- Hong Kong

- /

- Medical Equipment

- /

- SEHK:1302

Asian Market Insights: CNMC Goldmine Holdings And 2 Other Noteworthy Penny Stocks

Reviewed by Simply Wall St

As global markets respond to economic data and rate cut speculations, Asian indices have shown resilience amid these shifting dynamics. In this context, penny stocks—often representing smaller or newer companies—remain a relevant investment area despite their somewhat outdated label. By focusing on those with robust financials, investors can uncover potential opportunities for growth; here we examine CNMC Goldmine Holdings and two other noteworthy examples that may offer both stability and upside in the evolving market landscape.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| Food Moments (SET:FM) | THB4.06 | THB4.01B | ✅ 4 ⚠️ 0 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.47 | HK$909.23M | ✅ 4 ⚠️ 1 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.49 | HK$2.07B | ✅ 3 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.645 | SGD261.41M | ✅ 4 ⚠️ 2 View Analysis > |

| China Sunsine Chemical Holdings (SGX:QES) | SGD0.69 | SGD657.83M | ✅ 3 ⚠️ 2 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.91 | SGD11.45B | ✅ 5 ⚠️ 1 View Analysis > |

| Ekarat Engineering (SET:AKR) | THB0.96 | THB1.41B | ✅ 2 ⚠️ 2 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$0.95 | NZ$135.23M | ✅ 2 ⚠️ 5 View Analysis > |

| Rojana Industrial Park (SET:ROJNA) | THB4.76 | THB9.62B | ✅ 3 ⚠️ 3 View Analysis > |

| BRC Asia (SGX:BEC) | SGD3.50 | SGD960.23M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 972 stocks from our Asian Penny Stocks screener.

Let's uncover some gems from our specialized screener.

CNMC Goldmine Holdings (Catalist:5TP)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: CNMC Goldmine Holdings Limited is an investment holding company focused on the exploration and mining of gold deposits in Malaysia, with a market cap of SGD261.41 million.

Operations: The company generates revenue primarily from its mining operations, totaling $88.33 million.

Market Cap: SGD261.41M

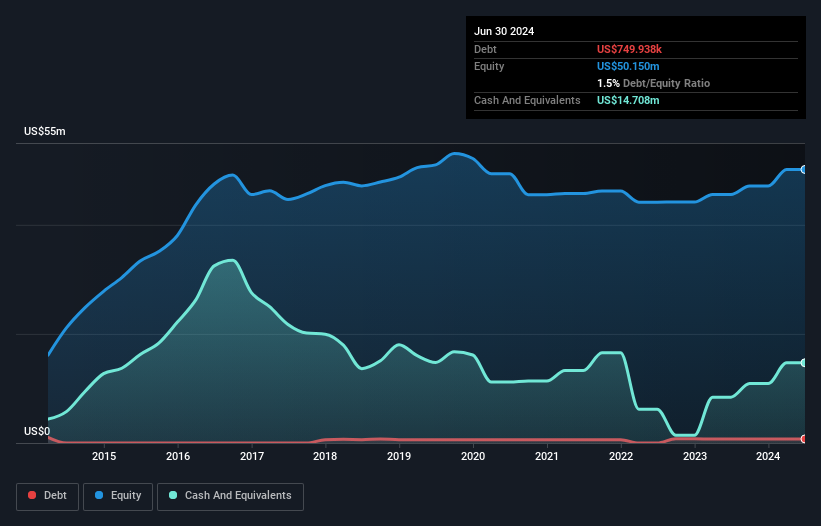

CNMC Goldmine Holdings has demonstrated robust financial performance, with earnings growing by 210.3% over the past year, significantly outpacing the industry. The company reported a net income of US$15.76 million for H1 2025, up from US$4.43 million the previous year, reflecting strong operational efficiency and high-quality earnings. Its short-term assets (US$51.3M) comfortably cover both short- and long-term liabilities, indicating solid financial health. Despite significant insider selling recently and an unstable dividend track record, CNMC's seasoned management team and favorable valuation compared to peers suggest potential for continued growth in this volatile sector.

- Click here to discover the nuances of CNMC Goldmine Holdings with our detailed analytical financial health report.

- Gain insights into CNMC Goldmine Holdings' future direction by reviewing our growth report.

LifeTech Scientific (SEHK:1302)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: LifeTech Scientific Corporation is an investment holding company that develops, manufactures, and trades interventional medical devices for cardiovascular and peripheral vascular diseases across Mainland China and other international markets, with a market cap of approximately HK$10.04 billion.

Operations: The company's revenue is derived from three main segments: Structural Heart Diseases Business generating CN¥527.58 million, Peripheral Vascular Diseases Business contributing CN¥751.11 million, and Cardiac Pacing and Electrophysiology Business with CN¥25.01 million.

Market Cap: HK$10B

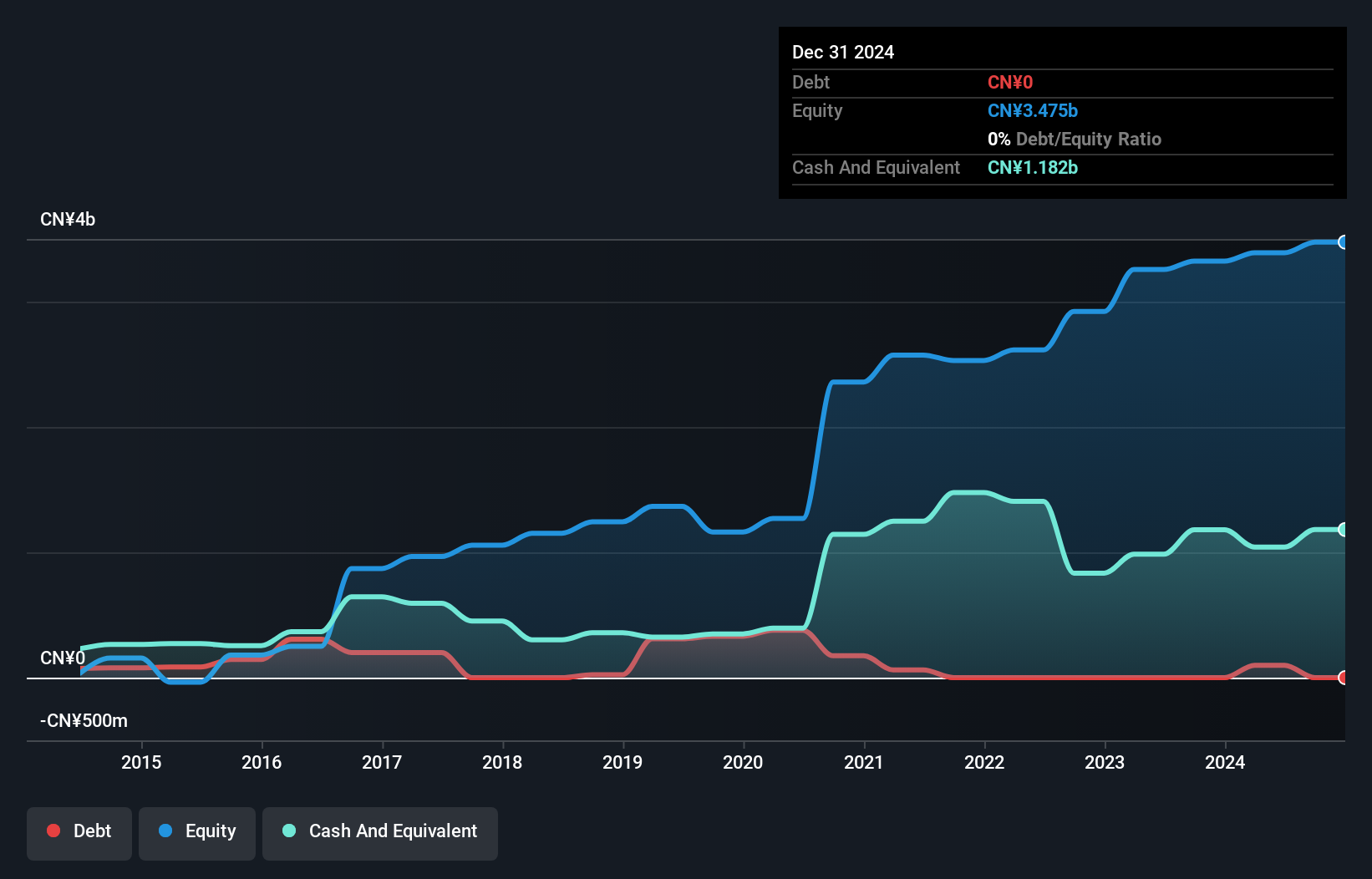

LifeTech Scientific Corporation, with a market cap of approximately HK$10.04 billion, operates debt-free and demonstrates financial stability by covering its short- and long-term liabilities with CN¥2.3 billion in short-term assets. However, the company faces challenges with negative earnings growth over the past year despite a 7.9% annual profit increase over five years. Its net profit margin has declined to 17.1% from 20.8%, reflecting pressures on profitability, while Return on Equity remains low at 4.8%. Recent board appointments may strengthen governance as LifeTech navigates industry competition amid stable volatility levels in its stock performance.

- Navigate through the intricacies of LifeTech Scientific with our comprehensive balance sheet health report here.

- Examine LifeTech Scientific's past performance report to understand how it has performed in prior years.

SSY Group (SEHK:2005)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: SSY Group Limited is an investment holding company that engages in the research, development, manufacturing, trading, and sale of pharmaceutical products to hospitals and distributors both within the People's Republic of China and internationally, with a market cap of HK$9.06 billion.

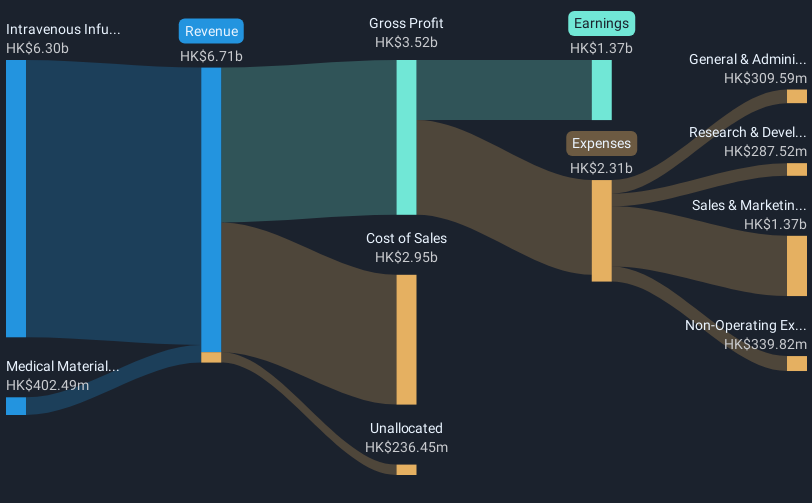

Operations: The company's revenue is primarily generated from its Intravenous Infusion Solution and Others segment, which accounts for HK$5.59 billion, followed by the Medical Materials segment with HK$405.07 million.

Market Cap: HK$9.06B

SSY Group Limited, with a market cap of HK$9.06 billion, primarily generates revenue from its Intravenous Infusion Solution segment. Recent approvals by China's National Medical Products Administration for drugs like Fampridine and Drotaverine Hydrochloride highlight the company's active pharmaceutical development strategy. Despite this, SSY faces challenges with negative earnings growth over the past year and a declining net profit margin to 18.4%. The company's financials show stability with short-term assets covering both short- and long-term liabilities, while interest payments are well covered by EBIT. However, dividend sustainability remains a concern due to limited free cash flow coverage.

- Take a closer look at SSY Group's potential here in our financial health report.

- Review our growth performance report to gain insights into SSY Group's future.

Make It Happen

- Click this link to deep-dive into the 972 companies within our Asian Penny Stocks screener.

- Curious About Other Options? Explore 24 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1302

LifeTech Scientific

An investment holding company, develops, manufactures, and trades in interventional medical devices for cardiovascular and peripheral vascular diseases and disorders in Mainland China, Europe, Rest of Asia, India, South America, Africa, and internationally.

Flawless balance sheet with low risk.

Market Insights

Community Narratives