- Singapore

- /

- Oil and Gas

- /

- SGX:G92

Investors five-year losses continue as China Aviation Oil (Singapore) (SGX:G92) dips a further 12% this week, earnings continue to decline

For many, the main point of investing is to generate higher returns than the overall market. But every investor is virtually certain to have both over-performing and under-performing stocks. So we wouldn't blame long term China Aviation Oil (Singapore) Corporation Ltd (SGX:G92) shareholders for doubting their decision to hold, with the stock down 47% over a half decade. Shareholders have had an even rougher run lately, with the share price down 22% in the last 90 days.

After losing 12% this past week, it's worth investigating the company's fundamentals to see what we can infer from past performance.

See our latest analysis for China Aviation Oil (Singapore)

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

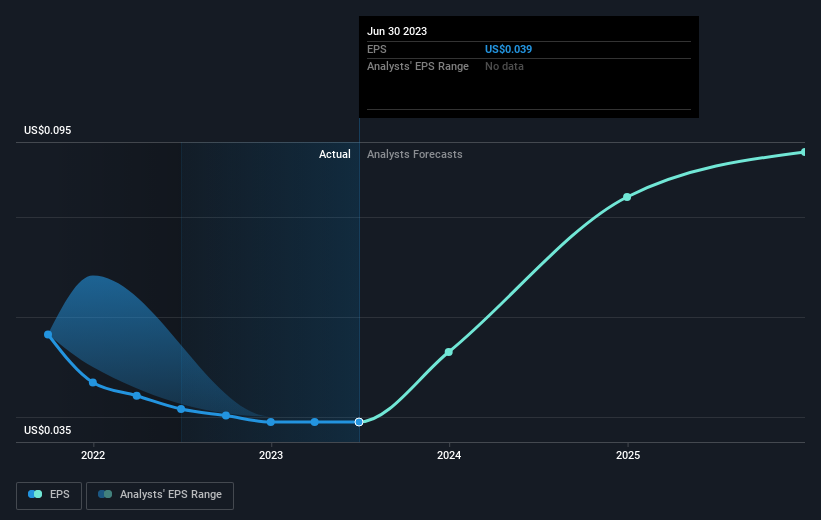

Looking back five years, both China Aviation Oil (Singapore)'s share price and EPS declined; the latter at a rate of 18% per year. This fall in the EPS is worse than the 12% compound annual share price fall. So the market may previously have expected a drop, or else it expects the situation will improve.

The company's earnings per share (over time) is depicted in the image below (click to see the exact numbers).

We're pleased to report that the CEO is remunerated more modestly than most CEOs at similarly capitalized companies. It's always worth keeping an eye on CEO pay, but a more important question is whether the company will grow earnings throughout the years. Dive deeper into the earnings by checking this interactive graph of China Aviation Oil (Singapore)'s earnings, revenue and cash flow.

What About Dividends?

It is important to consider the total shareholder return, as well as the share price return, for any given stock. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. As it happens, China Aviation Oil (Singapore)'s TSR for the last 5 years was -40%, which exceeds the share price return mentioned earlier. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

We're pleased to report that China Aviation Oil (Singapore) shareholders have received a total shareholder return of 14% over one year. That's including the dividend. There's no doubt those recent returns are much better than the TSR loss of 7% per year over five years. This makes us a little wary, but the business might have turned around its fortunes. Before forming an opinion on China Aviation Oil (Singapore) you might want to consider these 3 valuation metrics.

But note: China Aviation Oil (Singapore) may not be the best stock to buy. So take a peek at this free list of interesting companies with past earnings growth (and further growth forecast).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Singaporean exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SGX:G92

China Aviation Oil (Singapore)

Trades and supplies of jet fuel and other petroleum products to civil aviation industry worldwide.

Flawless balance sheet and undervalued.