- Singapore

- /

- Oil and Gas

- /

- SGX:T13

Discovering Ever Sunshine Services Group And 2 Other Promising Asian Penny Stocks

Reviewed by Simply Wall St

Amid escalating geopolitical tensions and fluctuating trade dynamics, Asian markets are navigating a complex landscape that demands careful attention from investors. For those interested in exploring smaller or newer companies, penny stocks—though an older term—remain a relevant investment area offering potential value. By focusing on those with solid financial foundations, investors can uncover opportunities among these stocks that may offer both stability and growth potential.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| YKGI (Catalist:YK9) | SGD0.104 | SGD44.2M | ✅ 2 ⚠️ 3 View Analysis > |

| JBM (Healthcare) (SEHK:2161) | HK$2.74 | HK$2.23B | ✅ 3 ⚠️ 0 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.19 | HK$750.83M | ✅ 4 ⚠️ 2 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD0.455 | SGD184.41M | ✅ 3 ⚠️ 2 View Analysis > |

| Goodbaby International Holdings (SEHK:1086) | HK$1.18 | HK$1.97B | ✅ 4 ⚠️ 2 View Analysis > |

| Halcyon Technology (SET:HTECH) | THB2.60 | THB780M | ✅ 2 ⚠️ 3 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD2.25 | SGD8.86B | ✅ 5 ⚠️ 0 View Analysis > |

| Beng Kuang Marine (SGX:BEZ) | SGD0.181 | SGD36.06M | ✅ 4 ⚠️ 3 View Analysis > |

| BRC Asia (SGX:BEC) | SGD3.13 | SGD858.72M | ✅ 3 ⚠️ 1 View Analysis > |

| Bosideng International Holdings (SEHK:3998) | HK$4.61 | HK$52.81B | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 1,158 stocks from our Asian Penny Stocks screener.

Let's explore several standout options from the results in the screener.

Ever Sunshine Services Group (SEHK:1995)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Ever Sunshine Services Group Limited is an investment holding company that offers property management services in the People's Republic of China, with a market capitalization of approximately HK$3.51 billion.

Operations: The company's revenue is derived from its property management services segment, which generated CN¥6.84 billion.

Market Cap: HK$3.51B

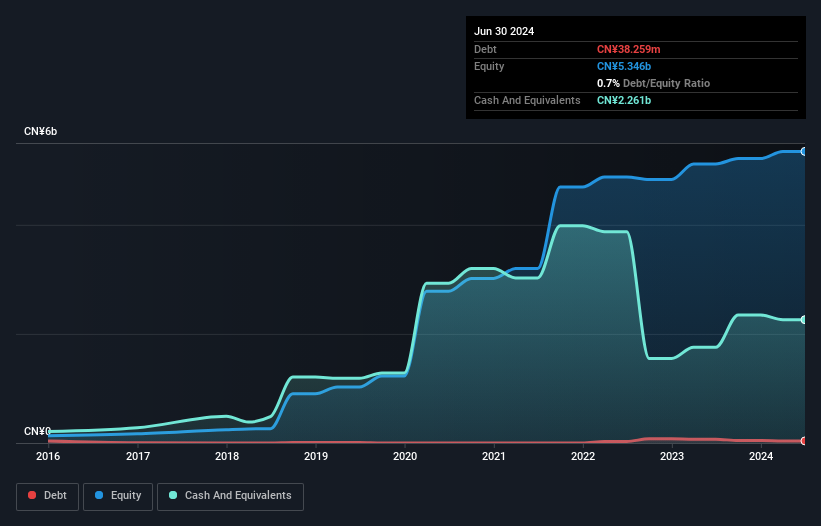

Ever Sunshine Services Group, with a market cap of HK$3.51 billion, reported revenue of CN¥6.84 billion and net income of CN¥478 million for 2024, showcasing a 10% earnings growth over the past year. The company's seasoned management and board have maintained high-quality earnings without significant shareholder dilution. Despite low return on equity at 11%, its financial stability is underscored by more cash than total debt and short-term assets exceeding liabilities. However, the dividend track record remains unstable following a recent decrease to HKD 0.0668 per share, highlighting potential areas for investor caution in this volatile sector.

- Navigate through the intricacies of Ever Sunshine Services Group with our comprehensive balance sheet health report here.

- Explore Ever Sunshine Services Group's analyst forecasts in our growth report.

Genor Biopharma Holdings (SEHK:6998)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Genor Biopharma Holdings Limited is a biopharmaceutical company that develops and commercializes oncology and autoimmune drugs in China and internationally, with a market cap of HK$1.53 billion.

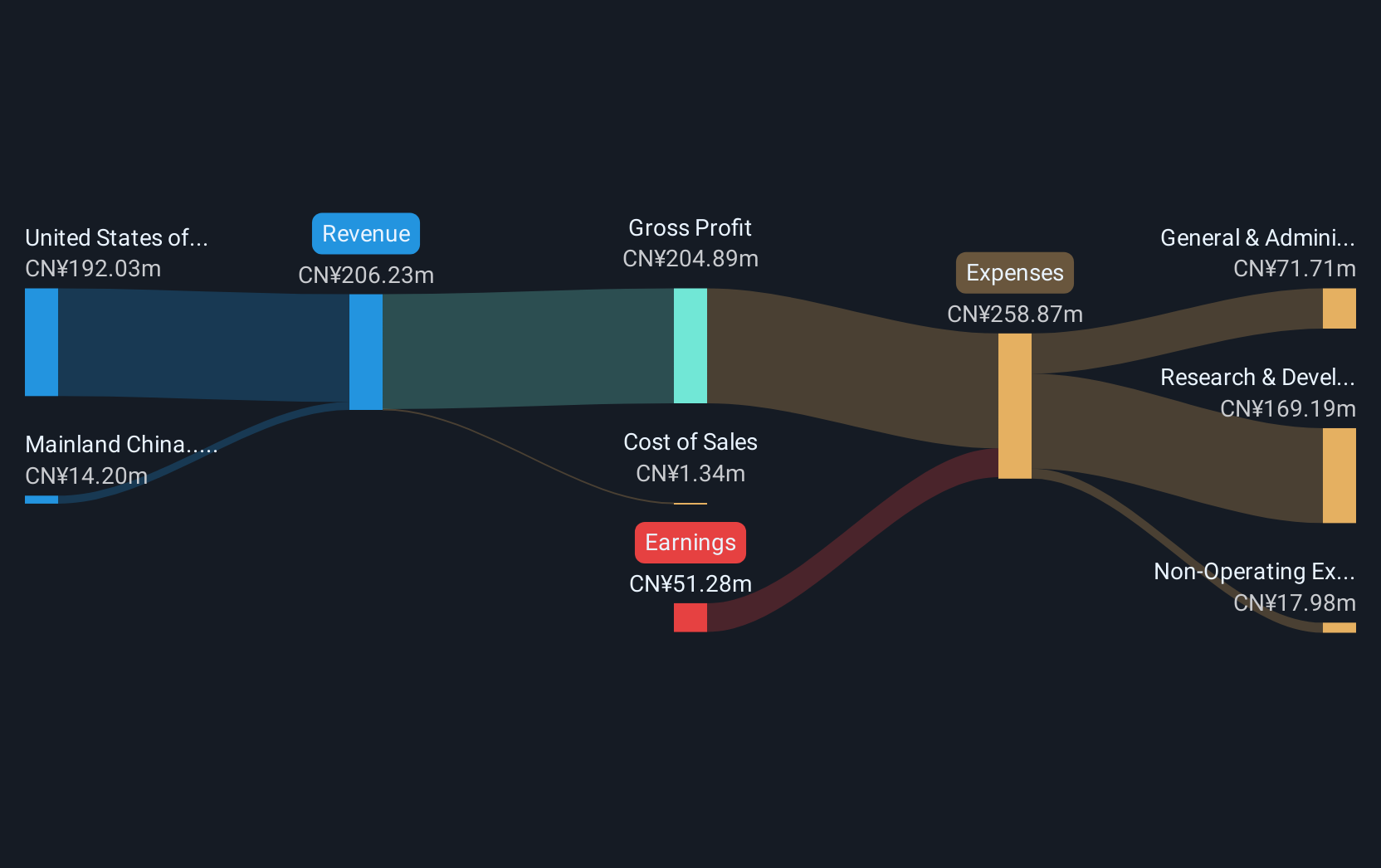

Operations: Genor Biopharma Holdings generates revenue primarily from its pharmaceuticals segment, amounting to CN¥206.23 million.

Market Cap: HK$1.53B

Genor Biopharma Holdings, with a market cap of HK$1.53 billion, is navigating the challenging biotech landscape by reducing losses over five years at 31.8% annually while remaining unprofitable. The recent approval of Lerociclib by China's NMPA marks a significant milestone, potentially enhancing its revenue stream in the oncology sector. Despite negative return on equity and no debt burden, Genor maintains financial resilience with short-term assets of CN¥1.1 billion covering liabilities and sufficient cash runway for over three years. Its seasoned management team further strengthens its strategic execution capabilities amid sector volatility.

- Take a closer look at Genor Biopharma Holdings' potential here in our financial health report.

- Explore historical data to track Genor Biopharma Holdings' performance over time in our past results report.

RH PetroGas (SGX:T13)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: RH PetroGas Limited is an investment holding company involved in the exploration, development, and production of oil and gas resources in Indonesia, with a market cap of SGD160.35 million.

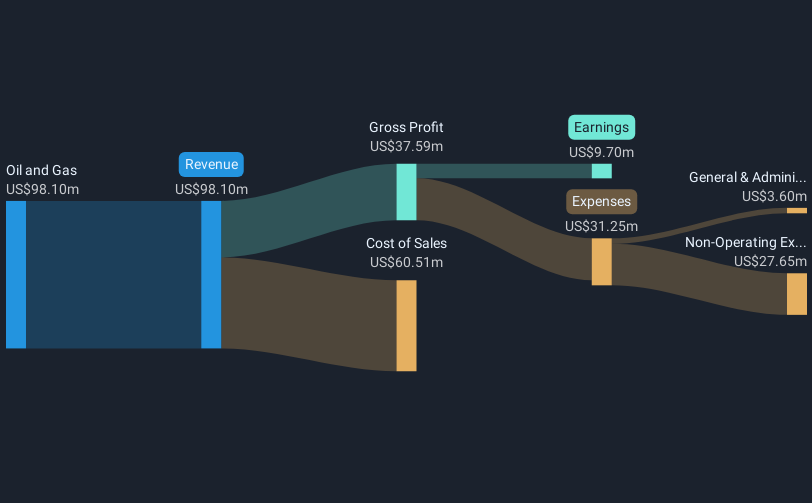

Operations: The company's revenue is primarily derived from its oil and gas operations, amounting to $89.28 million.

Market Cap: SGD160.35M

RH PetroGas Limited, with a market cap of SGD160.35 million, is trading significantly below its estimated fair value and has shown impressive earnings growth of 353.1% over the past year, outpacing industry averages. The company benefits from a strong balance sheet with no debt and short-term assets exceeding both short-term and long-term liabilities. However, recent earnings reports show a decline in sales to US$20.6 million for Q1 2025 compared to the previous year, alongside slight reductions in net income and earnings per share. The board's recent changes could impact strategic direction moving forward.

- Get an in-depth perspective on RH PetroGas' performance by reading our balance sheet health report here.

- Gain insights into RH PetroGas' future direction by reviewing our growth report.

Summing It All Up

- Take a closer look at our Asian Penny Stocks list of 1,158 companies by clicking here.

- Ready For A Different Approach? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SGX:T13

RH PetroGas

An investment holding company, engages in the exploration, development, and production of oil and gas resources in Indonesia.

Flawless balance sheet and slightly overvalued.

Market Insights

Community Narratives