- Singapore

- /

- Healthcare Services

- /

- SGX:QC7

Can You Imagine How Q & M Dental Group (Singapore)'s (SGX:QC7) Shareholders Feel About The 28% Share Price Increase?

Passive investing in index funds can generate returns that roughly match the overall market. But if you pick the right individual stocks, you could make more than that. For example, the Q & M Dental Group (Singapore) Limited (SGX:QC7) share price is up 28% in the last year, clearly besting the market decline of around 11% (not including dividends). So that should have shareholders smiling. On the other hand, longer term shareholders have had a tougher run, with the stock falling 6.3% in three years.

See our latest analysis for Q & M Dental Group (Singapore)

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

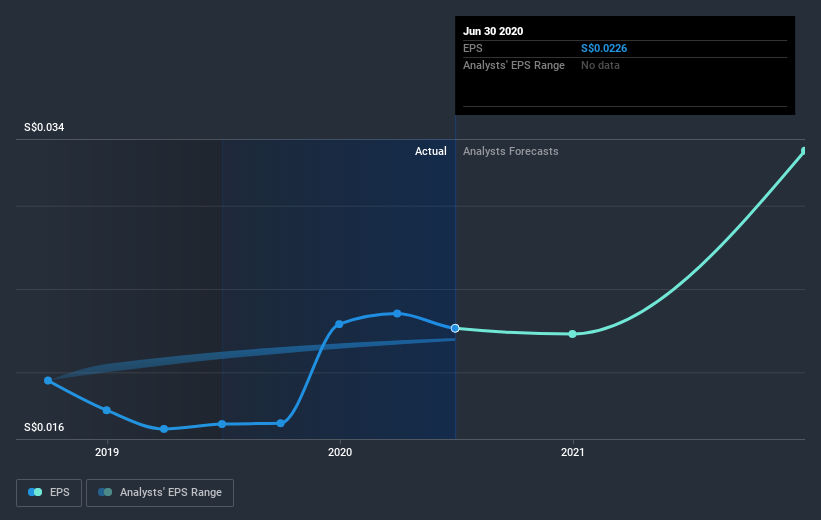

During the last year Q & M Dental Group (Singapore) grew its earnings per share (EPS) by 34%. It's fair to say that the share price gain of 28% did not keep pace with the EPS growth. So it seems like the market has cooled on Q & M Dental Group (Singapore), despite the growth. Interesting.

The graphic below depicts how EPS has changed over time (unveil the exact values by clicking on the image).

We know that Q & M Dental Group (Singapore) has improved its bottom line lately, but is it going to grow revenue? You could check out this free report showing analyst revenue forecasts.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. In the case of Q & M Dental Group (Singapore), it has a TSR of 35% for the last year. That exceeds its share price return that we previously mentioned. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

It's good to see that Q & M Dental Group (Singapore) has rewarded shareholders with a total shareholder return of 35% in the last twelve months. Of course, that includes the dividend. There's no doubt those recent returns are much better than the TSR loss of 1.2% per year over five years. This makes us a little wary, but the business might have turned around its fortunes. It's always interesting to track share price performance over the longer term. But to understand Q & M Dental Group (Singapore) better, we need to consider many other factors. For example, we've discovered 4 warning signs for Q & M Dental Group (Singapore) (1 is concerning!) that you should be aware of before investing here.

Of course Q & M Dental Group (Singapore) may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SG exchanges.

If you decide to trade Q & M Dental Group (Singapore), use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Q & M Dental Group (Singapore) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SGX:QC7

Q & M Dental Group (Singapore)

An investment holding company, provides private dental healthcare services in Singapore, Malaysia, China, and internationally.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives