- Singapore

- /

- Metals and Mining

- /

- Catalist:5TP

Asian Penny Stock Opportunities: CNMC Goldmine Holdings And 2 More Promising Picks

Reviewed by Simply Wall St

As global markets grapple with economic uncertainty and inflation concerns, Asian equities have shown resilience amid these challenges. Penny stocks, often seen as a niche investment category, continue to offer intriguing opportunities for growth, especially when backed by strong financial health. In this article, we explore several high-quality penny stocks in Asia that stand out for their potential to deliver impressive returns while maintaining sound balance sheets.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Interlink Telecom (SET:ITEL) | THB1.36 | THB1.89B | ✅ 4 ⚠️ 5 View Analysis > |

| Chumporn Palm Oil Industry (SET:CPI) | THB2.74 | THB1.73B | ✅ 2 ⚠️ 2 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.385 | SGD156.04M | ✅ 4 ⚠️ 1 View Analysis > |

| Beng Kuang Marine (SGX:BEZ) | SGD0.20 | SGD39.84M | ✅ 4 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.26 | SGD8.93B | ✅ 5 ⚠️ 0 View Analysis > |

| YesAsia Holdings (SEHK:2209) | HK$3.11 | HK$1.28B | ✅ 4 ⚠️ 3 View Analysis > |

| Bosideng International Holdings (SEHK:3998) | HK$4.01 | HK$45.93B | ✅ 4 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.29 | HK$813.93M | ✅ 4 ⚠️ 1 View Analysis > |

| Goodbaby International Holdings (SEHK:1086) | HK$1.23 | HK$2.05B | ✅ 4 ⚠️ 2 View Analysis > |

| Xiamen Hexing Packaging Printing (SZSE:002228) | CN¥3.16 | CN¥3.66B | ✅ 3 ⚠️ 1 View Analysis > |

Click here to see the full list of 1,113 stocks from our Asian Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

CNMC Goldmine Holdings (Catalist:5TP)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: CNMC Goldmine Holdings Limited is an investment holding company focused on the exploration and mining of gold deposits in Malaysia, with a market capitalization of SGD156.04 million.

Operations: The company's revenue is primarily generated from its mining segment, amounting to $65.20 million.

Market Cap: SGD156.04M

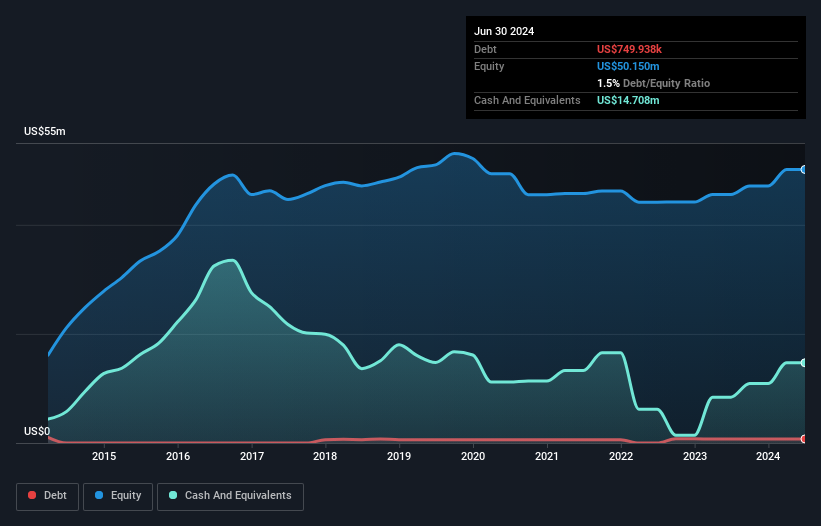

CNMC Goldmine Holdings has shown robust financial performance, with earnings growing by 140.3% over the past year, surpassing its five-year average growth of 48.5%. The company reported a net income of US$9.85 million for 2024, up from US$4.1 million in the previous year, driven by increased gold and metal concentrate sales. Its short-term assets exceed both short and long-term liabilities, reflecting sound financial health. Trading significantly below estimated fair value and boasting high-quality earnings alongside a strong return on equity of 22.5%, CNMC presents an intriguing option within the penny stock segment in Asia's mining sector.

- Click to explore a detailed breakdown of our findings in CNMC Goldmine Holdings' financial health report.

- Explore CNMC Goldmine Holdings' analyst forecasts in our growth report.

UNQ Holdings (SEHK:2177)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: UNQ Holdings Limited is a brand e-commerce service solutions provider in the People's Republic of China with a market cap of HK$0.33 billion.

Operations: UNQ Holdings Limited has not reported any specific revenue segments.

Market Cap: HK$330.13M

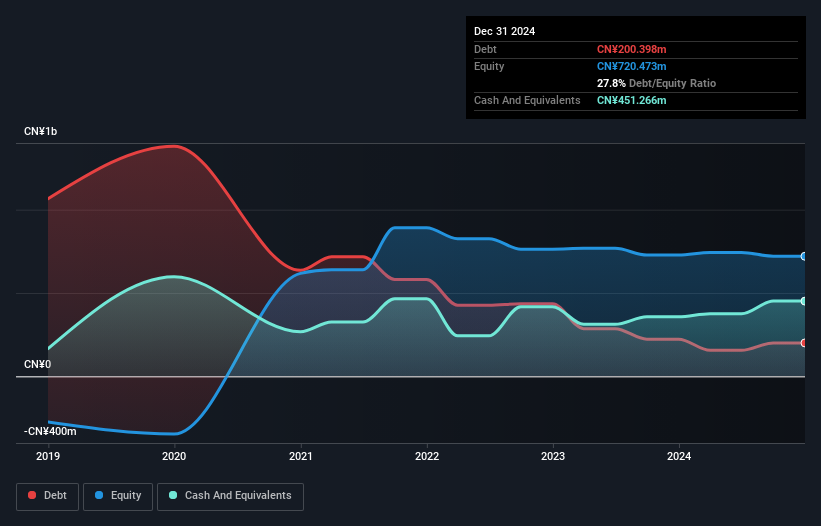

UNQ Holdings Limited, with a market cap of HK$0.33 billion, has recently become profitable, reporting a net income of CNY 37.89 million for 2024 compared to a loss the previous year. The company’s short-term assets significantly exceed both its long and short-term liabilities, indicating strong financial health. UNQ's earnings are high quality and interest payments are well-covered by profits. While trading at a substantial discount to estimated fair value, the stock remains volatile with a dividend payout not fully covered by earnings. The management team and board bring experience to navigate this volatility in the e-commerce sector.

- Unlock comprehensive insights into our analysis of UNQ Holdings stock in this financial health report.

- Examine UNQ Holdings' past performance report to understand how it has performed in prior years.

Broncus Holding (SEHK:2216)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Broncus Holding Corporation is a medical device company specializing in interventional pulmonology products across Mainland China, the European Union, the United States, and internationally, with a market cap of HK$578.44 million.

Operations: Broncus Holding Corporation has not reported any specific revenue segments.

Market Cap: HK$578.44M

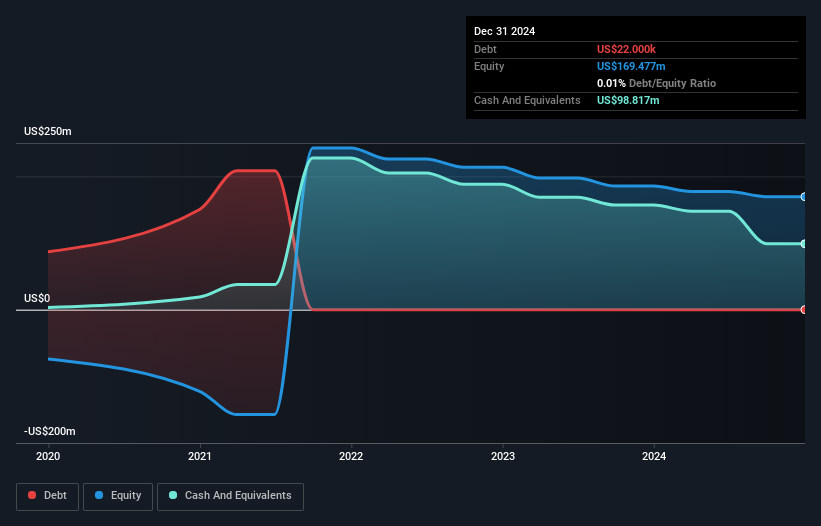

Broncus Holding Corporation, with a market cap of HK$578.44 million, has shown improvement in financial stability by transitioning from negative to positive shareholder equity over five years. Despite being unprofitable with a net loss of US$15.3 million for 2024, the company reduced its losses significantly compared to the previous year and increased revenue to US$8.13 million. The approval of BroncQCT® software in China enhances its product portfolio and positions it for growth in pulmonary diagnostics and treatment solutions. With more cash than debt and no long-term liabilities, Broncus is strategically positioned for future opportunities within the medical device sector.

- Dive into the specifics of Broncus Holding here with our thorough balance sheet health report.

- Learn about Broncus Holding's future growth trajectory here.

Key Takeaways

- Click here to access our complete index of 1,113 Asian Penny Stocks.

- Curious About Other Options? Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 20 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About Catalist:5TP

CNMC Goldmine Holdings

An investment holding company, engages in the exploration and mining of gold deposits in Malaysia.

Outstanding track record and undervalued.

Market Insights

Community Narratives