Fraser and Neave (SGX:F99) Has Re-Affirmed Its Dividend Of S$0.035

Fraser and Neave, Limited's (SGX:F99) investors are due to receive a payment of S$0.035 per share on 14th of February. This payment means that the dividend yield will be 3.4%, which is around the industry average.

See our latest analysis for Fraser and Neave

Fraser and Neave's Earnings Easily Cover the Distributions

Unless the payments are sustainable, the dividend yield doesn't mean too much. Based on the last payment, Fraser and Neave was quite comfortably earning enough to cover the dividend. This means that a large portion of its earnings are being retained to grow the business.

If the trend of the last few years continues, EPS will grow by 5.3% over the next 12 months. If the dividend continues on this path, the payout ratio could be 50% by next year, which we think can be pretty sustainable going forward.

Dividend Volatility

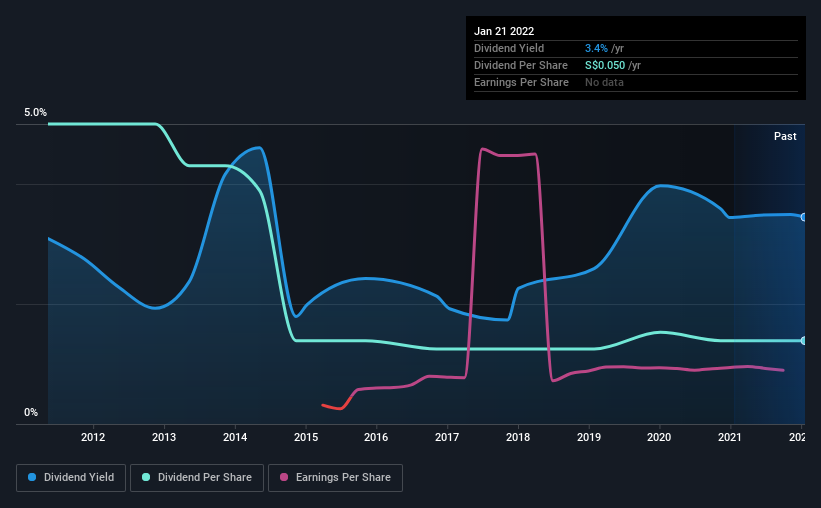

The company's dividend history has been marked by instability, with at least 1 cut in the last 10 years. Since 2012, the first annual payment was S$0.18, compared to the most recent full-year payment of S$0.05. The dividend has fallen 72% over that period. Generally, we don't like to see a dividend that has been declining over time as this can degrade shareholders' returns and indicate that the company may be running into problems.

The Dividend Has Growth Potential

Given that dividend payments have been shrinking like a glacier in a warming world, we need to check if there are some bright spots on the horizon. Fraser and Neave has impressed us by growing EPS at 5.3% per year over the past five years. Since earnings per share is growing at an acceptable rate, and the payout policy is balanced, we think the company is positioning itself well to grow earnings and dividends in the future.

Our Thoughts On Fraser and Neave's Dividend

Overall, a consistent dividend is a good thing, and we think that Fraser and Neave has the ability to continue this into the future. While the payout ratios are a good sign, we are less enthusiastic about the company's dividend record. The payment isn't stellar, but it could make a decent addition to a dividend portfolio.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. However, there are other things to consider for investors when analysing stock performance. For example, we've identified 2 warning signs for Fraser and Neave (1 is significant!) that you should be aware of before investing. We have also put together a list of global stocks with a solid dividend.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SGX:F99

Fraser and Neave

Engages in the food and beverage, and publishing and printing businesses in Singapore, Malaysia, Thailand, Vietnam, and internationally.

Excellent balance sheet average dividend payer.

Market Insights

Community Narratives

Recently Updated Narratives

Engineered for Stability. Positioned for Growth.

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026