David Iben put it well when he said, 'Volatility is not a risk we care about. What we care about is avoiding the permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We can see that International Cement Group Ltd. (SGX:KUO) does use debt in its business. But the real question is whether this debt is making the company risky.

When Is Debt A Problem?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we examine debt levels, we first consider both cash and debt levels, together.

What Is International Cement Group's Net Debt?

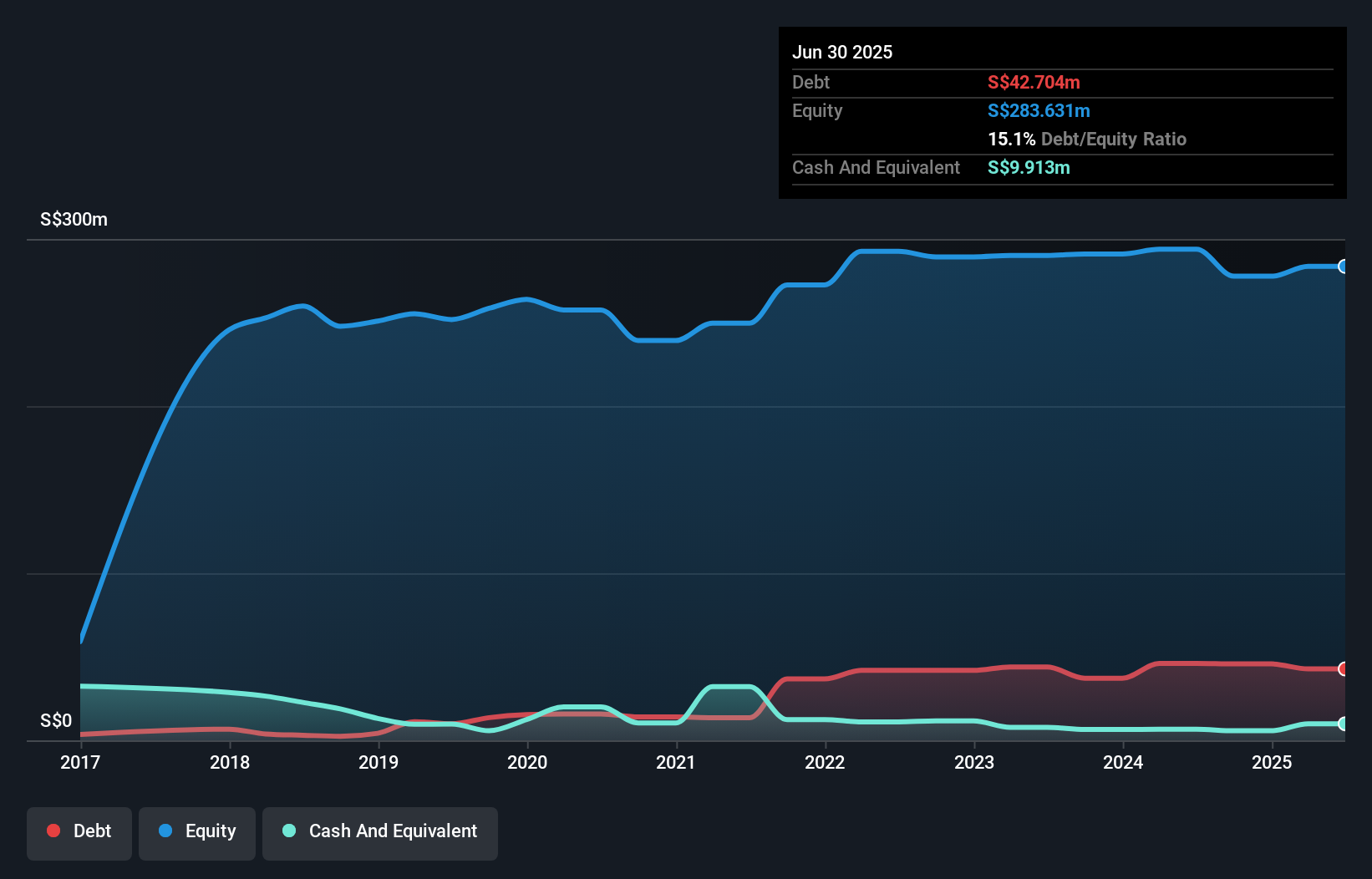

The image below, which you can click on for greater detail, shows that International Cement Group had debt of S$42.7m at the end of June 2025, a reduction from S$46.0m over a year. However, because it has a cash reserve of S$9.91m, its net debt is less, at about S$32.8m.

How Healthy Is International Cement Group's Balance Sheet?

We can see from the most recent balance sheet that International Cement Group had liabilities of S$85.9m falling due within a year, and liabilities of S$225.3m due beyond that. On the other hand, it had cash of S$9.91m and S$51.4m worth of receivables due within a year. So its liabilities outweigh the sum of its cash and (near-term) receivables by S$249.9m.

This deficit is considerable relative to its market capitalization of S$286.7m, so it does suggest shareholders should keep an eye on International Cement Group's use of debt. This suggests shareholders would be heavily diluted if the company needed to shore up its balance sheet in a hurry.

View our latest analysis for International Cement Group

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

International Cement Group's net debt is only 0.34 times its EBITDA. And its EBIT covers its interest expense a whopping 20.7 times over. So you could argue it is no more threatened by its debt than an elephant is by a mouse. Even more impressive was the fact that International Cement Group grew its EBIT by 134% over twelve months. That boost will make it even easier to pay down debt going forward. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since International Cement Group will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So we always check how much of that EBIT is translated into free cash flow. During the last three years, International Cement Group produced sturdy free cash flow equating to 56% of its EBIT, about what we'd expect. This cold hard cash means it can reduce its debt when it wants to.

Our View

International Cement Group's interest cover suggests it can handle its debt as easily as Cristiano Ronaldo could score a goal against an under 14's goalkeeper. But truth be told we feel its level of total liabilities does undermine this impression a bit. All these things considered, it appears that International Cement Group can comfortably handle its current debt levels. Of course, while this leverage can enhance returns on equity, it does bring more risk, so it's worth keeping an eye on this one. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. These risks can be hard to spot. Every company has them, and we've spotted 2 warning signs for International Cement Group you should know about.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SGX:KUO

International Cement Group

Engages in the production, sale, and distribution of cement, gypsum plasterboards, and related products in Singapore, Malaysia, Afghanistan, Tajikistan, Kazakhstan, and internationally.

Proven track record with adequate balance sheet.

Market Insights

Community Narratives

Recently Updated Narratives

TAV Havalimanlari Holding will fly high with 25.68% revenue growth

Fiducian: Compliance Clouds or Value Opportunity?

Q3 Outlook modestly optimistic

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success