- Singapore

- /

- Oil and Gas

- /

- SGX:G92

Further Upside For China Aviation Oil (Singapore) Corporation Ltd (SGX:G92) Shares Could Introduce Price Risks After 26% Bounce

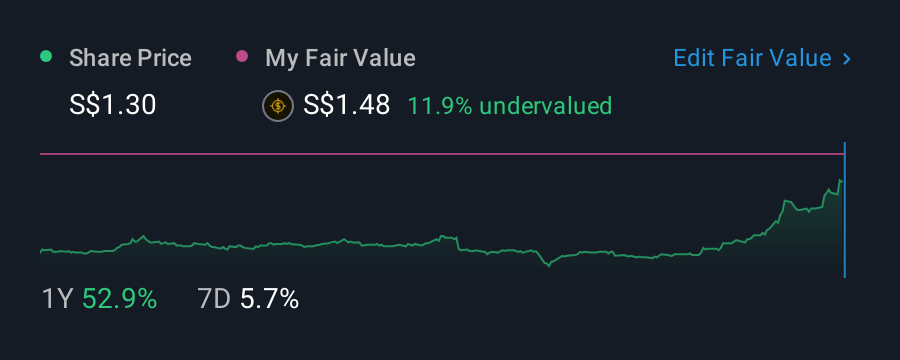

Despite an already strong run, China Aviation Oil (Singapore) Corporation Ltd (SGX:G92) shares have been powering on, with a gain of 26% in the last thirty days. Looking back a bit further, it's encouraging to see the stock is up 37% in the last year.

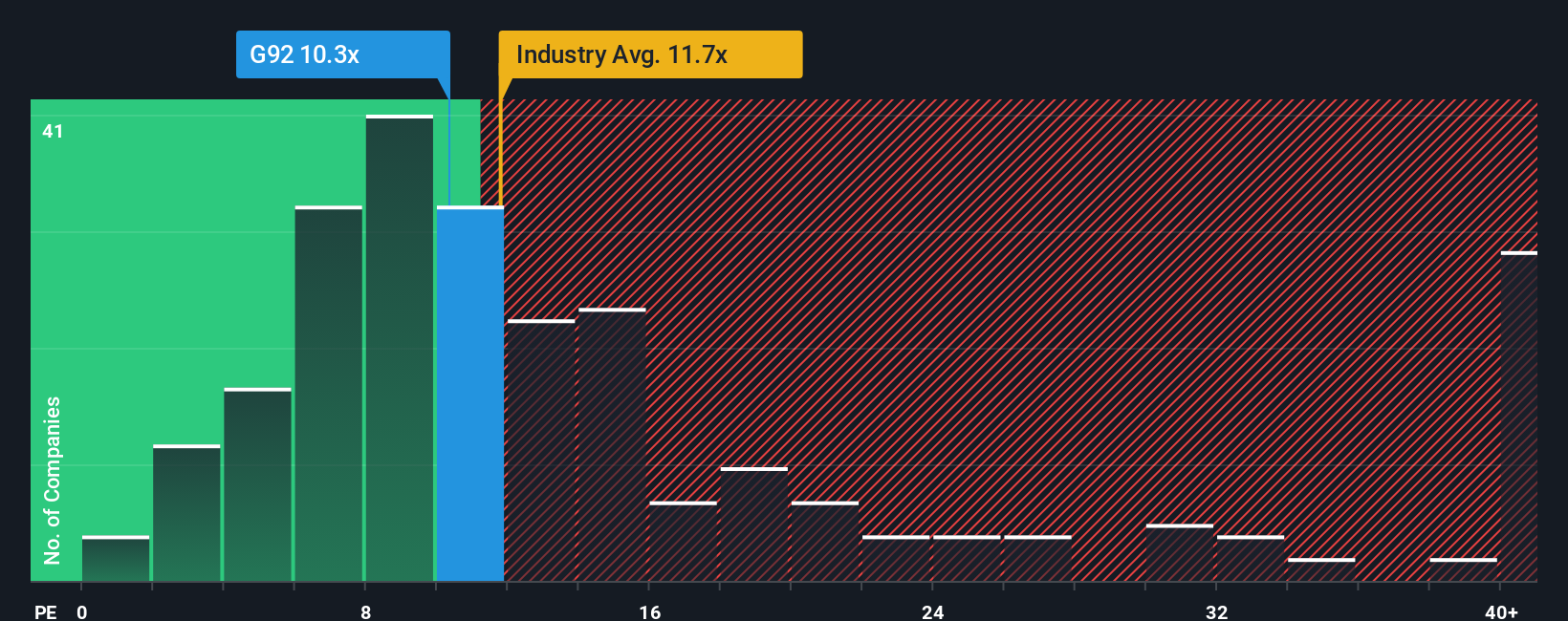

Although its price has surged higher, given about half the companies in Singapore have price-to-earnings ratios (or "P/E's") above 14x, you may still consider China Aviation Oil (Singapore) as an attractive investment with its 10.3x P/E ratio. Although, it's not wise to just take the P/E at face value as there may be an explanation why it's limited.

With earnings growth that's superior to most other companies of late, China Aviation Oil (Singapore) has been doing relatively well. It might be that many expect the strong earnings performance to degrade substantially, which has repressed the P/E. If not, then existing shareholders have reason to be quite optimistic about the future direction of the share price.

View our latest analysis for China Aviation Oil (Singapore)

Is There Any Growth For China Aviation Oil (Singapore)?

China Aviation Oil (Singapore)'s P/E ratio would be typical for a company that's only expected to deliver limited growth, and importantly, perform worse than the market.

If we review the last year of earnings growth, the company posted a terrific increase of 33%. The latest three year period has also seen an excellent 94% overall rise in EPS, aided by its short-term performance. Therefore, it's fair to say the earnings growth recently has been superb for the company.

Turning to the outlook, the next three years should generate growth of 6.5% per annum as estimated by the dual analysts watching the company. That's shaping up to be similar to the 7.1% each year growth forecast for the broader market.

With this information, we find it odd that China Aviation Oil (Singapore) is trading at a P/E lower than the market. Apparently some shareholders are doubtful of the forecasts and have been accepting lower selling prices.

The Final Word

The latest share price surge wasn't enough to lift China Aviation Oil (Singapore)'s P/E close to the market median. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that China Aviation Oil (Singapore) currently trades on a lower than expected P/E since its forecast growth is in line with the wider market. When we see an average earnings outlook with market-like growth, we assume potential risks are what might be placing pressure on the P/E ratio. It appears some are indeed anticipating earnings instability, because these conditions should normally provide more support to the share price.

It is also worth noting that we have found 1 warning sign for China Aviation Oil (Singapore) that you need to take into consideration.

It's important to make sure you look for a great company, not just the first idea you come across. So take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SGX:G92

China Aviation Oil (Singapore)

Trades in and supplies jet fuel to civil aviation industry worldwide.

Flawless balance sheet with proven track record and pays a dividend.

Market Insights

Community Narratives