Here's Why Indofood Agri Resources (SGX:5JS) Can Manage Its Debt Responsibly

Warren Buffett famously said, 'Volatility is far from synonymous with risk.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that Indofood Agri Resources Ltd. (SGX:5JS) does use debt in its business. But is this debt a concern to shareholders?

What Risk Does Debt Bring?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we think about a company's use of debt, we first look at cash and debt together.

Check out our latest analysis for Indofood Agri Resources

What Is Indofood Agri Resources's Debt?

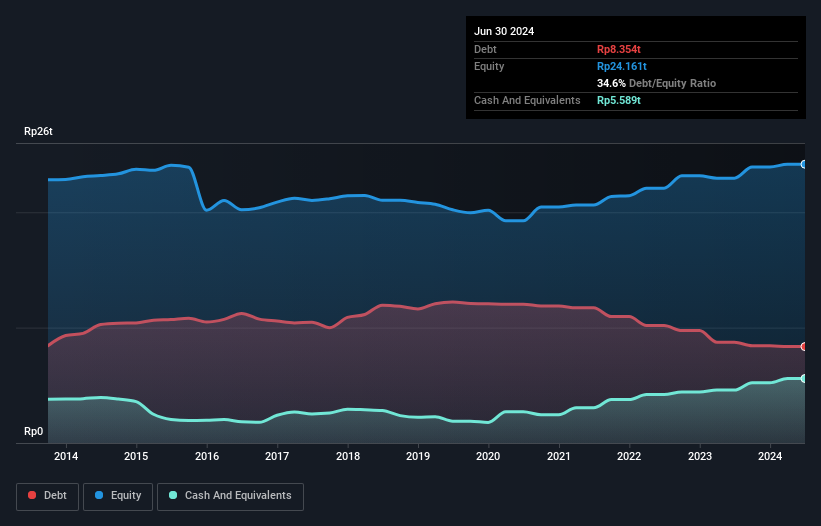

The image below, which you can click on for greater detail, shows that Indofood Agri Resources had debt of Rp8.35t at the end of June 2024, a reduction from Rp8.73t over a year. However, it does have Rp5.59t in cash offsetting this, leading to net debt of about Rp2.77t.

A Look At Indofood Agri Resources' Liabilities

Zooming in on the latest balance sheet data, we can see that Indofood Agri Resources had liabilities of Rp10t due within 12 months and liabilities of Rp3.31t due beyond that. On the other hand, it had cash of Rp5.59t and Rp911.6b worth of receivables due within a year. So it has liabilities totalling Rp7.01t more than its cash and near-term receivables, combined.

Given this deficit is actually higher than the company's market capitalization of Rp5.46t, we think shareholders really should watch Indofood Agri Resources's debt levels, like a parent watching their child ride a bike for the first time. Hypothetically, extremely heavy dilution would be required if the company were forced to pay down its liabilities by raising capital at the current share price.

In order to size up a company's debt relative to its earnings, we calculate its net debt divided by its earnings before interest, tax, depreciation, and amortization (EBITDA) and its earnings before interest and tax (EBIT) divided by its interest expense (its interest cover). Thus we consider debt relative to earnings both with and without depreciation and amortization expenses.

With net debt sitting at just 0.71 times EBITDA, Indofood Agri Resources is arguably pretty conservatively geared. And this view is supported by the solid interest coverage, with EBIT coming in at 7.3 times the interest expense over the last year. And we also note warmly that Indofood Agri Resources grew its EBIT by 16% last year, making its debt load easier to handle. The balance sheet is clearly the area to focus on when you are analysing debt. But it is Indofood Agri Resources's earnings that will influence how the balance sheet holds up in the future. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, a business needs free cash flow to pay off debt; accounting profits just don't cut it. So we clearly need to look at whether that EBIT is leading to corresponding free cash flow. Over the last three years, Indofood Agri Resources recorded free cash flow worth a fulsome 81% of its EBIT, which is stronger than we'd usually expect. That positions it well to pay down debt if desirable to do so.

Our View

On our analysis Indofood Agri Resources's conversion of EBIT to free cash flow should signal that it won't have too much trouble with its debt. But the other factors we noted above weren't so encouraging. To be specific, it seems about as good at staying on top of its total liabilities as wet socks are at keeping your feet warm. When we consider all the factors mentioned above, we do feel a bit cautious about Indofood Agri Resources's use of debt. While debt does have its upside in higher potential returns, we think shareholders should definitely consider how debt levels might make the stock more risky. Above most other metrics, we think its important to track how fast earnings per share is growing, if at all. If you've also come to that realization, you're in luck, because today you can view this interactive graph of Indofood Agri Resources's earnings per share history for free.

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SGX:5JS

Indofood Agri Resources

Operates as a vertically integrated agribusiness company in Singapore, Indonesia, China, Nigeria, Timor Leste, and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026