Investors Still Aren't Entirely Convinced By Kencana Agri Limited's (SGX:BNE) Revenues Despite 31% Price Jump

Kencana Agri Limited (SGX:BNE) shares have had a really impressive month, gaining 31% after a shaky period beforehand. Looking back a bit further, it's encouraging to see the stock is up 27% in the last year.

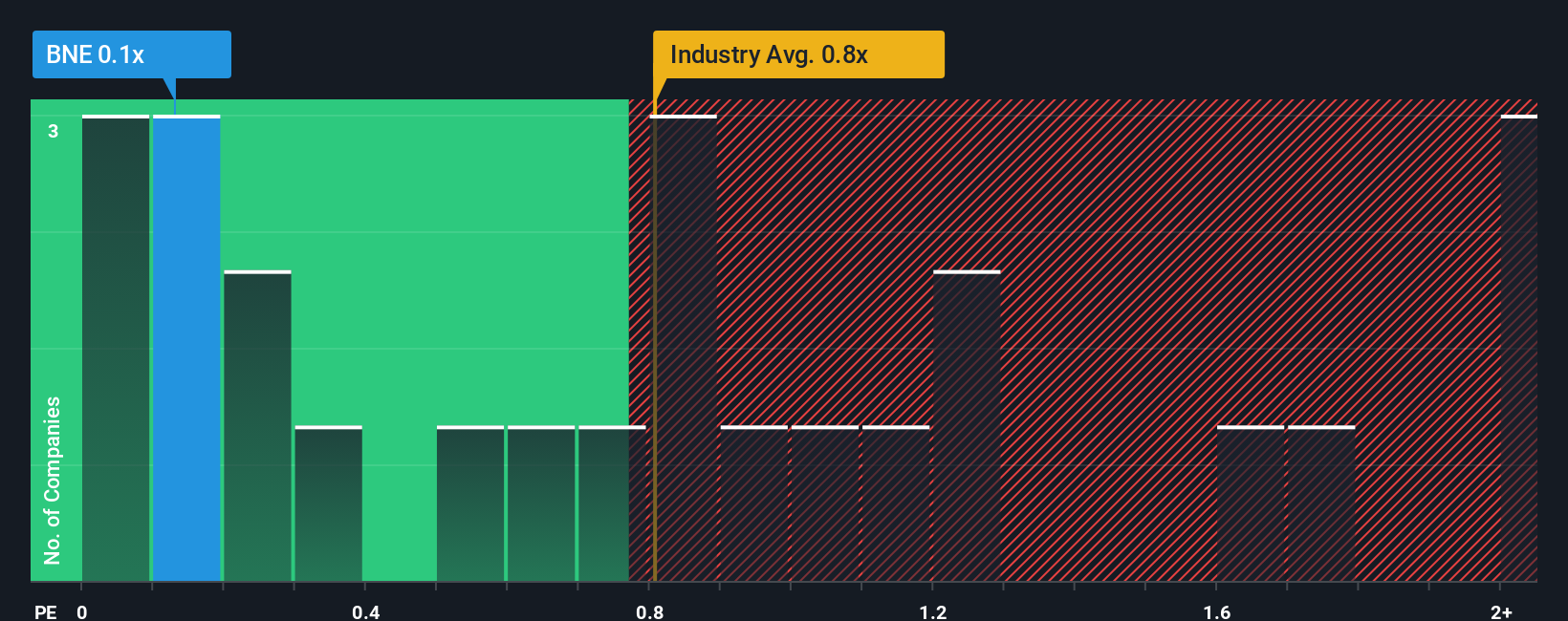

Although its price has surged higher, it would still be understandable if you think Kencana Agri is a stock with good investment prospects with a price-to-sales ratios (or "P/S") of 0.1x, considering almost half the companies in Singapore's Food industry have P/S ratios above 0.8x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's limited.

View our latest analysis for Kencana Agri

What Does Kencana Agri's Recent Performance Look Like?

The revenue growth achieved at Kencana Agri over the last year would be more than acceptable for most companies. Perhaps the market is expecting this acceptable revenue performance to take a dive, which has kept the P/S suppressed. If that doesn't eventuate, then existing shareholders have reason to be optimistic about the future direction of the share price.

Want the full picture on earnings, revenue and cash flow for the company? Then our free report on Kencana Agri will help you shine a light on its historical performance.How Is Kencana Agri's Revenue Growth Trending?

Kencana Agri's P/S ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the industry.

If we review the last year of revenue growth, the company posted a worthy increase of 13%. The latest three year period has also seen a 20% overall rise in revenue, aided somewhat by its short-term performance. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Comparing that to the industry, which is predicted to deliver 7.9% growth in the next 12 months, the company's momentum is pretty similar based on recent medium-term annualised revenue results.

With this information, we find it odd that Kencana Agri is trading at a P/S lower than the industry. It may be that most investors are not convinced the company can maintain recent growth rates.

The Key Takeaway

The latest share price surge wasn't enough to lift Kencana Agri's P/S close to the industry median. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

The fact that Kencana Agri currently trades at a low P/S relative to the industry is unexpected considering its recent three-year growth is in line with the wider industry forecast. When we see industry-like revenue growth but a lower than expected P/S, we assume potential risks are what might be placing downward pressure on the share price. revenue trends suggest that the risk of a price decline is low, investors appear to perceive a possibility of revenue volatility in the future.

Don't forget that there may be other risks. For instance, we've identified 3 warning signs for Kencana Agri (2 are potentially serious) you should be aware of.

If companies with solid past earnings growth is up your alley, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

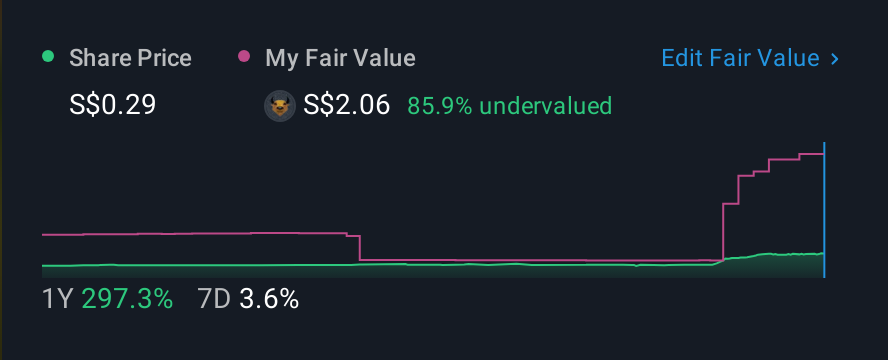

Valuation is complex, but we're here to simplify it.

Discover if Kencana Agri might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SGX:BNE

Kencana Agri

Operates as a plantation company in Indonesia, Malaysia, and internationally.

Good value with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives