- Singapore

- /

- Energy Services

- /

- SGX:NO4

Investors Still Aren't Entirely Convinced By Dyna-Mac Holdings Ltd.'s (SGX:NO4) Earnings Despite 30% Price Jump

Dyna-Mac Holdings Ltd. (SGX:NO4) shareholders would be excited to see that the share price has had a great month, posting a 30% gain and recovering from prior weakness. The last 30 days bring the annual gain to a very sharp 72%.

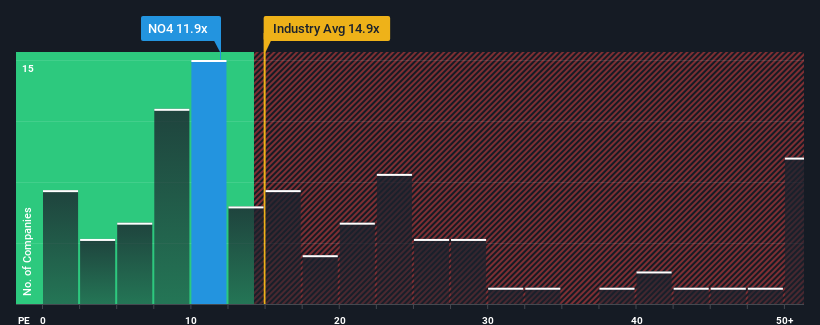

Even after such a large jump in price, it's still not a stretch to say that Dyna-Mac Holdings' price-to-earnings (or "P/E") ratio of 11.9x right now seems quite "middle-of-the-road" compared to the market in Singapore, where the median P/E ratio is around 11x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

Recent times have been pleasing for Dyna-Mac Holdings as its earnings have risen in spite of the market's earnings going into reverse. One possibility is that the P/E is moderate because investors think the company's earnings will be less resilient moving forward. If you like the company, you'd be hoping this isn't the case so that you could potentially pick up some stock while it's not quite in favour.

Check out our latest analysis for Dyna-Mac Holdings

Does Growth Match The P/E?

The only time you'd be comfortable seeing a P/E like Dyna-Mac Holdings' is when the company's growth is tracking the market closely.

Retrospectively, the last year delivered an exceptional 116% gain to the company's bottom line. However, the latest three year period hasn't been as great in aggregate as it didn't manage to provide any growth at all. Accordingly, shareholders probably wouldn't have been overly satisfied with the unstable medium-term growth rates.

Shifting to the future, estimates from the only analyst covering the company suggest earnings should grow by 10% per annum over the next three years. Meanwhile, the rest of the market is forecast to only expand by 6.3% each year, which is noticeably less attractive.

With this information, we find it interesting that Dyna-Mac Holdings is trading at a fairly similar P/E to the market. Apparently some shareholders are skeptical of the forecasts and have been accepting lower selling prices.

What We Can Learn From Dyna-Mac Holdings' P/E?

Dyna-Mac Holdings' stock has a lot of momentum behind it lately, which has brought its P/E level with the market. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

Our examination of Dyna-Mac Holdings' analyst forecasts revealed that its superior earnings outlook isn't contributing to its P/E as much as we would have predicted. There could be some unobserved threats to earnings preventing the P/E ratio from matching the positive outlook. It appears some are indeed anticipating earnings instability, because these conditions should normally provide a boost to the share price.

A lot of potential risks can sit within a company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Dyna-Mac Holdings with six simple checks.

If these risks are making you reconsider your opinion on Dyna-Mac Holdings, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SGX:NO4

Dyna-Mac Holdings

An investment holding company, engineers, fabricates, and constructs offshore floating production storage offloading and floating storage offloading topside modules for the oil and gas industries.

Outstanding track record with flawless balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026