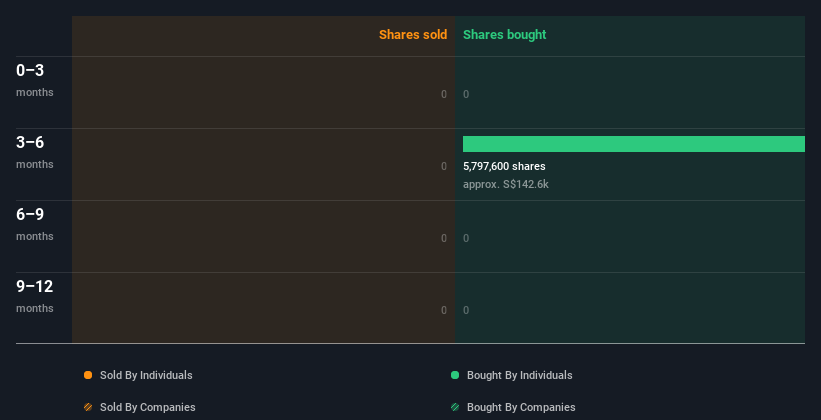

Ah Hua Ng bought a total of 5.80m shares over the year at an average price of S$0.026. You can see a visual depiction of insider transactions (by companies and individuals) over the last 12 months, below. By clicking on the graph below, you can see the precise details of each insider transaction!

There are always plenty of stocks that insiders are buying. If investing in lesser known companies is your style, you could take a look at this free list of companies. (Hint: insiders have been buying them).

Does Enviro-Hub Holdings Boast High Insider Ownership?

I like to look at how many shares insiders own in a company, to help inform my view of how aligned they are with insiders. I reckon it's a good sign if insiders own a significant number of shares in the company. Enviro-Hub Holdings insiders own 68% of the company, currently worth about S$23m based on the recent share price. Most shareholders would be happy to see this sort of insider ownership, since it suggests that management incentives are well aligned with other shareholders.

So What Does This Data Suggest About Enviro-Hub Holdings Insiders?

There haven't been any insider transactions in the last three months -- that doesn't mean much. However, our analysis of transactions over the last year is heartening. It would be great to see more insider buying, but overall it seems like Enviro-Hub Holdings insiders are reasonably well aligned (owning significant chunk of the company's shares) and optimistic for the future. So these insider transactions can help us build a thesis about the stock, but it's also worthwhile knowing the risks facing this company. While conducting our analysis, we found that Enviro-Hub Holdings has 2 warning signs and it would be unwise to ignore them.

Of course Enviro-Hub Holdings may not be the best stock to buy. So you may wish to see this free collection of high quality companies.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Enviro-Hub Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SGX:L23

Enviro-Hub Holdings

An investment holding company, engages in the trading, recycling, and refining of e-waste/metals in Singapore, Hong Kong, China, Malaysia, and internationally.

Excellent balance sheet with low risk.

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Meta’s Bold Bet on AI Pays Off

ADP Stock: Solid Fundamentals, But AI Investments Test Its Margin Resilience

Visa Stock: The Toll Booth at the Center of Global Commerce

Popular Narratives

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

The AI Infrastructure Giant Grows Into Its Valuation

Trending Discussion