- Singapore

- /

- Healthcare Services

- /

- SGX:A50

Reflecting on Thomson Medical Group's (SGX:A50) Share Price Returns Over The Last Year

Passive investing in an index fund is a good way to ensure your own returns roughly match the overall market. Active investors aim to buy stocks that vastly outperform the market - but in the process, they risk under-performance. That downside risk was realized by Thomson Medical Group Limited (SGX:A50) shareholders over the last year, as the share price declined 18%. That contrasts poorly with the market decline of 10%. Because Thomson Medical Group hasn't been listed for many years, the market is still learning about how the business performs. It's down 2.0% in the last seven days.

View our latest analysis for Thomson Medical Group

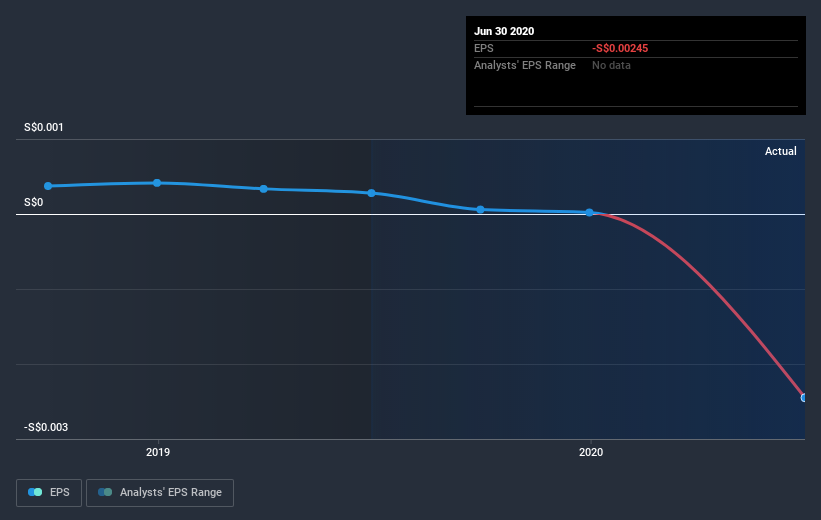

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

Thomson Medical Group fell to a loss making position during the year. Buyers no doubt think it's a temporary situation, but those with a nose for quality have low tolerance for losses. Of course, if the company can turn the situation around, investors will likely profit.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

We consider it positive that insiders have made significant purchases in the last year. Even so, future earnings will be far more important to whether current shareholders make money. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

A Different Perspective

Thomson Medical Group shareholders are down 18% for the year, even worse than the market loss of 10%. That's disappointing, but it's worth keeping in mind that the market-wide selling wouldn't have helped. With the stock flat over the last three months, the market now seems fairly ambivalent about the business. Basically, most investors should be wary of buying into a poor-performing stock, unless the business itself has clearly improved. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 2 warning signs for Thomson Medical Group that you should be aware of.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SG exchanges.

If you decide to trade Thomson Medical Group, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Thomson Medical Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SGX:A50

Thomson Medical Group

An investment holding company, provides healthcare services for women and children in Singapore, Malaysia, and Vietnam.

Moderate growth potential and slightly overvalued.

Similar Companies

Market Insights

Community Narratives