Those Who Purchased Global Palm Resources Holdings (SGX:BLW) Shares Five Years Ago Have A 58% Loss To Show For It

Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

We think intelligent long term investing is the way to go. But along the way some stocks are going to perform badly. For example the Global Palm Resources Holdings Limited (SGX:BLW) share price dropped 58% over five years. We certainly feel for shareholders who bought near the top. Unhappily, the share price slid 9.5% in the last week.

Check out our latest analysis for Global Palm Resources Holdings

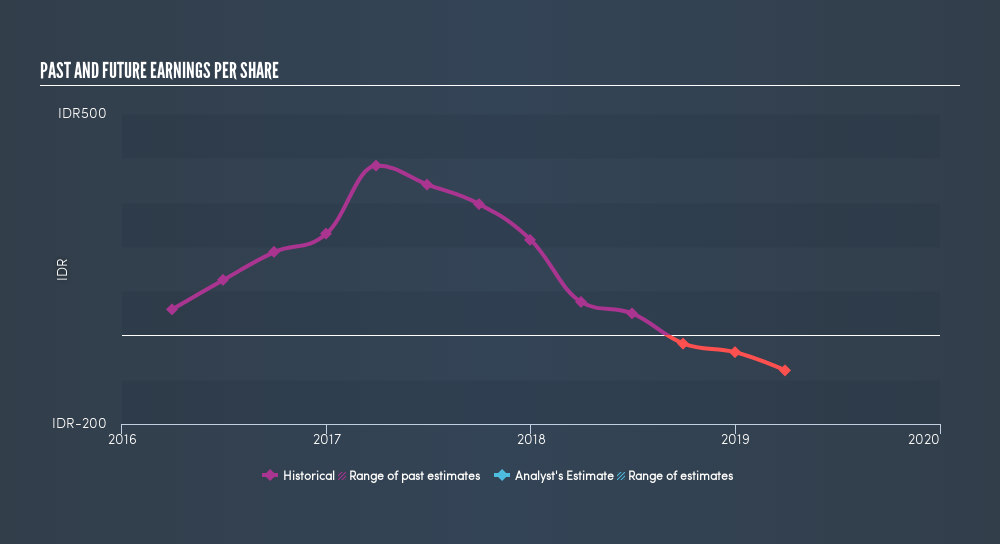

In his essay The Superinvestors of Graham-and-Doddsville Warren Buffett described how share prices do not always rationally reflect the value of a business. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

In the last half decade Global Palm Resources Holdings saw its share price fall as its EPS declined below zero. Since the company has fallen to a loss making position, it's hard to compare the change in EPS with the share price change. However, we can say we'd expect to see a falling share price in this scenario.

It might be well worthwhile taking a look at our free report on Global Palm Resources Holdings's earnings, revenue and cash flow.

A Dividend Lost

The value of past dividends are accounted for in the total shareholder return (TSR), but not in the share price return mentioned above. By accounting for the value of dividends paid, the TSR can be seen as a more complete measure of the value a company brings to its shareholders. Over the last 5 years, Global Palm Resources Holdings generated a TSR of -50%, which is, of course, better than the share price return. Even though the company isn't paying dividends at the moment, it has done in the past.

A Different Perspective

While the broader market gained around 6.1% in the last year, Global Palm Resources Holdings shareholders lost 5.0%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, longer term shareholders are suffering worse, given the loss of 13% doled out over the last five years. We'd need to see some sustained improvements in the key metrics before we could muster much enthusiasm. Shareholders might want to examine this detailed historical graph of past earnings, revenue and cash flow.

If you would prefer to check out another company -- one with potentially superior financials -- then do not miss this free list of companies that have proven they can grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SG exchanges.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About SGX:BLW

Global Palm Resources Holdings

Global Palm Resources Holdings Limited, an investment holding company, operates as an oil palm producer in Indonesia.

Flawless balance sheet and slightly overvalued.

Similar Companies

Market Insights

Community Narratives