- Singapore

- /

- Healthcare Services

- /

- SGX:A50

We Think Thomson Medical Group (SGX:A50) Can Stay On Top Of Its Debt

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. We note that Thomson Medical Group Limited (SGX:A50) does have debt on its balance sheet. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more common (but still painful) scenario is that it has to raise new equity capital at a low price, thus permanently diluting shareholders. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

Check out our latest analysis for Thomson Medical Group

What Is Thomson Medical Group's Net Debt?

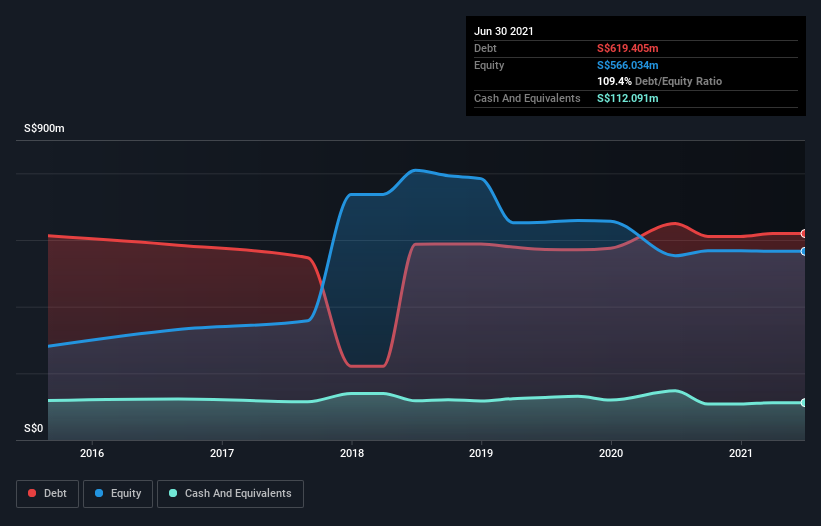

As you can see below, Thomson Medical Group had S$619.4m of debt at June 2021, down from S$649.3m a year prior. However, because it has a cash reserve of S$112.1m, its net debt is less, at about S$507.3m.

A Look At Thomson Medical Group's Liabilities

According to the last reported balance sheet, Thomson Medical Group had liabilities of S$83.3m due within 12 months, and liabilities of S$636.4m due beyond 12 months. On the other hand, it had cash of S$112.1m and S$26.9m worth of receivables due within a year. So it has liabilities totalling S$580.8m more than its cash and near-term receivables, combined.

Thomson Medical Group has a market capitalization of S$2.35b, so it could very likely raise cash to ameliorate its balance sheet, if the need arose. However, it is still worthwhile taking a close look at its ability to pay off debt.

We measure a company's debt load relative to its earnings power by looking at its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and by calculating how easily its earnings before interest and tax (EBIT) cover its interest expense (interest cover). The advantage of this approach is that we take into account both the absolute quantum of debt (with net debt to EBITDA) and the actual interest expenses associated with that debt (with its interest cover ratio).

Thomson Medical Group shareholders face the double whammy of a high net debt to EBITDA ratio (7.6), and fairly weak interest coverage, since EBIT is just 2.2 times the interest expense. The debt burden here is substantial. Looking on the bright side, Thomson Medical Group boosted its EBIT by a silky 67% in the last year. Like a mother's loving embrace of a newborn that sort of growth builds resilience, putting the company in a stronger position to manage its debt. The balance sheet is clearly the area to focus on when you are analysing debt. But you can't view debt in total isolation; since Thomson Medical Group will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

But our final consideration is also important, because a company cannot pay debt with paper profits; it needs cold hard cash. So we always check how much of that EBIT is translated into free cash flow. Looking at the most recent three years, Thomson Medical Group recorded free cash flow of 34% of its EBIT, which is weaker than we'd expect. That weak cash conversion makes it more difficult to handle indebtedness.

Our View

We weren't impressed with Thomson Medical Group's interest cover, and its net debt to EBITDA made us cautious. But like a ballerina ending on a perfect pirouette, it has not trouble growing its EBIT. It's also worth noting that Thomson Medical Group is in the Healthcare industry, which is often considered to be quite defensive. When we consider all the factors mentioned above, we do feel a bit cautious about Thomson Medical Group's use of debt. While we appreciate debt can enhance returns on equity, we'd suggest that shareholders keep close watch on its debt levels, lest they increase. When analysing debt levels, the balance sheet is the obvious place to start. But ultimately, every company can contain risks that exist outside of the balance sheet. Be aware that Thomson Medical Group is showing 1 warning sign in our investment analysis , you should know about...

When all is said and done, sometimes its easier to focus on companies that don't even need debt. Readers can access a list of growth stocks with zero net debt 100% free, right now.

Valuation is complex, but we're here to simplify it.

Discover if Thomson Medical Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SGX:A50

Thomson Medical Group

An investment holding company, provides healthcare services for women and children in Singapore and Malaysia.

Reasonable growth potential and fair value.

Similar Companies

Market Insights

Community Narratives