- Singapore

- /

- Oil and Gas

- /

- SGX:Y35

The AnAn International (SGX:Y35) Share Price Has Soared 900%, Delighting Many Shareholders

While stock picking isn't easy, for those willing to persist and learn, it is possible to buy shares in great companies, and generate wonderful returns. When you buy and hold the right company, the returns can make a huge difference to both you and your family. In the case of AnAn International Limited (SGX:Y35), the share price is up an incredible 900% in the last year alone. In the last week the share price is up 3.4%. On the other hand, longer term shareholders have had a tougher run, with the stock falling 69% in three years.

Anyone who held for that rewarding ride would probably be keen to talk about it.

See our latest analysis for AnAn International

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

AnAn International went from making a loss to reporting a profit, in the last year.

When a company is just on the edge of profitability it can be well worth considering other metrics in order to more precisely gauge growth (and therefore understand share price movements).

Unfortunately AnAn International's fell 21% over twelve months. So the fundamental metrics don't provide an obvious explanation for the share price gain.

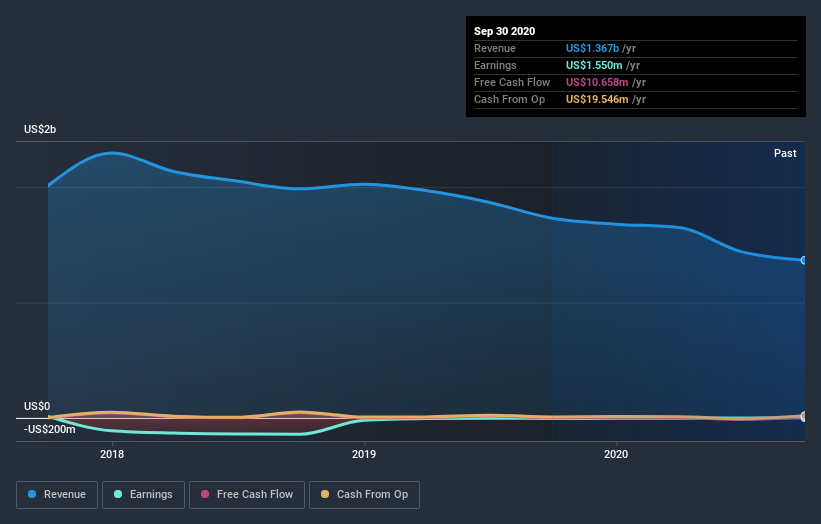

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

This free interactive report on AnAn International's balance sheet strength is a great place to start, if you want to investigate the stock further.

A Different Perspective

We're pleased to report that AnAn International shareholders have received a total shareholder return of 900% over one year. Notably the five-year annualised TSR loss of 14% per year compares very unfavourably with the recent share price performance. The long term loss makes us cautious, but the short term TSR gain certainly hints at a brighter future. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider risks, for instance. Every company has them, and we've spotted 2 warning signs for AnAn International you should know about.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on SG exchanges.

If you’re looking to trade AnAn International, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About SGX:Y35

AnAn International

An investment holding company, trades in petrochemical, fuel oil, and petroleum products in Europe, Singapore, Hong Kong, and the People’s Republic of China.

Good value with adequate balance sheet.

Market Insights

Community Narratives