- Singapore

- /

- Healthcare Services

- /

- SGX:QC7

SSI Group And 2 More Promising Penny Stocks

Reviewed by Simply Wall St

Global markets have recently experienced volatility, with U.S. stocks declining amid cautious commentary from the Federal Reserve and looming political uncertainties. In such a climate, investors often look for opportunities that offer both potential growth and affordability, which is where penny stocks come into play. Though the term may seem outdated, these smaller or newer companies can still provide value when they possess strong financial foundations and clear growth paths.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.51 | MYR2.49B | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.765 | A$140.36M | ★★★★☆☆ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.41 | MYR1.15B | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.89 | MYR298.75M | ★★★★★★ |

| ME Group International (LSE:MEGP) | £2.115 | £796.86M | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$4.14 | HK$45.59B | ★★★★★★ |

| LaserBond (ASX:LBL) | A$0.55 | A$64.47M | ★★★★★★ |

| Begbies Traynor Group (AIM:BEG) | £0.926 | £146.07M | ★★★★★★ |

| Lever Style (SEHK:1346) | HK$0.86 | HK$545.92M | ★★★★★★ |

| Secure Trust Bank (LSE:STB) | £3.52 | £67.13M | ★★★★☆☆ |

Click here to see the full list of 5,850 stocks from our Penny Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

SSI Group (PSE:SSI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: SSI Group, Inc., along with its subsidiaries, operates as a specialty retailer mainly in the Philippines and has a market capitalization of approximately ₱10.01 billion.

Operations: The company generates revenue primarily through its store operations, amounting to ₱29.02 billion.

Market Cap: ₱10.01B

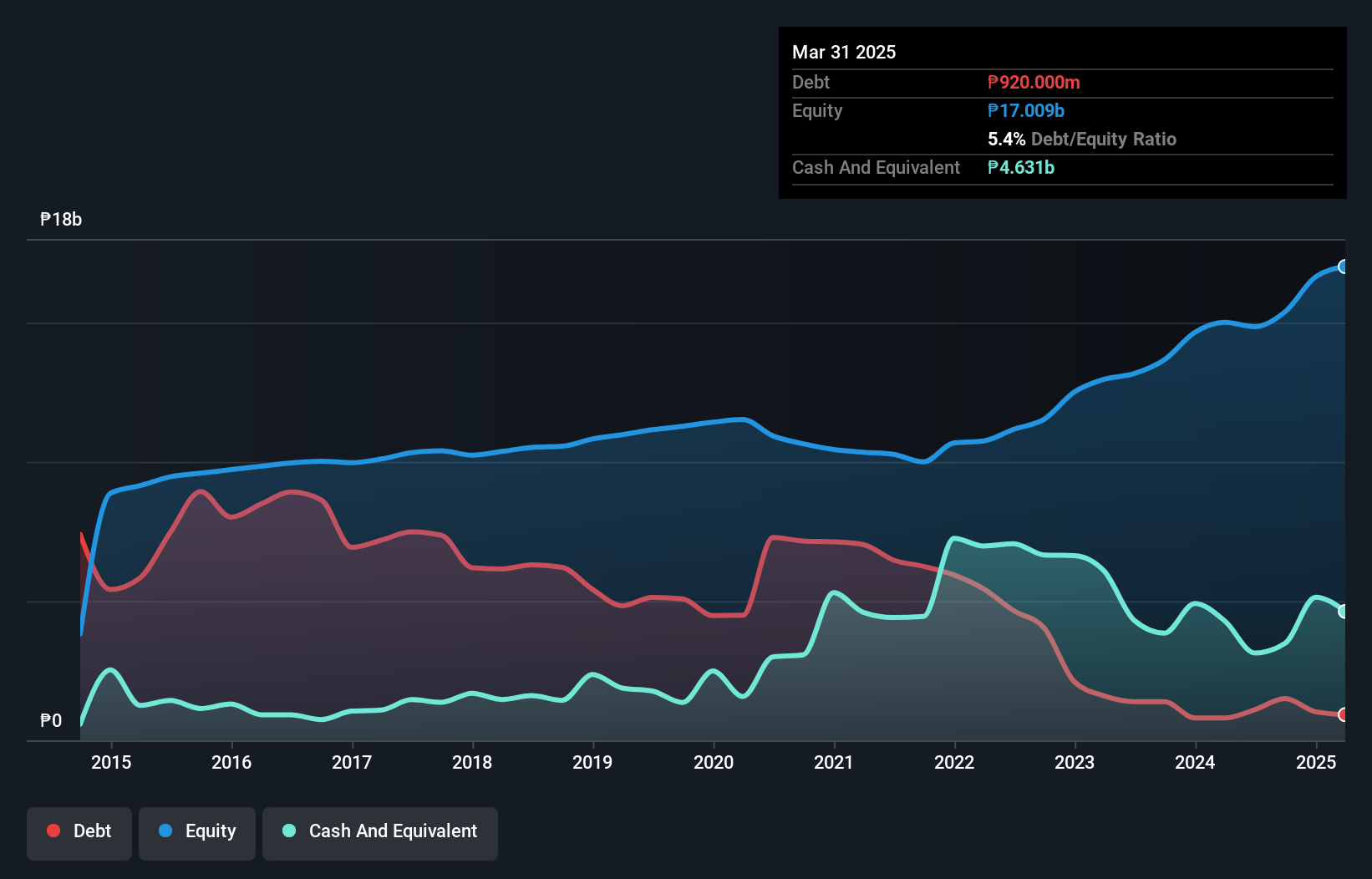

SSI Group, Inc. has shown a mixed financial performance recently, with third-quarter revenue rising to ₱6.97 billion from ₱6.54 billion a year ago, though net income for the nine months fell to ₱1.26 billion from ₱1.53 billion previously. The company benefits from experienced board leadership and reduced debt levels over five years, now having more cash than total debt and strong coverage of interest payments by EBIT at 16.3 times. Despite stable weekly volatility and high-quality earnings, SSI's profit margins have declined slightly, and its return on equity remains low at 15.1%.

- Dive into the specifics of SSI Group here with our thorough balance sheet health report.

- Gain insights into SSI Group's historical outcomes by reviewing our past performance report.

Oceanus Group (SGX:579)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Oceanus Group Limited is an investment holding company that sells processed marine products, sugar, beverages, and other commodities across Singapore, Hong Kong, Macau, Thailand, and the People’s Republic of China with a market cap of SGD153.99 million.

Operations: The company's revenue is primarily derived from its Distribution segment, which accounts for SGD343.36 million, followed by the Services segment at SGD5.56 million.

Market Cap: SGD153.99M

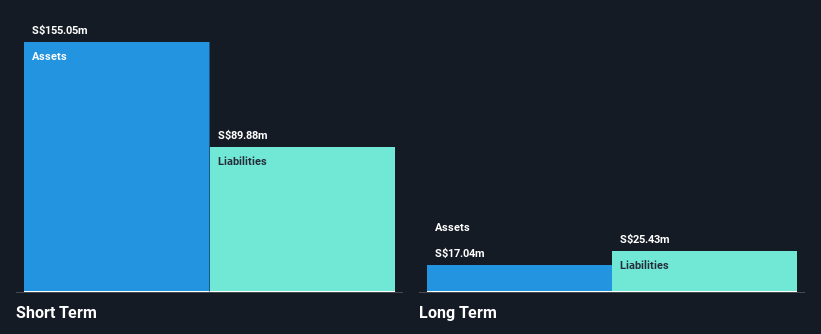

Oceanus Group Limited, with a market cap of SGD153.99 million, derives most of its revenue from the Distribution segment (SGD343.36 million). Despite having sufficient short-term assets to cover both short and long-term liabilities, the company remains unprofitable with a negative return on equity (-4.94%). Its debt levels are high, with a net debt to equity ratio of 133.2%. The management team is seasoned with an average tenure of 5.1 years, and while share price volatility remains high over the past three months, Oceanus is trading significantly below its estimated fair value by analysts' assessments.

- Click to explore a detailed breakdown of our findings in Oceanus Group's financial health report.

- Learn about Oceanus Group's historical performance here.

Q & M Dental Group (Singapore) (SGX:QC7)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Q & M Dental Group (Singapore) Limited is an investment holding company that offers private dental healthcare services in Singapore, Malaysia, China, and internationally, with a market cap of SGD260.95 million.

Operations: The company generates revenue primarily from its Primary Healthcare segment, amounting to SGD171.06 million.

Market Cap: SGD260.95M

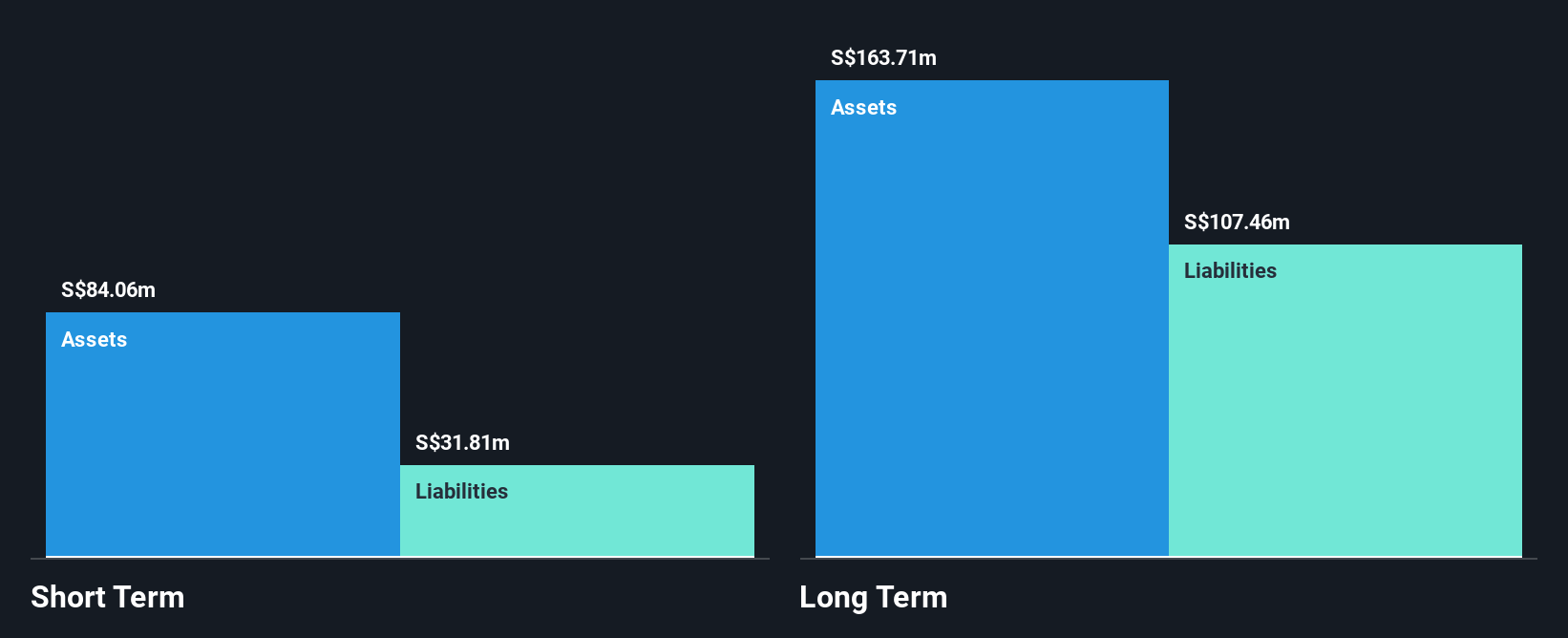

Q & M Dental Group (Singapore) Limited, with a market cap of SGD260.95 million, generates significant revenue from its Primary Healthcare segment (SGD171.06 million). The company maintains a stable financial position with short-term assets surpassing short-term liabilities but faces challenges covering long-term liabilities. Despite high debt levels, interest payments are well covered by EBIT. Recent board changes highlight a lack of experienced directors, though the management team is seasoned. While earnings have grown substantially in the past year and exceed industry averages, Q & M trades below estimated fair value with analysts predicting further price appreciation.

- Jump into the full analysis health report here for a deeper understanding of Q & M Dental Group (Singapore).

- Examine Q & M Dental Group (Singapore)'s earnings growth report to understand how analysts expect it to perform.

Next Steps

- Gain an insight into the universe of 5,850 Penny Stocks by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Q & M Dental Group (Singapore) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:QC7

Q & M Dental Group (Singapore)

An investment holding company, provides private dental healthcare services in Singapore, Malaysia, China, and internationally.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives