- Hong Kong

- /

- Electronic Equipment and Components

- /

- SEHK:1050

Asian Market Insights: 3 Penny Stocks With Market Caps Over US$20M

Reviewed by Simply Wall St

Amidst global concerns about AI valuations and economic uncertainties, Asian markets have mirrored some of the cautious sentiment seen in other regions. For investors interested in exploring smaller or newer companies, penny stocks continue to present intriguing opportunities despite their somewhat dated terminology. These stocks, often representing under-the-radar growth potential at lower price points, can offer significant upside when backed by strong financial health and solid fundamentals.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Lever Style (SEHK:1346) | HK$1.53 | HK$946.34M | ✅ 4 ⚠️ 1 View Analysis > |

| Advice IT Infinite (SET:ADVICE) | THB5.00 | THB3.1B | ✅ 3 ⚠️ 2 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.47 | HK$2.05B | ✅ 4 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD1.05 | SGD425.55M | ✅ 4 ⚠️ 2 View Analysis > |

| T.A.C. Consumer (SET:TACC) | THB4.94 | THB2.96B | ✅ 3 ⚠️ 3 View Analysis > |

| Atlantic Navigation Holdings (Singapore) (Catalist:5UL) | SGD0.098 | SGD51.3M | ✅ 2 ⚠️ 4 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.34 | SGD13.14B | ✅ 5 ⚠️ 1 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$1.03 | NZ$146.62M | ✅ 2 ⚠️ 5 View Analysis > |

| Scott Technology (NZSE:SCT) | NZ$2.85 | NZ$235.47M | ✅ 4 ⚠️ 2 View Analysis > |

| Lum Chang Holdings (SGX:L19) | SGD0.445 | SGD166.71M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 962 stocks from our Asian Penny Stocks screener.

Let's uncover some gems from our specialized screener.

Karrie International Holdings (SEHK:1050)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Karrie International Holdings Limited is an investment holding company that manufactures and sells metal, plastic, and electronic products across various regions including Hong Kong, Japan, Mainland China, Asia, North America, and Western Europe with a market capitalization of approximately HK$5.09 billion.

Operations: The company's revenue is primarily generated from its Metal and Plastic Business, which accounts for HK$2.04 billion, and its Electronic Manufacturing Services Business, contributing HK$1.20 billion.

Market Cap: HK$5.09B

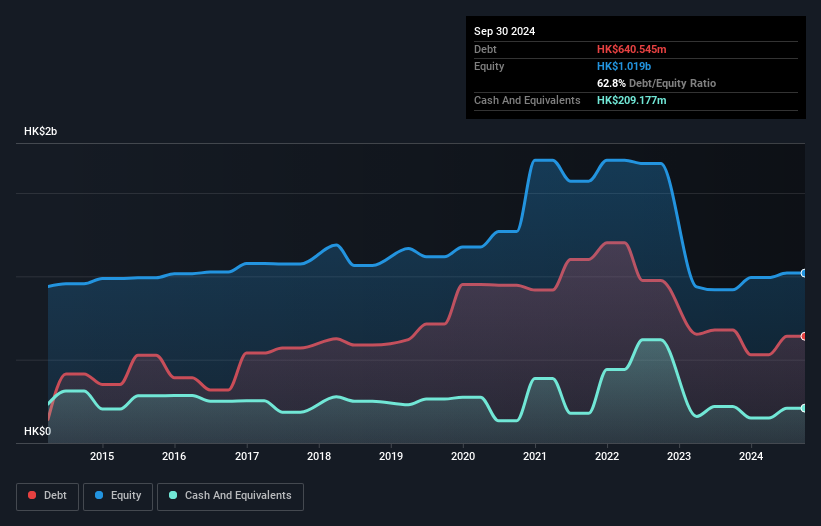

Karrie International Holdings, with a market cap of HK$5.09 billion, shows a mixed financial picture as an investment option. The company has demonstrated earnings growth of 20.5% over the past year, outperforming the electronic industry average and indicating high-quality earnings. However, its Return on Equity remains low at 19%, and it faces significant debt levels with a net debt to equity ratio of 41.2%. Recent events include a private placement raising HKD 150 million through convertible bonds and stable half-year sales figures at HKD 1,608.75 million compared to last year’s performance.

- Click to explore a detailed breakdown of our findings in Karrie International Holdings' financial health report.

- Explore historical data to track Karrie International Holdings' performance over time in our past results report.

Sansiri (SET:SIRI)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Sansiri Public Company Limited, along with its subsidiaries, operates in the property development sector in Thailand and has a market capitalization of approximately THB24.41 billion.

Operations: The company generates revenue primarily from real estate (THB29.62 billion), with additional contributions from building management, project management, and real estate brokerage (THB2.58 billion), as well as its hotel business (THB890 million).

Market Cap: THB24.41B

Sansiri Public Company Limited, with a market cap of THB24.41 billion, presents a varied financial profile within the penny stock landscape. The company has experienced significant earnings growth over the past five years, yet recent performance shows negative earnings growth and declining profit margins from 13.2% to 11.3%. Despite trading below its estimated fair value and having high-quality earnings, Sansiri faces challenges with a high net debt to equity ratio of 130.8%, which is not well covered by operating cash flow. Recent expansions include new subsidiaries focused on real estate investments both domestically and internationally.

- Jump into the full analysis health report here for a deeper understanding of Sansiri.

- Learn about Sansiri's future growth trajectory here.

Samko Timber (SGX:E6R)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Samko Timber Limited, with a market cap of SGD34.59 million, is an investment holding company that provides timber-related products.

Operations: No revenue segments have been reported for Samko Timber.

Market Cap: SGD34.59M

Samko Timber Limited, with a market cap of SGD34.59 million, operates without long-term liabilities and is debt-free, which reduces financial risk. However, its Return on Equity is low at -34.6%, indicating inefficiency in generating profits from shareholders' equity. The company's net profit margin has improved significantly to 56.4% from negative figures last year, yet recent earnings growth has been negative at -69.7%. Despite being priced attractively with a Price-To-Earnings ratio of 6.4x compared to the Singapore market average of 14.8x, volatility remains high and the management team lacks experience with an average tenure of just 1.7 years.

- Navigate through the intricacies of Samko Timber with our comprehensive balance sheet health report here.

- Examine Samko Timber's past performance report to understand how it has performed in prior years.

Summing It All Up

- Jump into our full catalog of 962 Asian Penny Stocks here.

- Looking For Alternative Opportunities? We've found 15 US stocks that are forecast to pay a dividend yeild of over 6% next year. See the full list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Karrie International Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1050

Karrie International Holdings

An investment holding company, manufactures and sells metal, plastic, and electronic products in Hong Kong, Japan, Mainland China, Asia, North America, and Western Europe.

Excellent balance sheet with proven track record.

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success