Is Great Eastern Still a Bargain After Its 11% Surge and Sector Optimism in 2025?

Reviewed by Simply Wall St

If you have been following Great Eastern Holdings lately, you have probably noticed its stock catching more eyes on the market. With a last close at $15.31 and a year-to-date gain of 13.4%, plus an impressive 11.3% jump just in the past week, investors are clearly reacting to more than just routine headlines. Much of this momentum can be traced back to recent shifts across the insurance sector, with investors re-evaluating risk and growth in a changing economic landscape. There has been renewed optimism in financials, and Great Eastern Holdings is riding that wave.

The longer-term gains are equally striking. Over the past three years, the stock is up 80.1%, and if you had been patient for five years, your total return would now be at a solid 100.0%. Growth like this does not happen by accident, but it raises a question many shareholders (and would-be investors) are asking: is the stock still attractively priced, or is it time to be cautious?

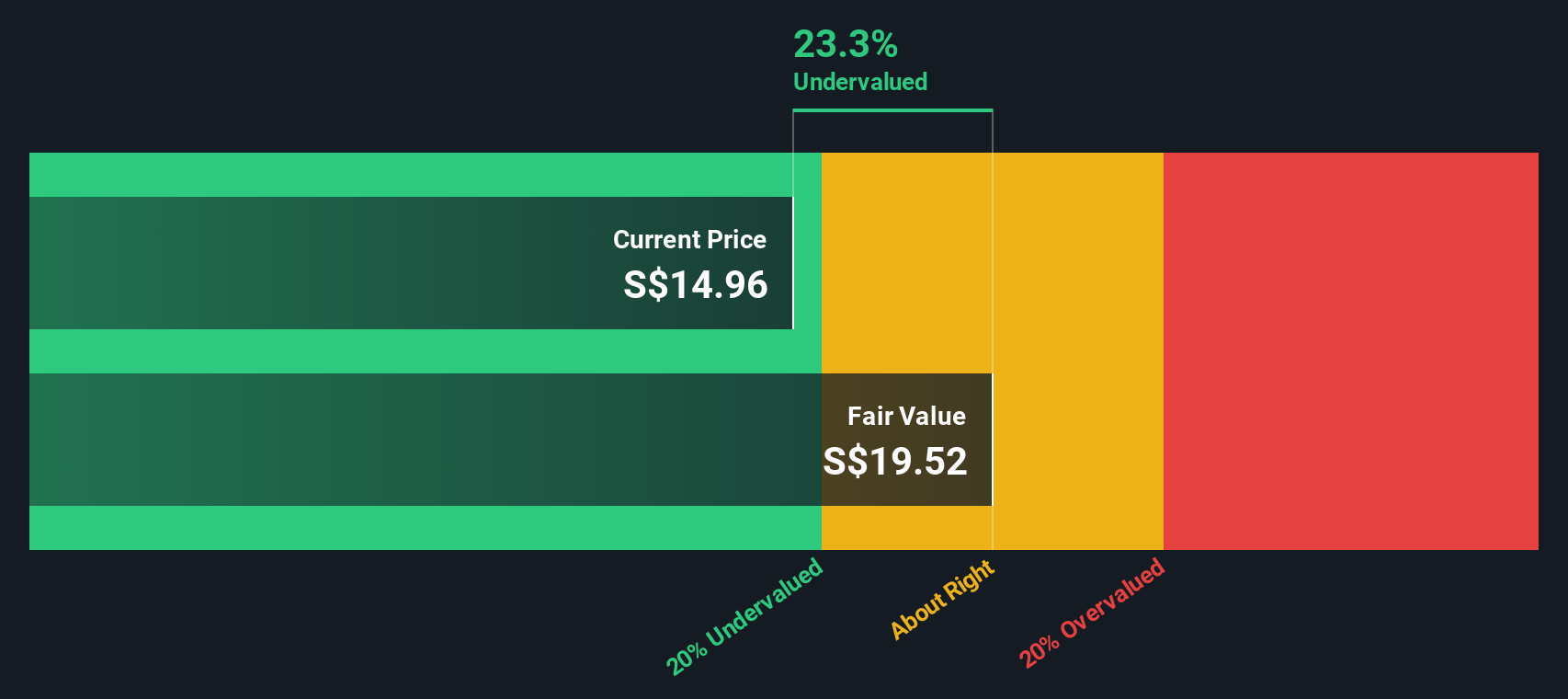

That is where valuation becomes key. For Great Eastern Holdings, we track six critical valuation checks, and the company scores 4 out of 6. This means it appears undervalued on most major metrics. But do those numbers tell the full story, or is there a smarter way to look at the share price?

Let us break down these valuation angles one by one before exploring a more nuanced approach at the end of this article that could give you the clearest view yet on whether Great Eastern is a deal or not.

Great Eastern Holdings delivered 0.0% returns over the last year. See how this stacks up to the rest of the Insurance industry.Approach 1: Great Eastern Holdings Excess Returns Analysis

The Excess Returns model assesses a company's ability to generate returns on equity that exceed its cost of equity. In simple terms, it measures how effectively Great Eastern Holdings puts investors' money to work above the minimum return they expect. This approach focuses on the company’s core profitability and efficiency, rather than just its reported profits.

For Great Eastern Holdings, the data is telling:

- Book Value: SGD9.75 per share

- Stable Earnings Per Share (EPS): SGD0.87 (based on the median return on equity from the past 5 years)

- Cost of Equity: SGD0.51 per share

- Excess Return: SGD0.36 per share

- Average Return on Equity: 9.81%

- Stable Book Value: SGD8.89 per share (based on historical median)

Based on this methodology, the intrinsic value from the Excess Returns model comes in significantly above the current share price. The stock is trading at a roughly 21.5% discount to its estimated intrinsic value, suggesting that the market may be underestimating Great Eastern’s efficiency in generating shareholder returns.

Result: UNDERVALUED

Head to the Valuation section of our Company Report for more details on how we arrive at this Fair Value for Great Eastern Holdings.

Approach 2: Great Eastern Holdings Price vs Earnings

The price-to-earnings (PE) ratio is often the go-to metric for valuing consistently profitable companies like Great Eastern Holdings. It helps investors understand what they are paying for each dollar of earnings, and is especially relevant when a company has stable or growing profits.

What makes a "fair" PE ratio depends on growth prospects and perceived risks. Higher expected growth and lower risks usually justify a higher PE, while slower growth or greater uncertainties call for a lower PE multiple.

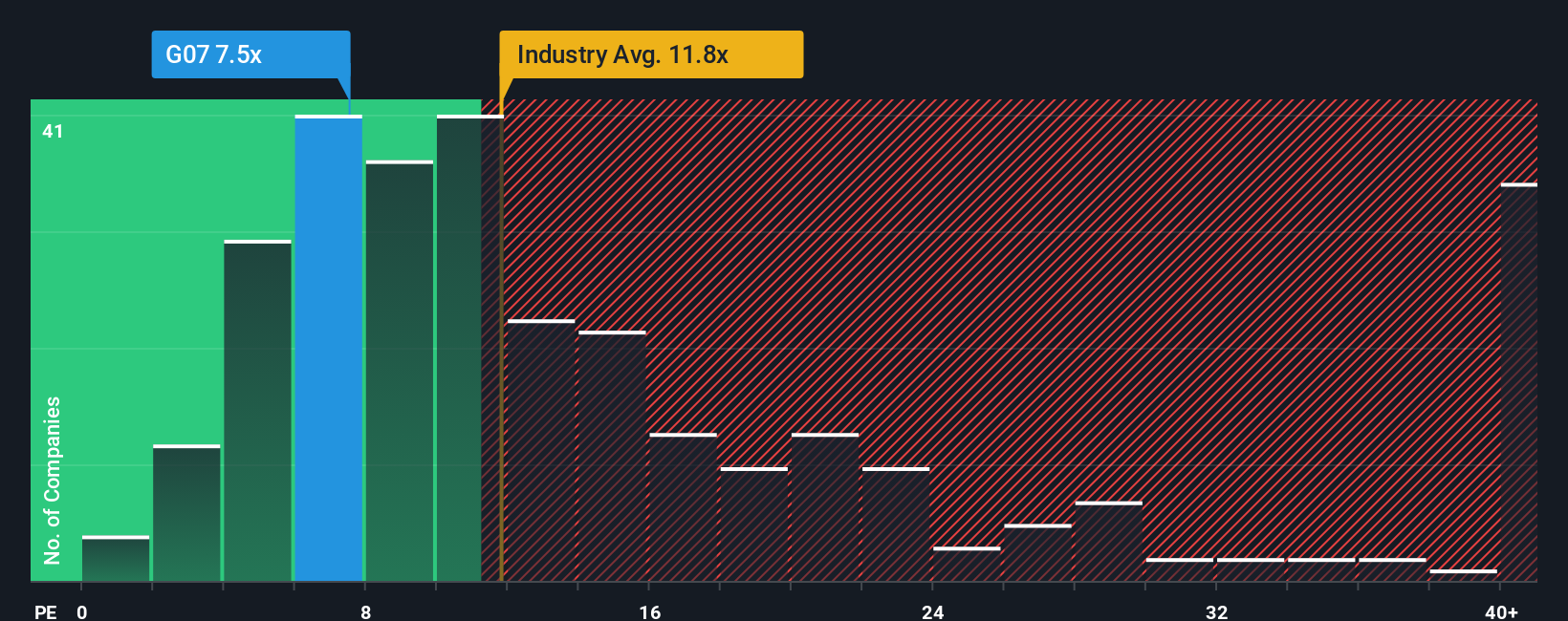

Currently, Great Eastern Holdings trades on a PE ratio of 7.7x. This compares favorably to the insurance industry average of 12.2x and is well below the average of listed peers at 26.7x. At first glance, this positions Great Eastern as one of the more affordable stocks in its sector based on earnings.

Simply Wall St’s proprietary “Fair Ratio” goes beyond simple peer or industry benchmarks. It estimates the most appropriate multiple for the company by factoring in its earnings growth outlook, risk profile, profit margins, industry dynamics, and size. This holistic lens avoids the pitfalls of surface-level comparisons by ensuring that all relevant business characteristics are reflected in the valuation.

Looking at the actual PE compared to this tailored Fair Ratio, Great Eastern Holdings’ valuation appears to be right in line with expectations. The difference between the two is less than 0.1x, suggesting the current market price fairly reflects the company’s earnings potential and risks.

Result: ABOUT RIGHT

Upgrade Your Decision Making: Choose your Great Eastern Holdings Narrative

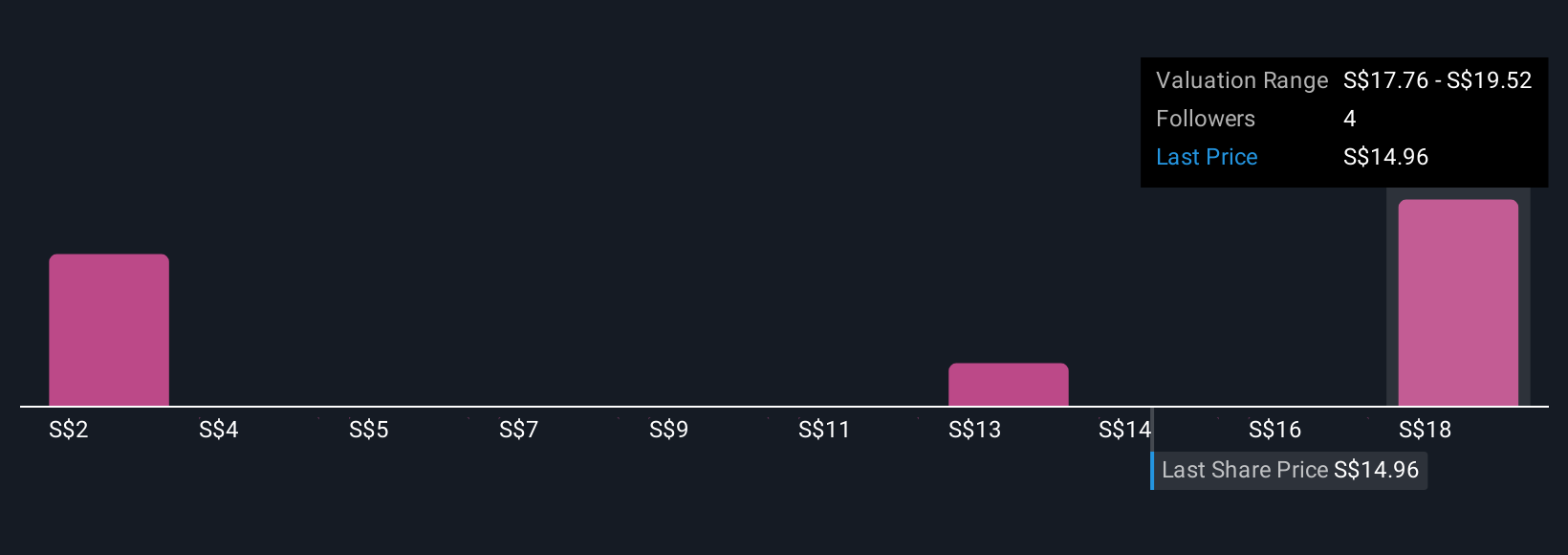

Earlier we mentioned that there is an even better way to understand valuation, so let us introduce you to Narratives. A Narrative is your personalized investment story, connecting what you believe about a company’s potential with the numbers. You use your own estimates for future revenue, earnings, margins, and ultimately a fair value. Narratives let you link Great Eastern Holdings’ story to a financial forecast, and from there to what you think is a reasonable price.

This approach is simple, intuitive, and available to everyone on Simply Wall St’s Community page, where millions of investors share and compare their Narratives. Narratives empower you to decide when to buy or sell by directly comparing your Fair Value to the current market price. They automatically update as news or earnings are released, ensuring your decisions are always based on the latest data.

For example, while one investor might set a higher fair value for Great Eastern Holdings by projecting stronger growth, another might take a much more conservative view based on potential risks. The Narrative tool lets you see and compare both perspectives. In today’s fast-moving market, Narratives offer a dynamic, user-friendly way to invest with confidence and clarity.

Do you think there's more to the story for Great Eastern Holdings? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:G07

Great Eastern Holdings

An investment holding company, provides insurance products in Singapore, Malaysia, and rest of Asia.

Good value average dividend payer.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Alphabet: The Under-appreciated Compounder Hiding in Plain Sight

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

The Quiet Giant That Became AI’s Power Grid

Popular Narratives

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.

MicroVision will explode future revenue by 380.37% with a vision towards success